Want to eat all of the avocado toast and get all of your coffee out? Well, there is a way to afford it all. How? Financial Planning.

Financial planning is like Apple Maps for your financial journey. It’s your road map to achieving your life goals, whether that’s buying a house, traveling the world, or retiring early. Like any solid roadmap, it needs detail, adaptability, and continual traffic updates.

Yet, according to an article by CNBC, millennials struggle to demonstrate basic financial literacy.

On average, 18-to 34-year-olds can correctly answer only about 2.5 out of six key financial literacy questions, according to FINRA’s 2018 National Financial Capability Study. Only 17% of people in that age group could answer four or more questions correctly, down from 30% who could in 2009.

Experts say thriving in today’s world demands more than a college degree. Living in America is increasingly sink or swim, as seen by the widening gap between rich and poor. Essential expenses have gotten more expensive, while (real) wage growth has been negligible.

CNBC and FINRA National Financial Capability Study

So, how can we fix that? Let’s dive into why financial planning is critical, what it includes, and how to create your financial plan.

What is a Financial Plan?

Simply put, a financial plan is a comprehensive overview of your financial goals, the resources you currently have, and the steps you need to take to achieve these goals. It’s not just about saving and investing; it’s about aligning your money with your ambitions and understanding the steps necessary to meet those aspirations.

Why is Financial Planning Important?

- Goal Setting: Setting financial goals is like setting a destination in Apple Maps. Where are you headed? Maybe it’s a beach house, a trip to Europe, or paying off your student loans. Whatever it is, financial planning helps outline the steps you need to take to get there.

- Financial Security: A solid financial plan helps secure your future. By investing wisely, maintaining an emergency fund, and ensuring you’re insured, you safeguard against financial instability.

- Debt Management: Understanding your liabilities and managing them efficiently is part of financial planning. It helps you prevent unmanageable debt and keeps you in control of your finances.

- Peace of Mind: A good financial plan gives you a clear financial direction, thus reducing stress and uncertainty about the future.

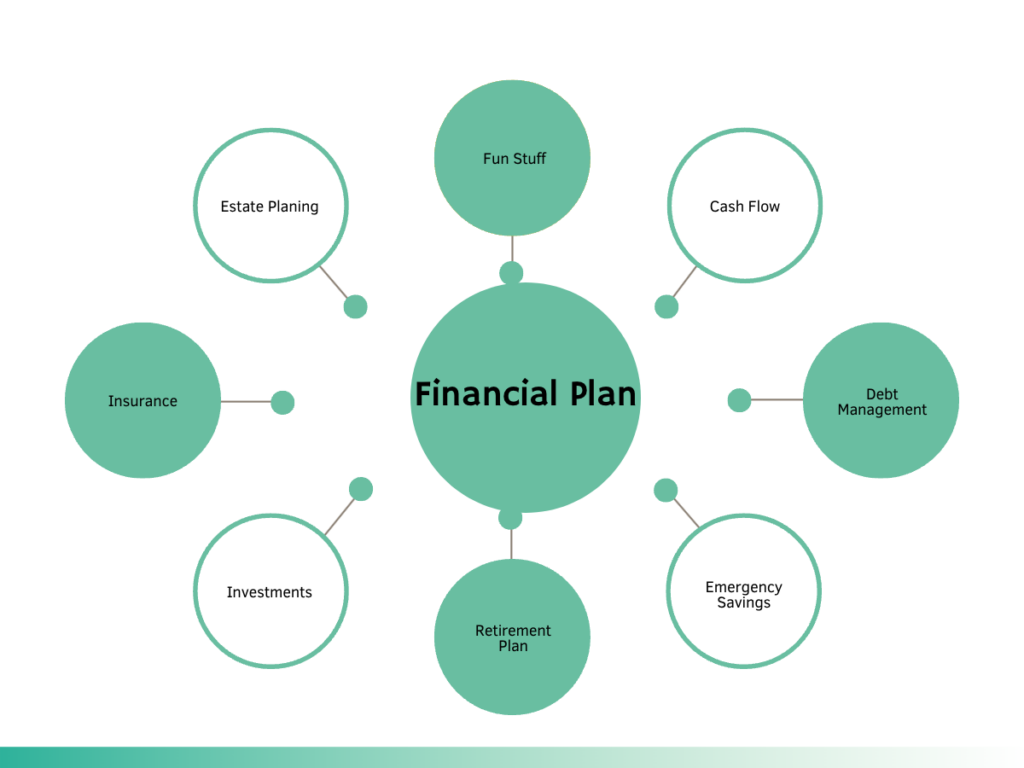

What is Included in a Financial Plan?

A financial plan should include the following elements:

- Income and Expenses: The first step is understanding your cash flow – what’s coming in and what’s going out.

- Debt Review: This includes all your liabilities, from student loans to credit card debts.

- Emergency Fund: This fund should ideally cover 3-6 months’ worth of living expenses in case of a sudden job loss or a medical emergency.

- Retirement Plan: Even if retirement seems like a lifetime away, the earlier you start planning, the better.

- Investments: Diversified investments can provide you with extra income and accelerate your financial goals.

- Insurance: Having the right insurance coverage helps protect you from unexpected financial blows.

- Estate Planning: Though not a fun topic, estate planning is crucial to ensure that your assets are distributed as per your wishes after your demise.

How to Create a Financial Plan

- Set Your Financial Goals: Start by defining your short-term (1-3 years), mid-term (3-10 years), and long-term (10+ years) financial goals. This could include saving for a vacation, buying a home, or planning retirement.

- Understand Your Current Situation: Detail your income, expenses, assets, and liabilities. A clear picture of your current financial situation is necessary to create a plan that works for you.

- Create a Budget: Now that you understand your income and expenses, it’s time to create a realistic budget. This budget should cater to your needs and goals, and most importantly, it should be something you can stick to.

- Build an Emergency Fund: Ensure you have an emergency fund before investing. This is your safety net, giving you financial stability during unpredictable situations.

- Plan for Retirement: Begin with your employer’s 401(k) plan, if available. Take full advantage of matching contributions and consider other retirement accounts, such as IRAs (Individual Retirement Accounts). The key is to start early; thanks to the magic of compound interest, even small contributions can grow significantly over time.

- Develop an Investment Strategy: Depending on your risk tolerance and time horizon, diversify your portfolio among different asset classes. This could include stocks, bonds, mutual funds, or real estate. A diversified portfolio can help to balance risk and reward.

- Get Adequate Insurance: Protect yourself from financial shocks with the right insurance policies. This can include health insurance, life insurance, and disability insurance. Don’t forget about renter’s or homeowner’s insurance, either.

- Estate Planning: As mentioned, this isn’t a fun topic, but it’s important. Consider creating a will, assigning power of attorney, and designating beneficiaries for your retirement accounts and insurance policies.

- Review and Adjust Regularly: Your financial plan isn’t a set-and-forget document. Regularly review your plan to align with your current situation and goals. Your plan may need adjustment when life events like a new job, marriage, or a baby occur.

To make the process easier, consider working with a financial planner. These professionals can provide expert guidance and help you make educated decisions about your money. Just ensure the independent financial advisor you choose is a fiduciary, which means they’re legally obligated to act in your best interests.

Conclusion

If you’re a millennial in the midst of building your career, now is the perfect time to get serious about financial planning. By setting clear financial goals, creating a budget, and making informed decisions, you can pave the way to financial independence.

Remember, it’s okay if your plan isn’t perfect from the start. What’s more important is that you begin the journey. Financial planning is a dynamic process that changes as your life evolves.

The saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.” The same applies to financial planning. Start today and reap the benefits in the future. Your older self will thank you.