Let’s talk about two compelling money concepts: financial independence and financial freedom. Millennials are redefining how we perceive money, and these terms signify more than just having plenty of cash in the bank.

Defining Financial Independence

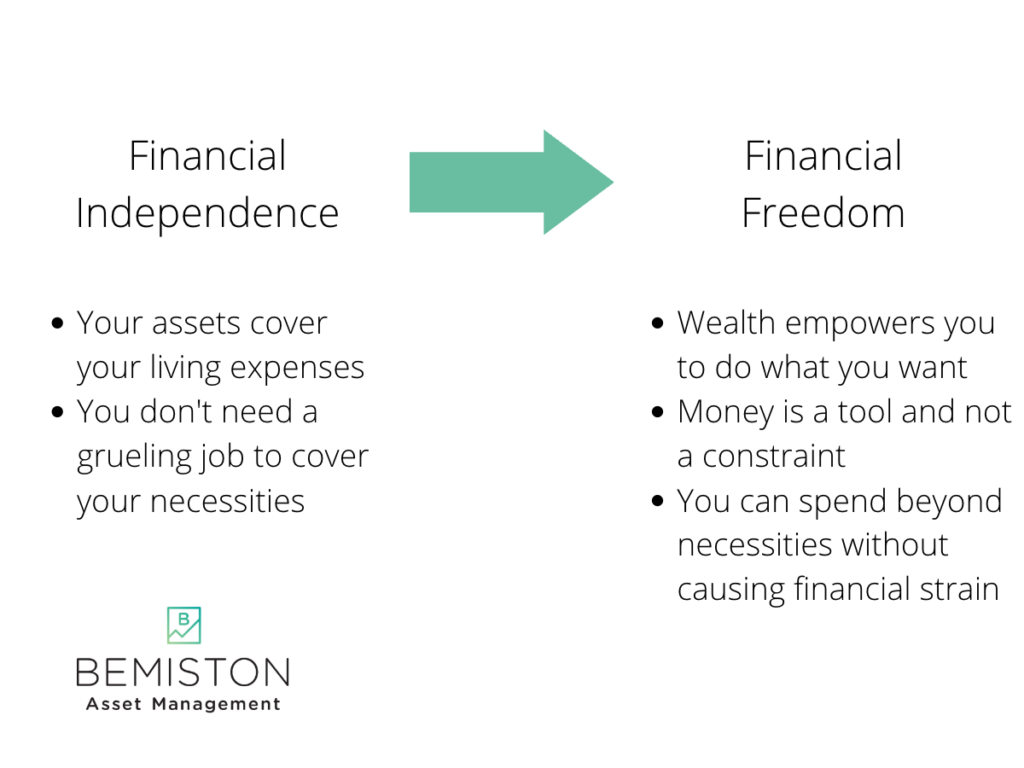

So, what exactly is financial independence? It’s the point where your assets generate enough income to cover your living expenses. In other words, you don’t need to actively work to afford your lifestyle. You can meet your financial responsibilities without working a hard 9-to-5 job if you have income generating assets.

You can leave that grueling office gig and find something else to fill your day-to-day. If you love coffee, you can work as a barista. Or, if you love to cook, you can work in a restaurant.

You can find something challenging that you enjoy, and the money is unimportant. When you clock out, you’re done.

But how does this differ from financial freedom? People often use the terms interchangeably, but they’re subtly different.

Understanding Financial Freedom

Financial freedom is a step beyond financial independence. It’s when your wealth allows you to live the lifestyle you desire without worrying about money. It’s not just about covering your necessities; it’s about having the ability to pursue your passions, travel, give back, or even splurge occasionally without jeopardizing your financial health.

The quest for financial independence and freedom is much more than accumulating wealth—it’s about building a life where money is a tool, not a constraint. You want to attach purpose to your money.

The two, though different, can complement each other. Financial freedom allows you to live your life on your terms, and financial independence provides the financial foundation to support that life.

Both demand disciplined saving, astute investments, and prudent spending habits. It is also important to remember that these terms will mean different things to different people, as everyone’s financial goals and lifestyle choices are unique.

Your Ten-Step Guide to Financial Independence

As millennials, we value experiences over things, and we aspire to live life on our own terms. Financial independence and freedom are gateways to such a life. Here’s a roadmap to get there:

1. Get Clear on Your Financial Goals

The first step towards financial independence is defining what it means for you. What kind of lifestyle do you want to maintain? What are your long-term goals—buying a house, traveling, starting a business, retiring early? Use these goals to guide your financial planning.

2. Embrace Budgeting and Saving

Contrary to popular belief, budgeting isn’t restrictive—it’s empowering. It’s about understanding where your money goes and making conscious decisions. Start by tracking your income and expenses, then create a budget that aligns with your financial goals.

When it comes to saving, the ‘pay yourself first’ principle is key. Before you allocate money to any expenses, set aside a portion of your income for savings or investments. A good starting point could be 20% of your income, but you can adjust this figure based on your financial situation and goals.

You can use a spreadsheet or app. My favorite app is YNAB. It’s more involved to set up than most apps, but it makes you more intentional with your spending.

3. Eliminate High-Interest Debts

Debt can significantly hinder your journey to financial independence. High-interest debts, such as credit card debt, should be paid off as quickly as possible. Consider strategies like the avalanche method (paying off debts with the highest interest rates first) or the snowball method (paying off the smallest debts first to gain momentum).

4. Invest, Invest, Invest

Investing is a powerful tool for wealth creation and a cornerstone of financial independence. By investing in assets like stocks, bonds, mutual funds, real estate, or even starting your own business, you’re putting your money to work.

Time and compounding are your best friends when it comes to investing. The earlier you start, the better.

Remember, every investment carries risk, so do your homework. Diversify your investments to spread risk, and consider seeking advice from a financial advisor.

5. Build Multiple Income Streams

Relying solely on your day job for income can be risky and slow your journey to financial independence. Consider creating additional income streams, such as a side hustle, rental income, or investments. Building additional income streams can supercharge wealth if you’re willing to do the extra work and take on the potential risks.

6. Continually Educate Yourself

Stay informed about personal finance and investment trends. In this digital age, numerous resources can help you expand your financial knowledge, such as podcasts, blogs, books, and online courses. Understanding the financial world allows you to make informed decisions and be proactive rather than reactive.

Staying informed is also becoming more challenging. Laws and rules are constantly changing. Over the past several years, we have seen significant changes in laws and rules around saving and investing. Dedicating time to stay informed has become more crucial.

7. Make Retirement Planning a Priority

Even if retirement seems far off, planning for it shouldn’t be delayed. Consider investing in retirement accounts like 401(k)s or IRAs that offer tax advantages. The power of compounding means that the earlier you start saving for retirement, the less principal you’ll have to invest to get the amount you need to retire.

8. Practice Mindful Spending

Mindful spending is about ensuring your money is going towards what truly matters to you. Before making a purchase, ask yourself if it aligns with your goals or if it’s just an impulse buy. Being mindful of your money can help prevent needless spending and keep your savings on track.

9. Get Insured

Insurance is often overlooked in financial planning, but it’s crucial for protecting your assets and providing a safety net for unexpected life events. Be it health, auto, life, or home insurance, the right coverage can save you from financial disaster.

10. Review and Adjust Your Financial Plan Regularly

Your financial plan isn’t set in stone. As your life situation changes—marriage, kids, job changes, or unforeseen expenses—it’s important to review and adjust your plan accordingly.

It’s a Journey Not a Destination

Remember, financial independence and freedom aren’t about “getting rich quick. It’s a journey, and it takes time, discipline, and financial acumen.

Everyone’s journey is different, and there’s no one-size-fits-all approach. What’s important is that you’re taking steps towards a future where you’re in control of your finances, not the other way around.

Achieving financial independence and freedom means having the ability to make choices that allow you to enjoy life while also securing your future. It’s about having your money work for you, allowing you to spend more time doing what you love with the people you love. And that, dear millennials, is what we’re striving for.

Start your journey today, step by step. Embrace the challenge and enjoy the process. The ultimate goal is to become financially independent and free, living a fulfilling and meaningful life. Happy planning, and here’s to your financial freedom!