There is a lot of negative sentiment in markets now, just as inflation pain and recession fears began to ebb. Despite zero evidence, many investors were banking on the FED pivoting from the aggressive rate hikes sooner rather than later. Some investors got ahead, bidding stocks off their June lows for a mid-summer rally in July.

J-Pow in Jackson Hole

Investors were quite cautious as the lords of global central banks convened atop a mountain to discuss the global economy and monetary policy. While many assumed the Fed chair, Jerome Powell, would not say anything of note, he did signal that there was little chance of reversal anytime soon. The Fed will keep raising rates and keep them high for a long time, even if that tanks the labor market and puts the economy into recession.

- J-POW mentioned full employment zero times in his speech

- Only cares about headline CPI inflation

- Now including food and energy prices for policy decisions, adding more fun

- Willing to tank the labor market to get inflation under control (and get credibility back).

The Fed will keep raising rates until inflation falls, even if they end up nuking the job market and causing a recession.

Interest Rates Can Only Go So Far

The Fed president is doing precisely what he has been telling us he was going to do. There is no surprise here at all. The Fed is fighting inflation at all costs. A tighter monetary policy with higher rates is driving prices of financial assets down, including stocks and houses. As I have written before, I am unsure how much the Fed can do to fight inflation.

- The Fed’s interest rate tools can’t fix supply chains. There have been many debates on how much of the inflation is the Fed’s fault, but this report suggests that inflation would have been 6% instead of 9% without supply bottlenecks.

- Powell and his company also can’t do anything to fix the global energy market or oil supply.

- The Fed can’t go and change climate conditions, plant crops, or pack meat.

The Fed used two tools to help provide liquidity during the pandemic collapse: interest rates and quantitative easing.

Quantitative Easing: The Fed’s Other Tool

Quantitative easing, or QE, doesn’t get much attention outside the financial world. QE is when a central bank purchases securities such as US Treasuries or mortgage-backed securities in the open market. The idea is to stimulate the economy by lowering interest rates and putting more money out there, making it easier for banks to lend.

Its results are questionable.

- QE is not money printing. However, it does affect interest rates. However, it does affect interest rates. The Fed essentially trades cash for assets that never touch individuals or businesses.

- It makes it easier for banks to lend, as they have more cash and not bonds. Banks are not required to lend.

- Investors change asset allocations. If interest rates are super low, they will need to take on more risk to achieve the same level of returns—buy stocks over bonds.

- QE favors borrowers at the expense of savers.

- The policy also pushes up the value of assets such as stocks, bonds, houses, etc.—further increasing the divide between the haves and have-nots.

Quantitative Tightening Is a Big Deal for Stocks

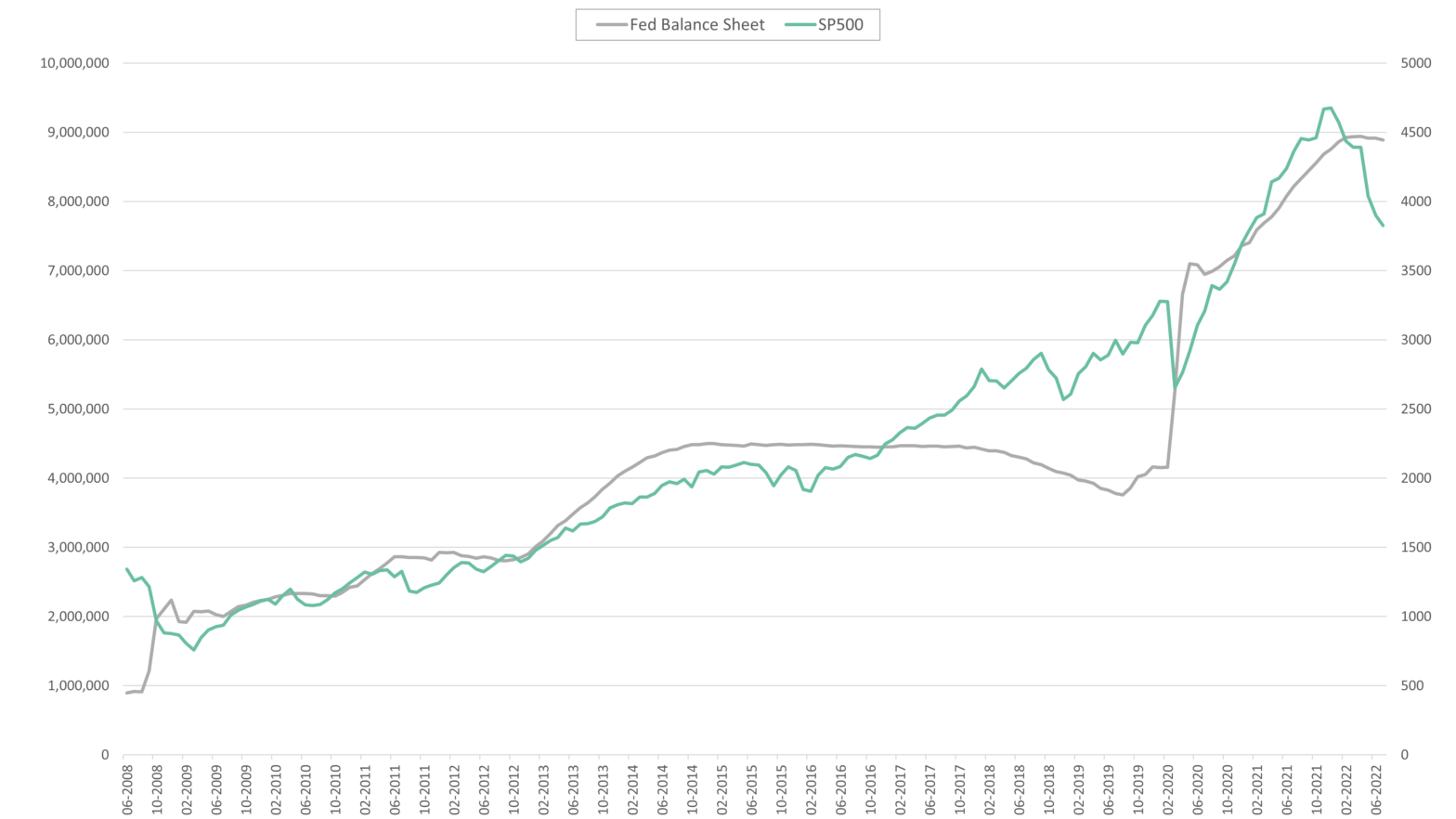

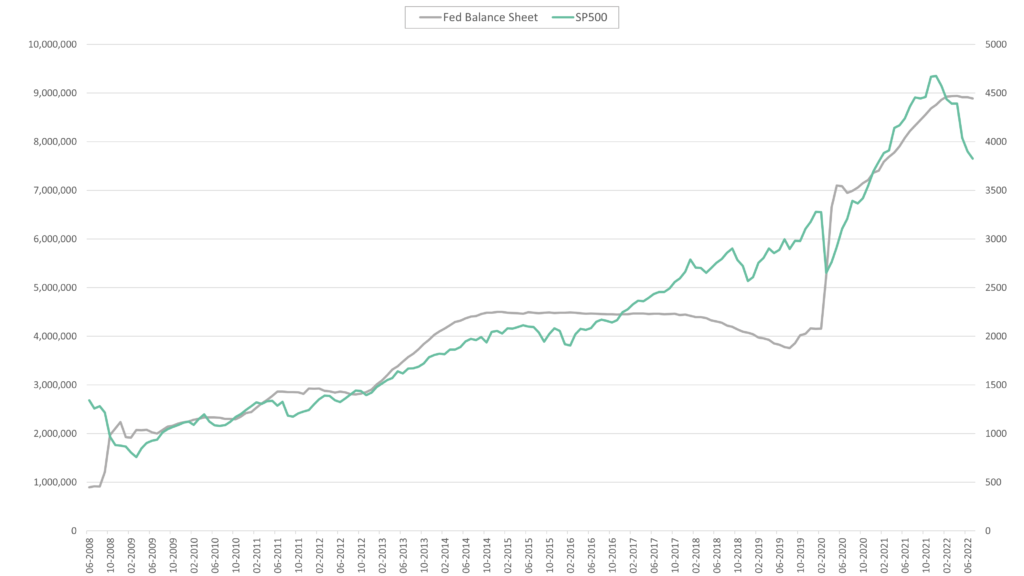

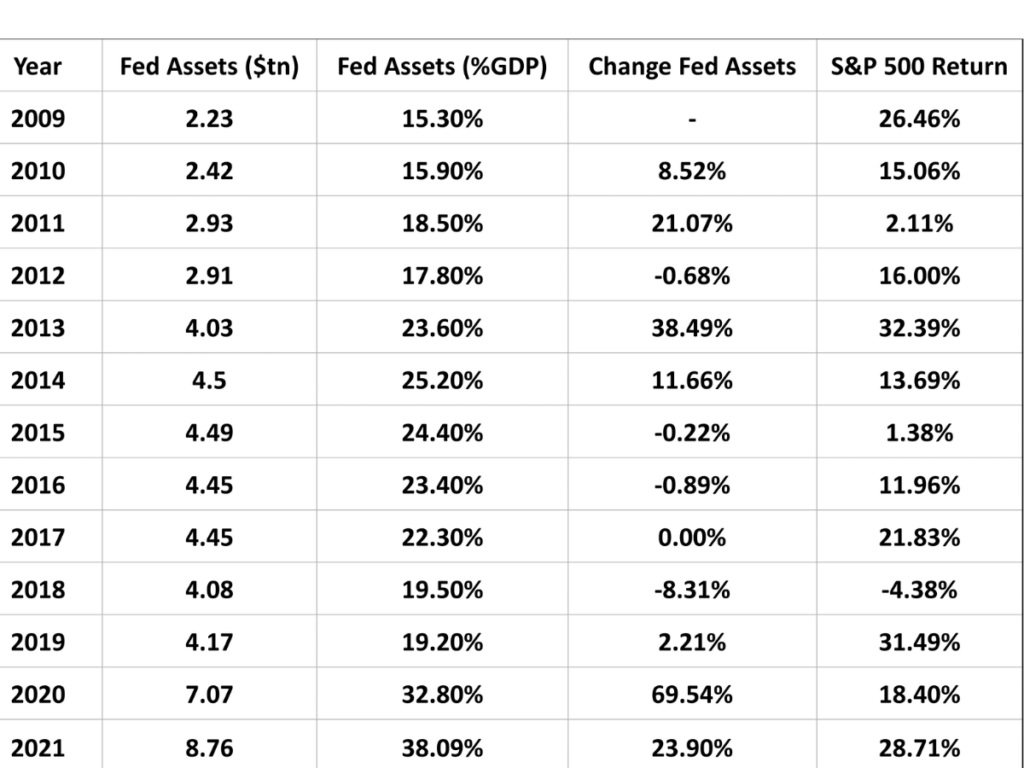

It’s no secret the Fed is taking away the punch bowl by raising interest rates. However, the Fed has also accumulated a $9 trillion balance sheet that will begin to unwind, putting further pressure on balance asset valuations.

The Fed’s first experiment with QE in the wake of the Great Recession was to encourage lending and borrowing. It went okayish. The economy stopped free falling, but we were missing consumer demand. There is a lot I have said previously about missing demand, so that I won’t rehash it.

Notably, investors, this time around, need to pay attention to any sudden changes in the rate the Fed runs down its balance sheet. While QE’s effects on economic growth are debatable, its impact on financial assets is not.

- QE lowers interest rates lifting assets like stocks and private equity

- From 1950 – 2008, the S&P 500 posted average returns of around 12% per year. After the QE started in 2009, the S&P 500 averaged over 16.5% through 2021.

The winding down of QE is known as QT or quantitative tightening. The “easing” is much more rapid than the oncoming “tightening.” The Fed will certainly be careful to signal any changes to the pace of quantitative tightening.

Rapidly increasing interest rates are indeed roiling the market over the near term. However, investors will miss a mighty longer-term wind in their sails as the Fed begins its quantitative tightening of about $9 trillion.