What Is an HSA?

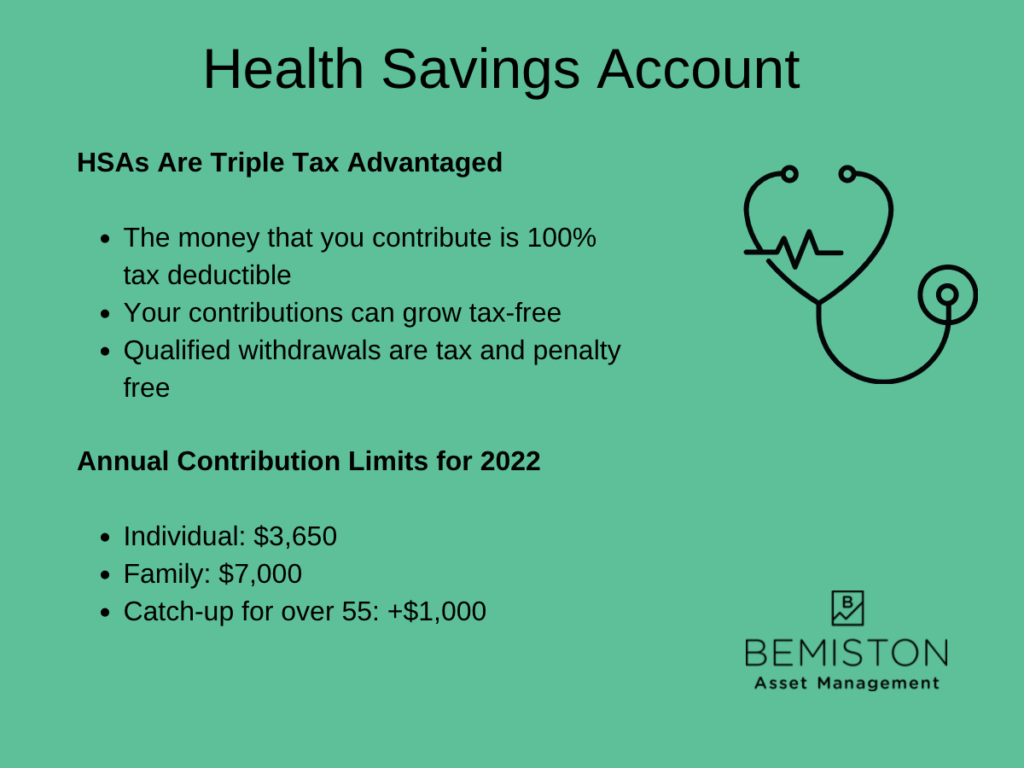

An HSA, or Health Savings Account, is a tax-advantaged account for individuals with high-deductible health plans (HDHP). The HSA allows individuals to save for medical expenses that the HDHP does not cover. The 2022 HSA contribution limits are $3,650 per individual and $7,000 for a family. There is a $1,000 catch-up contribution for those 55 or older.

How Does an HSA work?

An HSA allows an individual to save on healthcare costs when they have high deductibles. As you might have guessed, a high-deductible health plan has higher deductibles but lower premiums. The minimum deductibles may vary by year, but for 2022 it is $1,400 for individuals and $2,800 for families.

Because of the ACA (Affordable Care Act), preventative care is entirely covered by your plan. So, you should not have a copay for a wellness exam or for a flu shot. If you happen to get sick or injured, you will need to pay for your medical treatment.

Your HSA provider may issue you a debit card for expenses or require you to log in through a web portal to get reimbursed. Either way, it will be essential for you to keep your receipts.

Tax Benefits of an HSA

Health savings accounts are triple-tax advantaged, offering more tax benefits than a 401(k) or an IRA.

The contributions that you make to the account are 100% tax-deductible up to the maximum amount, regardless of income and whether you itemize deductions or not. By funding with pre-tax dollars, you lower your taxable income.

The money in the HSA grows tax-free. The contributions that you make can be invested similarly to what you would find in a retirement account.

Potentially, younger and healthier workers can invest aggressively to grow a portfolio to handle the inevitable medical expenses as they grow older. In the investible sense, the growth potential can be considered a retirement account for your health expenses.

Money withdrawn from the account for qualified medical expenses is tax-free and penalty-free. Eligible expenses are pretty broad. They generally cover those expenses that are necessary to alleviate or prevent physical or mental illness.

HSAs can be used for dental, vision, and some over-the-counter treatments. You can find a complete list of covered expenses here.

Does an HSA Roll Over?

Another excellent feature of HSAs is that they are portable. This means the money contributed to the account, including from an employer, is yours forever. Even if you change employers, leave the insurance plan, or stop working altogether, you get to keep the money.

Unlike a Flexible Spending Account, there is no “use it or lose it” provision for the contributions made within a calendar year. Whatever goes unused in an HSA remains in the account for subsequent years. This simple fact can establish an HSA as a potent savings tool for retirement.

HSA as a Retirement Tool

If you already contribute to a retirement plan, such as a 401(k), you need to do that first, at least up to where your employer matches. After making sure you fund your retirement account, an HSA can be a powerful tool that can help you in retirement. As mentioned earlier, the triple-tax benefit allows you to deduct the contributions, grow your funds year-over-year, and cover qualified medical expenses tax and penalty-free.

The ability to grow funds within an HSA tax-free is what makes it so great for young workers and high-net-worth individuals or families. If you can cover your medical expenses from taxable accounts, you can grow your HSA as part of your retirement savings.

Downsides of an HSA

If you choose to invest the money in your HSA, you are exposing yourself to the market’s volatility. A severe market downturn could leave you with a lot less money to cover your medical expenses. That is potentially dangerous while health care costs are ever-increasing.

Also, HSAs are, by nature, more expensive. After all, HSAs are associated with High Deductible Health Plans. For 2022, high deductibles are $1,400 for individuals and $2,800 for families.

HDHPs can be problematic for people with chronic health problems, as they will have to meet the high deductible before the coverage kicks in annually. The higher premiums can strain lower and erratic income budgets. Keeping this in mind, HDHP makes the most sense for the young and healthy or those with substantial net worth.

Choosing an HSA Provider

Your employer may already have an HSA provider available to you through a financial administrator. If you can select your own, keep in mind that there will be variations among fees, rates, minimum balance requirements, and investment options.

There is a lot of due diligence required to help you find the best option for you. The Balance has a list of providers and items to consider. I also know some advisors like to use HealthSavings.com for a broad choice in passive investment options. Other advisors want to use HSAbank.com for a more user-friendly experience.

Working with an investment advisor can help you find the right plan and investment options that fit your needs.

Generally, lower account fees and low-cost, passive investment products that allow you to diversify your portfolio are the best.

Is an HSA Right for You?

By planning and tracking your expenses, you can maximize the use of your HSA right now. You can also invest with your HSA and grow it for when you will inevitably need it to cover medical expenses in the future.

An HSA can be considered a tax-advantaged emergency fund used in conjunction with your actual emergency fund, but you tap into the HSA first. Ultimately, an HSA allows you to reap tax benefits today, accumulate wealth for tomorrow, and spend that wealth tax-free.

With the triple tax advantage and the high probability of substantial medical-related expenses in retirement, using an HSA provides clear and significant benefits. If you meet the requirement for an HDHP, are a young worker, or have substantial wealth, an HSA can be a powerful tax planning tool.

Talking to a financial advisor can help you sift through the complexities and find out if an HDHP and HSA, along with which option, make sense for you.