Category: Financial Planning

-

The One Big Beautiful Bill Act — What It Means for Your Taxes

On July 4, 2025, Congress passed the One Big Beautiful Bill Act (OBBBA), the biggest tax overhaul since 2017’s Tax Cuts and Jobs Act. Some changes are permanent, others expire in just a few years, and many come with income-based “danger zones” where the benefits vanish quickly. Here’s what’s in it for you, what to…

-

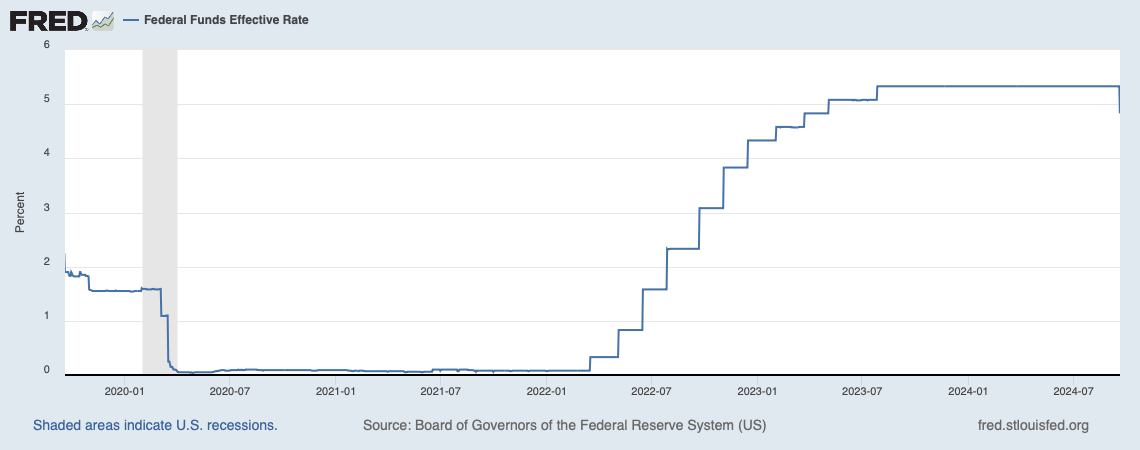

Interest Rate Cuts: Here Are Five Things You Can Do

Unless you live under a rock, you probably saw that the Federal Reserve cut interest rates, shifting its focus away from fighting inflation. Whenever the Fed shifts gears on the level or direction of rates, it can be an excellent time to review your overall savings and investment strategy, especially your cash savings. As the…

-

The Ultimate Guide to Setting Financial Goals

Let’s face it – we millennials have unique financial challenges. From student loan debt to an ever-evolving job market, the pressure is real. It’s a lot. However, you can navigate these increasing challenges. Setting financial goals can be your financial North Star. Let’s explore how to establish your short-term and long-term financial goals and why…

-

How to Become Financially Independent: A Millennial’s Guide

Let’s talk about two compelling money concepts: financial independence and financial freedom. Millennials are redefining how we perceive money, and these terms signify more than just having plenty of cash in the bank. Defining Financial Independence So, what exactly is financial independence? It’s the point where your assets generate enough income to cover your living…

-

Get Ahead: Your Guide to Financial Planning

Want to eat all of the avocado toast and get all of your coffee out? Well, there is a way to afford it all. How? Financial Planning. Financial planning is like Apple Maps for your financial journey. It’s your road map to achieving your life goals, whether that’s buying a house, traveling the world, or…

-

Financial Things Every New Parent Needs to Consider

As a parent, your primary concern is ensuring your children have everything they need to grow up healthy, happy, and well-educated. However, it is equally important to consider their financial future, particularly in today’s volatile and uncertain economic environment. In this blog post, we will explore some of the most critical financial considerations parents need…