It is no secret that the job market is hot right now. Many people have changed jobs in the past year or might consider doing so next year. Leaving for a new opportunity can be great, but you shouldn’t forget about your old 401(k).

After leaving your job, you may be asking: “Should I roll over my 401(k) to IRA or a new employer?” There are many reasons why you should roll over your 401(k) to an IRA. You generally have four options for your 401(k) after leaving an employer:

- Leave it in your current retirement plan

- Withdraw funds, and pay taxes and early withdrawal penalties (don’t do this)

- Roll it over to your new employer

- Or, the best option: a 401(k) rollover to an IRA

1. More Investment Choices

401(k) plans can vary quite a bit in quality depending on your plan administrator and employer. 401(k)s are limited in the investment options offered, typically only mutual funds, which are sometimes not the best.

With an IRA, you can hold just about anything. Mutual funds, exchange-traded funds (ETFs), and individual stocks and bonds. You can hold anything you would in a 401(k), plus about a billion other things. Plus, there are no restrictions on how often you trade or rebalance your portfolio.

401(k) plans (and 403b) are great when your employer matches contributions. You get the tax advantages of the deduction plus the “free money” match from your employer. But unless your employer is matching your contributions, an IRA is better because of the additional investment options.

2. Lower Investment Fees and Costs

Another reason you should roll over your 401(k) to an IRA is to have better cost control. A 401(k) plan has a set fund structure that can potentially carry higher than average fees, eating into your portfolio’s return. Furthermore, plan administration and consultant fees are in addition to the plan’s total cost.

Rolling your 401(k) into an IRA would allow you to take advantage of dirt-cheap mutual funds or even trade individual stocks and bonds for free. You would also avoid administrative costs, significantly lowering your portfolio’s fees, which can add up over your career.

3. Potential for Roth Conversion

The opportunity for a Roth conversion is another excellent reason to roll your 401(k) into an IRA. With a traditional IRA or 401(k), you avoid paying taxes upfront but pay income taxes on the withdrawal. A Roth IRA is the exact opposite, as you contribute after you pay taxes, but withdrawals are tax-free.

If you have a long time until retirement or expect a higher tax rate in retirement, a Roth IRA may be an excellent idea for you. To do this, you will most likely need to roll over to a traditional IRA first. Then, when it is appropriate, convert to a Roth IRA account.

A Roth IRA conversion will create an income tax liability against the conversion amount. For that reason, professionals highly recommend that you coordinate with a financial advisor or tax professional before initiating a Roth conversion. Doing so can help you avoid unexpected tax bill and penalties.

A powerful reason to roll over your 401(k) to an IRA is that you can control when you pay your taxes with a Roth conversion. There are many reasons millennials should use a Roth IRA to reach their financial goals.

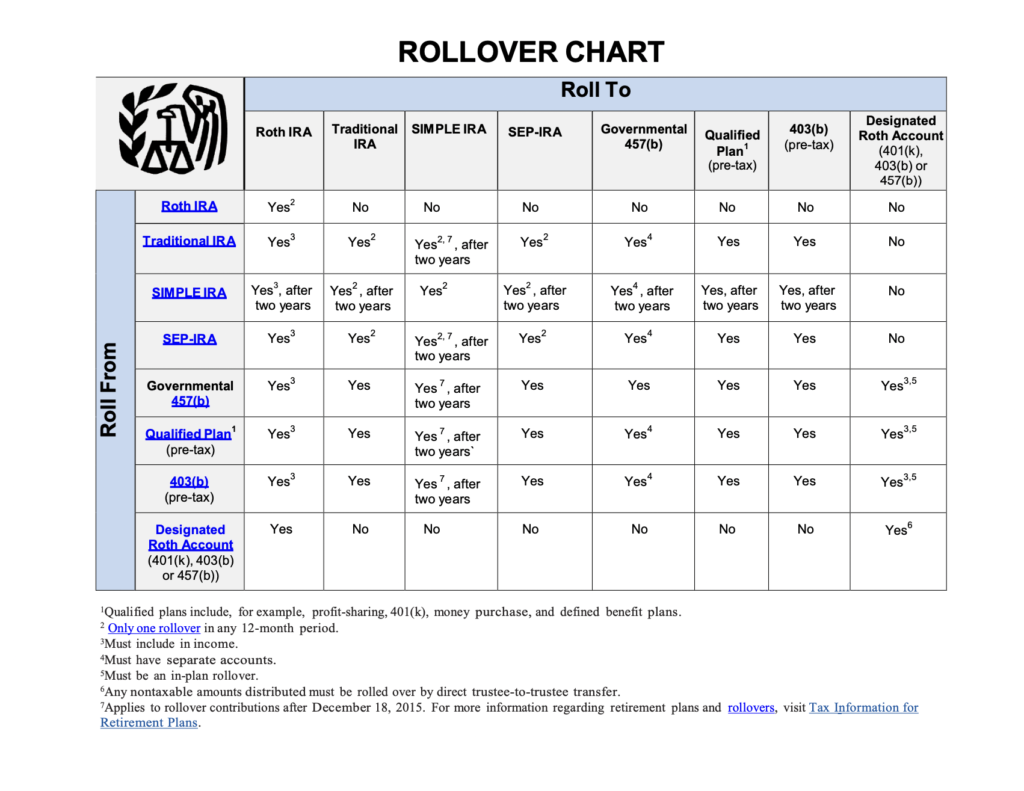

Source: Internal Revenue Service

4. Fewer Rules With an IRA

IRA rules are set by the IRS and very straightforward, making it easier for savers to understand what they can and cannot do. Employers set up 401(k) plans, having many variations. It can be challenging to understand all the rules set forth by a 401(k).

5. Access to Professional Advice

Another reason to not roll over your 401(k) to your new employer is to gain access to professional advice. Many financial advisors require you to have an account under their umbrella to access their services. Rolling your 401(k) into an IRA would give you access to professional investment advice and financial planning not offered in a 401(k) plan.

After rolling over your IRA to a professional advisor, they will help you with your current 401(k) and everything else to help your financial life.

6. Consolidation of Retirement Accounts

Workers these days don’t have pensions anymore. Without these lucrative retirement schemes tying people to their jobs, people are more likely to change employers. That is especially true among millennials.

If workers change jobs every few years, they could potentially have quite a few 401(k) retirement accounts. Rolling over your 401(k) to an IRA after switching jobs will help you better keep track of your retirement savings.

How To Transfer Your 401(k) To an IRA

You have the most control and choice with an IRA, so you should roll it over into one. When conducting a 401(k) rollover, you need to be careful as a simple mistake can be very costly.

A Direct Rollover Is the Safest Rollover

A direct rollover is when one financial institution sends a check to another—you generally never touch the physical check, if possible. The check will be made out to the financial institution of your choosing with instructions to put it into an IRA under your name. Straightforward.

Please Do Not Do an Indirect Rollover

You do NOT want to have the check made payable to you. It may seem counterintuitive, as it is your money. However, if the check is made payable to you, the IRS could treat this as a distribution to you.

Your employer is required to withhold 20% for taxes automatically. On top of that, you have 60 days to put the money back into IRA or 401(k). So, if you want your account to maintain at least the same level of value, you would need to come up with that 20% withholding. The 20% is withheld for taxes and will NOT go into your account.

If you cannot come up with that 20% withholding, the IRS will count that as a withdrawal, which might carry an additional 10% penalty. Avoid this potentially costly and annoying mistake by paying attention to the details and conducting a direct rollover.

As you can see, an indirect rollover is potentially expensive and not helpful to you. Please avoid doing it. Even if you get that 20% withholding back, it takes forever, and you miss out on participating in the market.

Source: Internal Revenue Service

Why You Should Roll Over Your 401(k) To an IRA

When you leave your job, you need to consider whether you should roll over your 401(k) to a new employer or an IRA. The reasons why you should roll over your 401(k): more cost control, more investment options, the potential for professional advice, fewer rules, consolidation, and control over taxes.

Unless you have an incredible 401(k) plan featuring very cheap options, you are better off with an IRA. Remember, the best part of a 401(k) plan is the match. After you change jobs, your old employer won’t continue to match your contribution, so you are better off moving your retirement savings elsewhere.

Don’t Do It Alone

Working with a financial advisor can help you gain clarity and achieve your financial goals. Delegating responsibility to a professional will alleviate any stress or confusion around money.