Category: Stock Market

-

Why Not All S&P 500?

Why not own all of the S&P 500? Just $SPY ’til you die? If we’re going to take this approach, why not just own the NASDAQ? It’s done better than the S&P. Why not just own the “Mag Seven” that carry both indexes? Why not use a DeLorean and Grays Sports Almanac to build your…

-

Should Stock Buybacks Be Regulated?

Share buybacks have re-entered the news lately as part of the CHIPS Act. The CHIPS Act specifically bars any firms receiving government money from repurchasing shares for a number of years. The CHIPS Act is a piece of legislation that is part of the Biden administration’s initiative to restore microchip manufacturing in the US. All-in-all,…

-

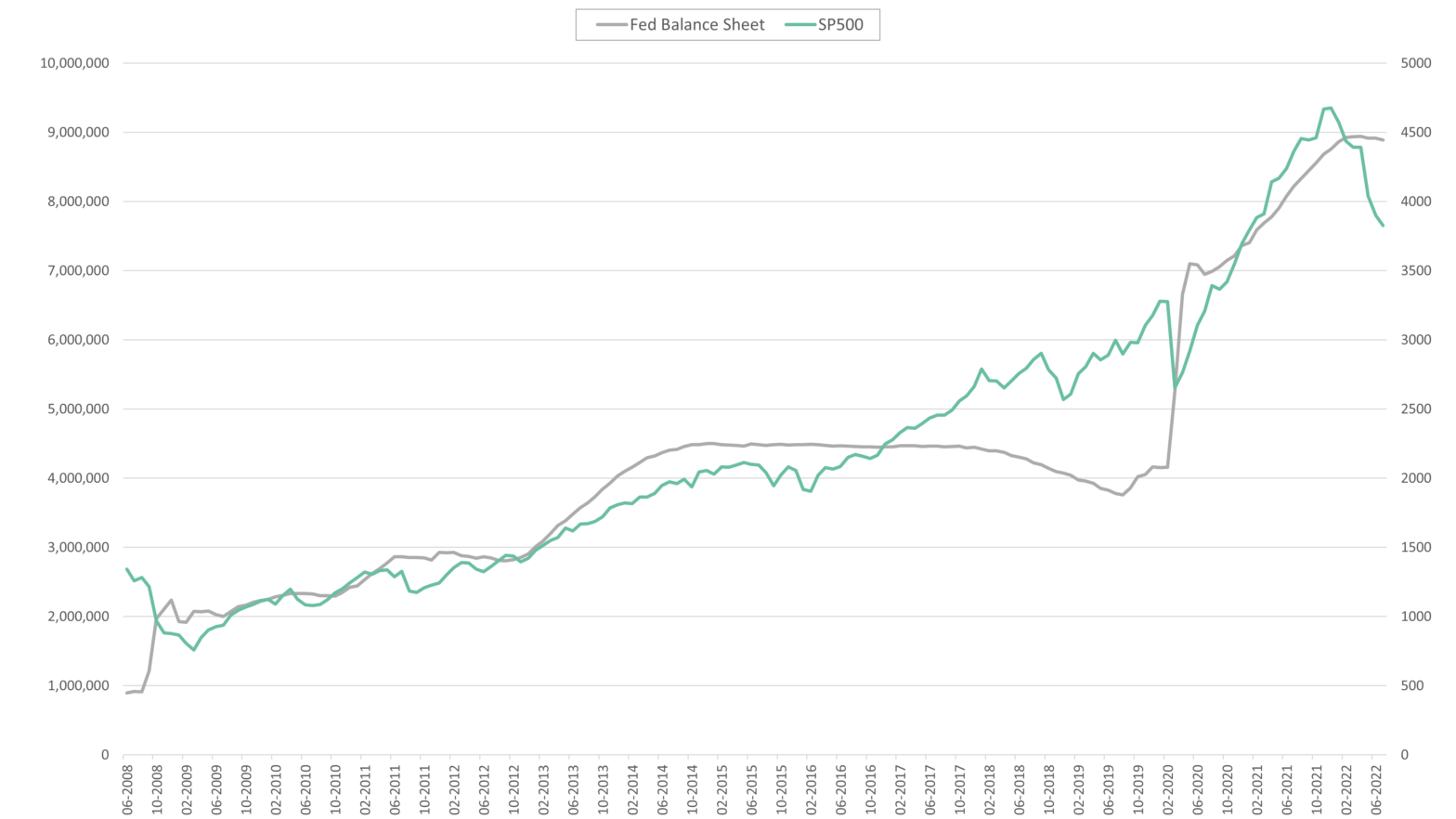

Investors Should Worry More About Quantitative Tightening

There is a lot of negative sentiment in markets now, just as inflation pain and recession fears began to ebb. Despite zero evidence, many investors were banking on the FED pivoting from the aggressive rate hikes sooner rather than later. Some investors got ahead, bidding stocks off their June lows for a mid-summer rally in…

-

What A Year This Quarter Has Been

It has been a difficult quarter for investors. Major indexes entered bear territory (means down 20%). US treasuries, generally the safest of assets for when investors are scared, have had their worst year since the 70s (when interest rates go up, bonds go down). Commodities, which I generally say “they suck until they don’t,” have…

-

The Economy: How Did We Get Here and Where Is It Going?

Markets have been getting a lot of attention lately beyond the financial media. The S&P 500 is down 21%, the tech-heavy NASDAQ 100 is off over 29%, and the smaller company-oriented Russell 2000 is down over 24% year to date. Investors have a lot of concerns over the economy right now: Investors are facing a…

-

Technology Sector Continues Selloff as Stock Market Falls

Markets are down significantly to start the year. The most reliable producers of earnings growth have begun to falter. Indexes are experiencing a broad-based sell-off led by big tech companies. Amazon, one of the largest companies in the S&P 500, dropped 14% on Friday to the lowest level since June 2020. Amazon lost $206.2 billion…