Category: Economics

-

Should Stock Buybacks Be Regulated?

Share buybacks have re-entered the news lately as part of the CHIPS Act. The CHIPS Act specifically bars any firms receiving government money from repurchasing shares for a number of years. The CHIPS Act is a piece of legislation that is part of the Biden administration’s initiative to restore microchip manufacturing in the US. All-in-all,…

-

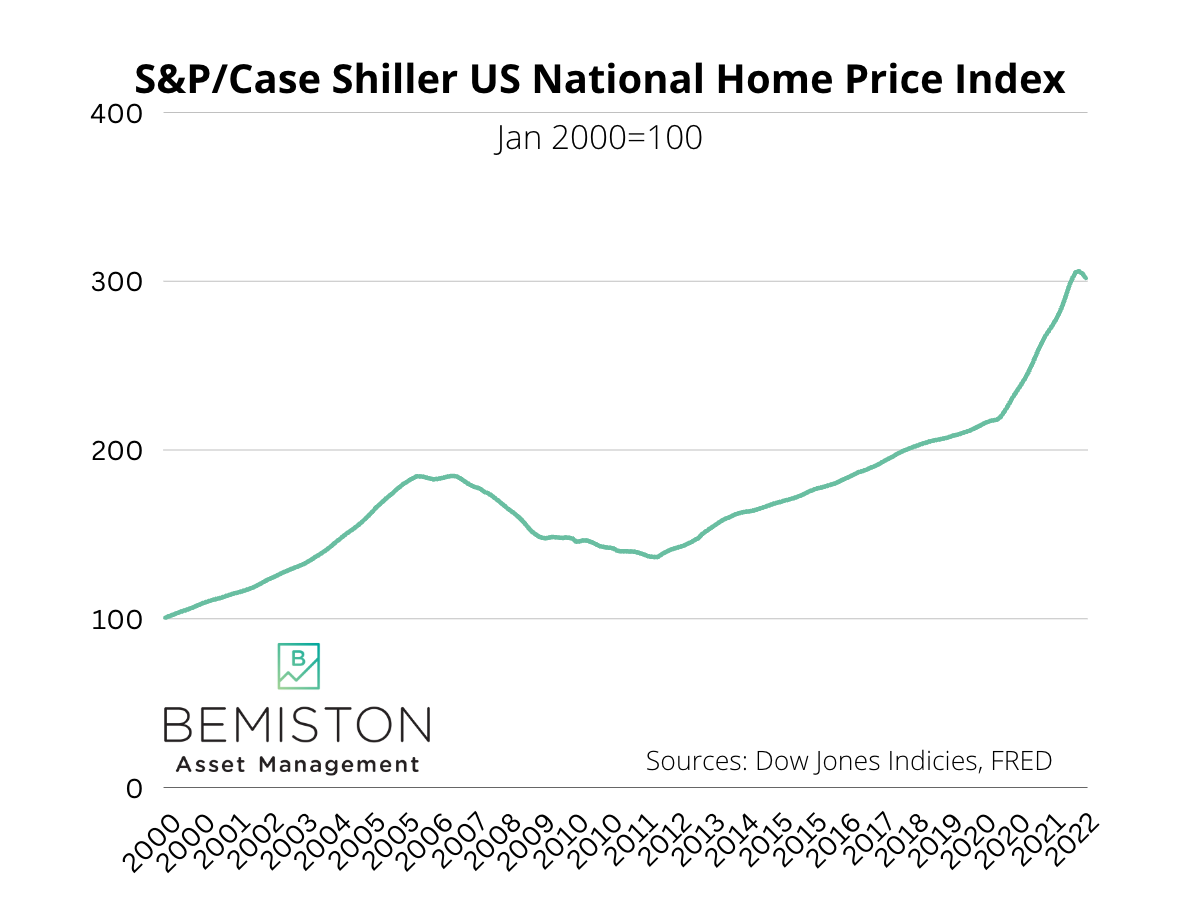

When Are Home Prices Dropping?

Various factors are pushing housing to extremes that have not been seen in generations, if at all. Home prices are just off all-time highs, while mortgage rates are at the highest in over a decade. With mortgage rates increasing so quickly in 2022, people wonder when home prices will drop. Ultra-low mortgage rates and a…

-

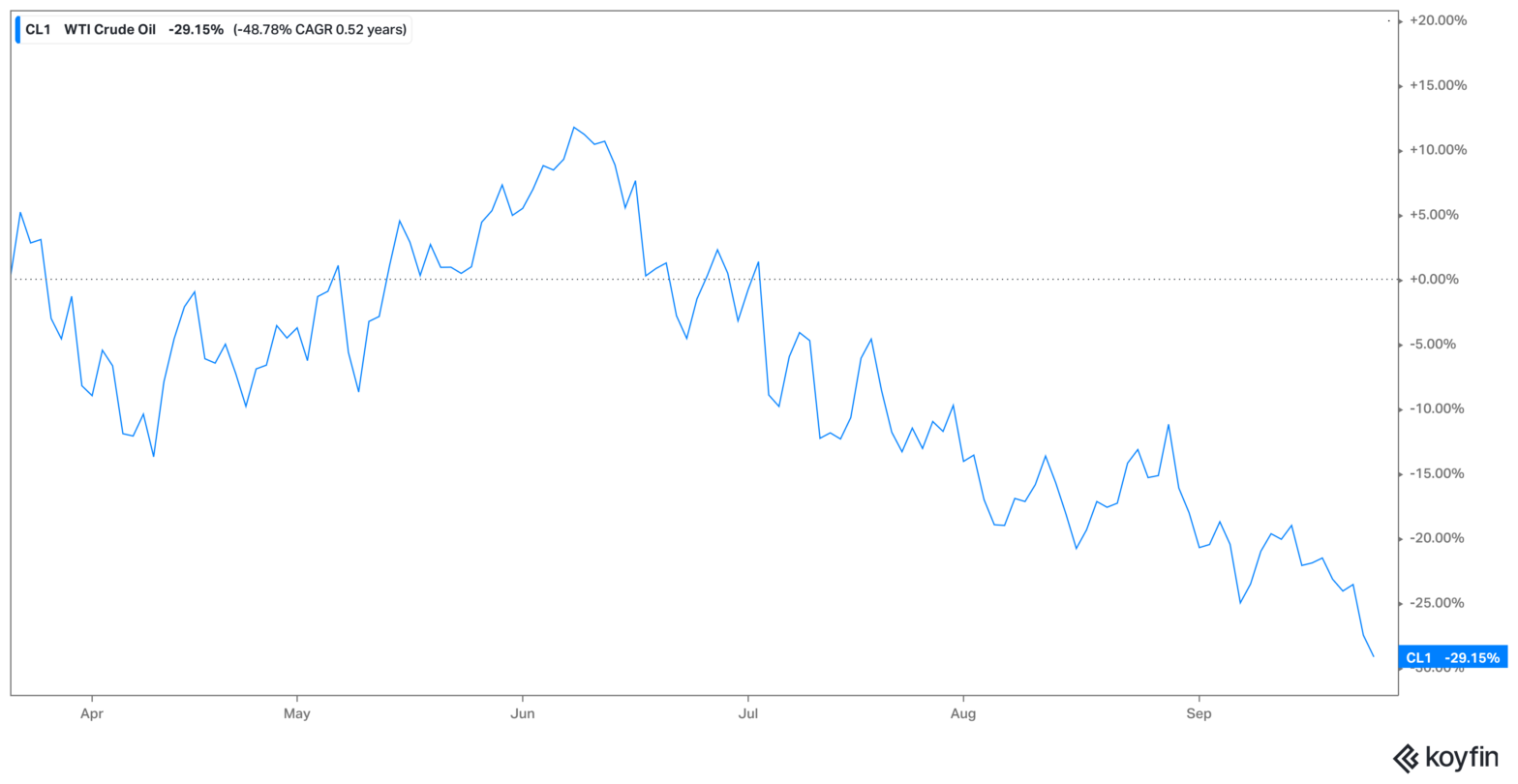

Using the Strategic Petroleum Reserve To Fight Inflation

The inflation numbers for August came in hotter than expected, rising 0.1% for the month against the falling forecast. On the surface, it does not seem too bad, considering inflation is over 8% for the year, and it paused in July. The Fed and investors were by far and away hoping that they had seen…

-

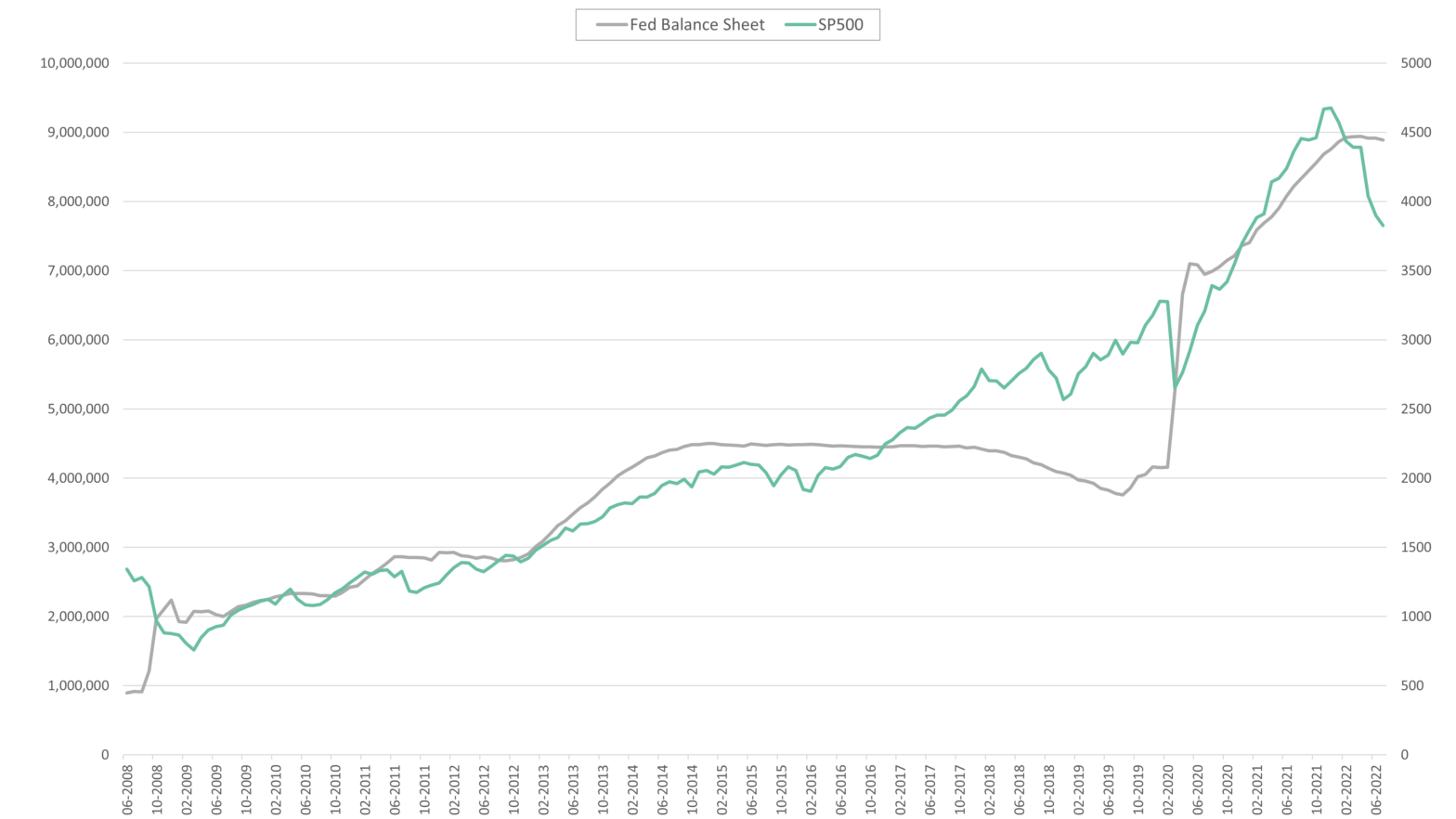

Investors Should Worry More About Quantitative Tightening

There is a lot of negative sentiment in markets now, just as inflation pain and recession fears began to ebb. Despite zero evidence, many investors were banking on the FED pivoting from the aggressive rate hikes sooner rather than later. Some investors got ahead, bidding stocks off their June lows for a mid-summer rally in…

-

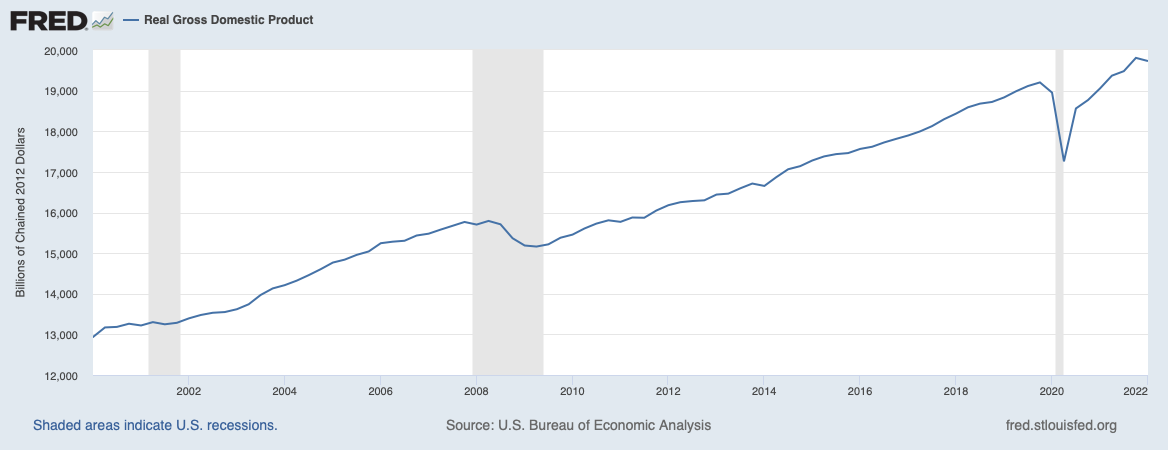

Recession or Nah?

The recession debate has died down a bit as political and financial commentators gravitated to the next dumb debate over the White House’s quote of zero inflation for July. Inflation was zero for July. The inflation rate for the twelve months ending in July is 8.5%. I am unsure if it was worse seeing so…

-

What Exactly Is a Recession?

So, how are things going in the economy? Not great. But not terrible either. While the jobs market remains strong, the biggest concern for consumers and policymakers is inflation. The Fed is rapidly increasing rates to tame inflation. However, the Fed may not be able to do a lot to cure the supply chain issues…