At the beginning of 2024, just about everyone thought mortgage rates would finally start falling. Inflation was cooling, a recession looked possible, and the Federal Reserve was expected to cut rates aggressively. The Mortgage Bankers Association even forecasted that 30-year fixed mortgages would land near 6% by year-end, a nice break from the near-8% rates of late 2023.

That prediction turned out wrong.

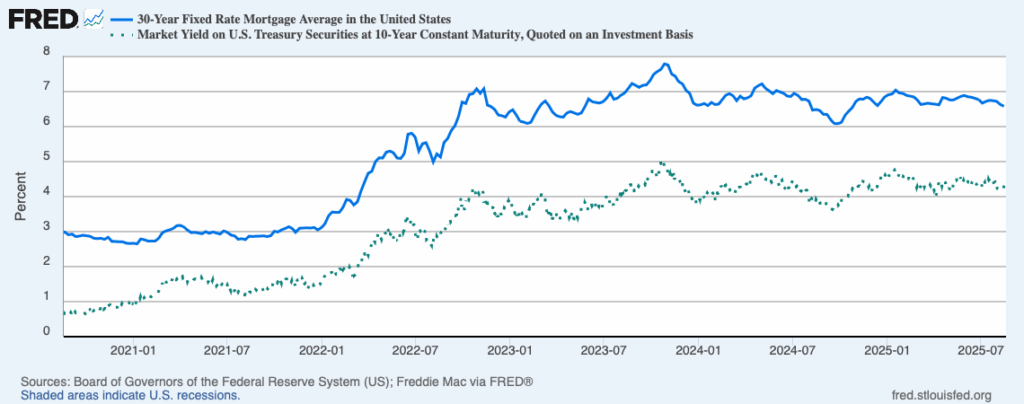

Fast forward to mid-2025: the Fed has trimmed its benchmark rate by 75 basis points, yet the average 30-year mortgage is still stubbornly stuck around 6.6%–6.8%, not far from where it started. For homebuyers waiting for relief, it feels like the Fed’s moves don’t matter. And in a sense, they don’t—at least not directly.

Why Fed Cuts Don’t Translate to Mortgage Relief

Most people assume the Federal Reserve controls mortgage rates. It doesn’t. The Fed sets the federal funds rate, which influences short-term borrowing like credit cards and savings yields. But mortgage rates are long-term oriented, and they move with the 10-year U.S. Treasury yield—a market benchmark driven by:

- Inflation expectations

- Economic growth (jobs, spending, wages)

- Deficit and debt concerns

- Global demand for U.S. bonds

This disconnect is why Fed rate cuts have coincided with mortgage rates holding steady or even rising. The bond market cares less about what the Fed just did and more about what inflation and growth will do.

The Pandemic Hangover

To see why mortgage rates feel “unfair” today, it helps to look back at the pandemic years:

- The Fed slashed rates to near zero to keep borrowing cheap.

- It bought trillions in mortgage-backed securities (MBS), flooding the market with demand.

- The 30-year mortgage rate fell to 2.65% in January 2021, the lowest on record.

- Millions of homeowners refinanced, locking in ultra-cheap mortgages.

That era is over. The Fed isn’t buying mortgage bonds anymore—in fact, it’s shrinking its balance sheet. And investors know today’s borrowers want the option to refinance if rates ever drop again. Which brings us to…

Prepayment Risk: The Invisible Hand Behind Mortgage Rates

Mortgages don’t sit on a bank’s books forever. They’re bundled into securities that investors buy. But unlike Treasuries, mortgages carry a unique risk: prepayment.

- When rates fall, homeowners refinance.

- Investors get their principal back sooner.

- They’re then forced to reinvest at lower yields.

This “refinance option” has value. Homeowners effectively own that option, and investors sell it. Because of that, investors demand a higher return on mortgage securities compared to Treasuries. And the more people believe rates could fall in the future, the more valuable that option becomes—keeping mortgage rates higher today.

It’s why the real estate agent line “date the rate, marry the house” comes with a giant asterisk. Yes, refinancing later is possible, but the market has already priced in that expectation.

Why Rates Stay Stubbornly High

Several forces are keeping mortgage rates from falling, even after Fed cuts:

- Economic Resilience

The U.S. economy keeps surprising on the upside. Job growth and consumer spending remain solid, blunting the case for aggressive easing. - Sticky Inflation

Inflation has come down from its peaks but still sits above the Fed’s 2% target. Add new tariffs and wage pressures, and bond markets expect “higher for longer.” - Fed’s Slow Dance

The Fed’s policy rate sits at 4.25–4.50%. Cuts are coming, but in slow motion. Markets that once expected half a dozen cuts in 2024 are now bracing for just two or three more in late 2025. - Global and Political Uncertainty

Geopolitics, trade policy, and fiscal deficits all weigh on bond investors’ minds. Add the return of presidential-tweet-induced volatility (yes, that’s back), and investors are demanding higher yields for long-term bonds. - Investor Appetite for Mortgages

Some large institutions have pulled back from buying mortgage-backed securities altogether, citing the risks above. With fewer buyers, yields must rise to attract capital—translating into higher mortgage rates.

So, When Will Mortgage Rates Actually Fall?

The best guess: slowly, and not nearly as far as many hope.

- 2025: Most forecasts see mortgage rates staying in the mid-6% range.

- 2026: Some relief could bring them into the low-6s, but only if inflation cools more decisively.

- Forget about 3–4% rates. Those were a once-in-a-century fluke, fueled by zero Fed rates and massive bond-buying. Unless we revisit that emergency playbook, those days are gone.

The Bottom Line for Homebuyers

Waiting for a “mortgage rate drop” probably isn’t a winning strategy. Instead:

- Shop aggressively: Lenders vary more than you think.

- Strengthen your offer: Bigger down payments can offset higher borrowing costs.

- Think long-term: If rates dip in the future, refinancing is a bonus—not a plan.

Mortgage rates today are less about what the Fed says and more about what the bond market believes. And right now, the bond market still sees inflation risk, economic resilience, and plenty of uncertainty ahead.

That’s why mortgage rates remain stubbornly high—even as the Fed eases as seemingly everyone expects.