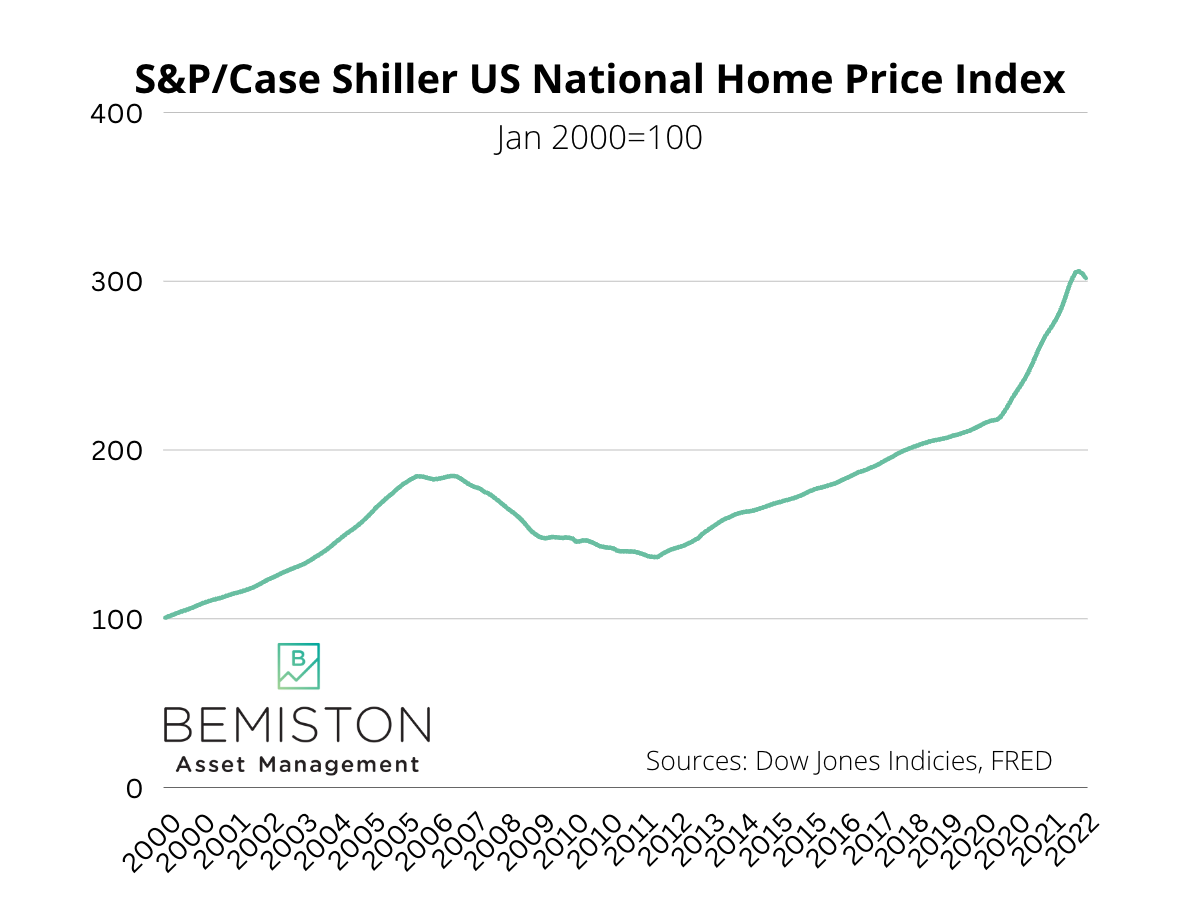

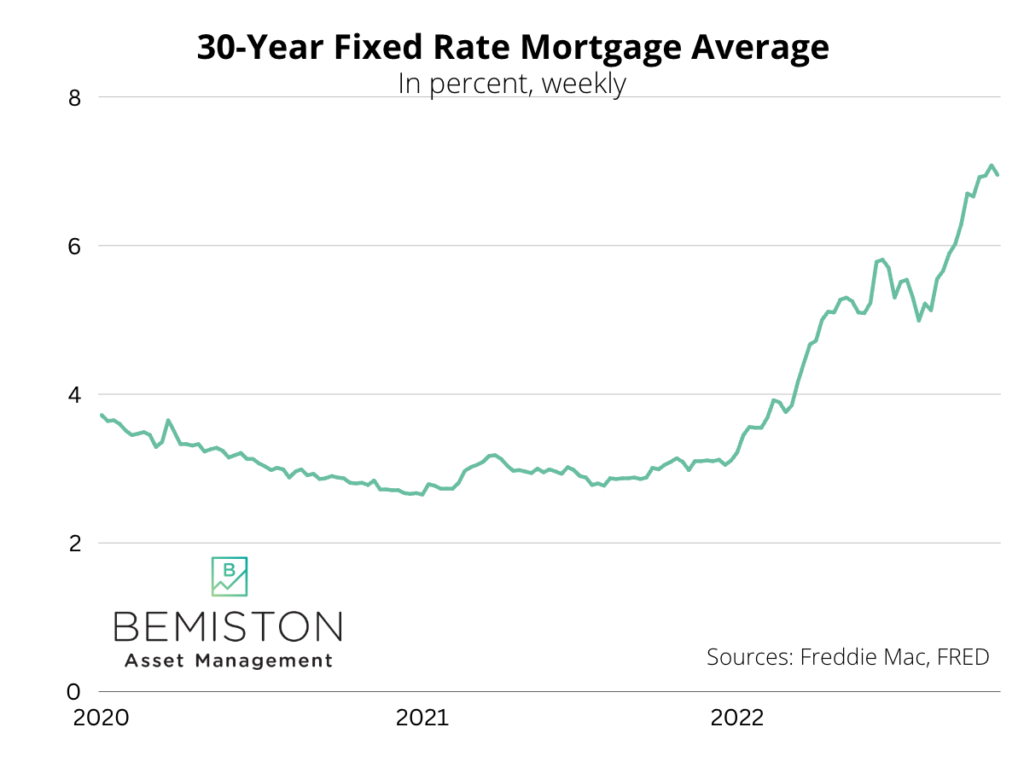

Various factors are pushing housing to extremes that have not been seen in generations, if at all. Home prices are just off all-time highs, while mortgage rates are at the highest in over a decade. With mortgage rates increasing so quickly in 2022, people wonder when home prices will drop.

Ultra-low mortgage rates and a limited supply of houses fueled a rally in home prices and home equity. Home prices in the US rose 60% from the trough in 2012 to 2019. During the pandemic, the Fed cut rates to historic lows and began buying mortgage-backed securities, sending prices higher by another 30%.

- There is a scorching demand from millennials as they finally come into their formative homebuying years.

- Supply is tight as we (as a country) did not build enough in the wake of the Global Financial Crisis.

- Mortgage rates are soaring as the Federal Reserve increases interest rates and stopped its QE program.

Millennials are homebuyers now.

Millennials are now the largest generation and are solidly into their homebuying years, making up 37% of homebuyers in 2022. However, the largest generation, millennials, comprise only 17% of homeowners.

Saddled with student loan debt while entering a poor job market, millennials struggled to find their financial footing. Because of those experiences, they marry later, start families later than previous generations, and buy homes later.

Millennials are the largest generation, and about 63% still have no savings for a home downpayment. However, older millennials are driving the demand for single-family homes. And as younger millennials shed student loan debt and marry, they will enter the market for single-family homes.

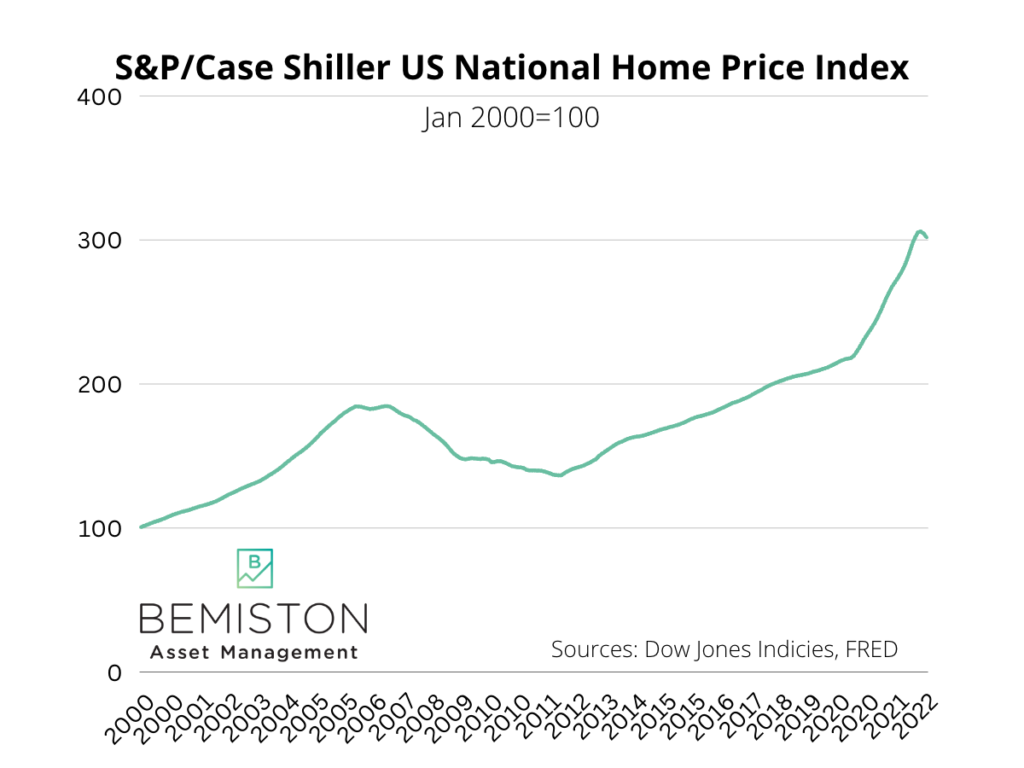

We need more single-family homes.

Much like many supply chain woes of the pandemic, many current housing problems stem from the Global Financial Crisis. The housing boom and bust of the early 2000s led to chronic underbuilding and underinvestment in the supporting supply chain. Depending on where you look and how you define a home, the US is short 3-5 million homes.

For years, builders have needed to bring more inventory to market to keep up with demand. With tight housing supply and historically low mortgage rates, demand surged. Ultimately you reap what you sew, and we did not sew very many homes after the Global Financial Crisis.

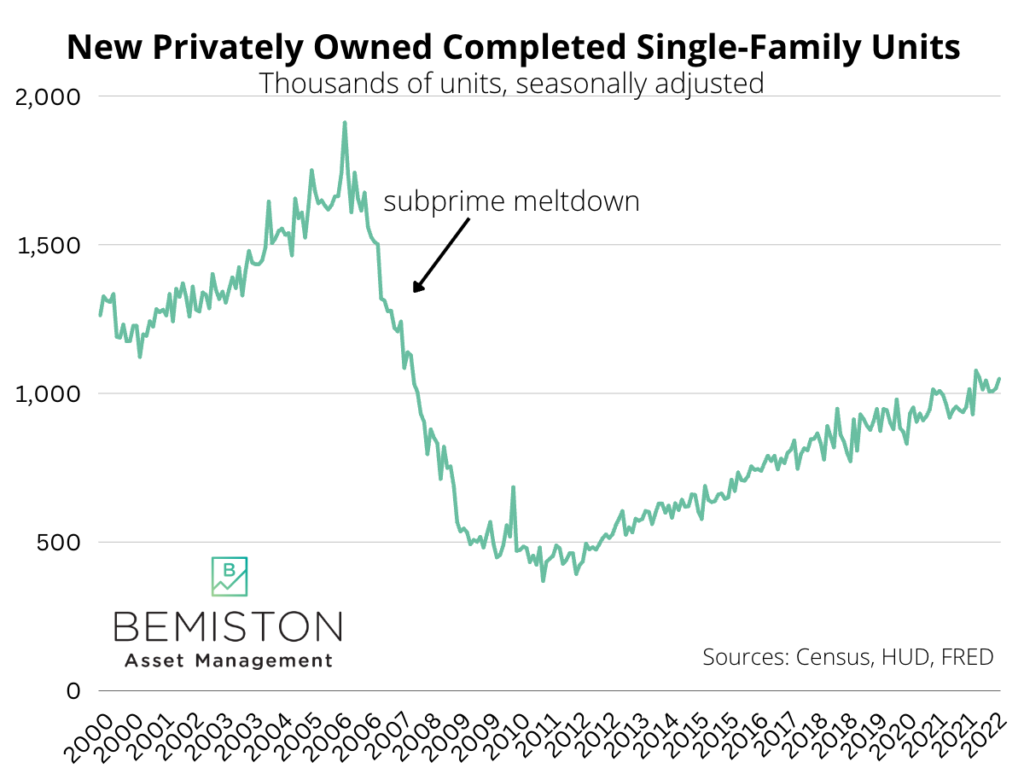

Mortgage interest rates soar higher.

It is not a secret that the Federal Reserve Bank is increasing interest rates quickly. The fed funds rate is a significant factor in determining mortgage rates, but there are other things affecting mortgage rates.

The Fed is also winding down its bond-buying program (quantitative easing), which includes a considerable amount of mortgage-backed securities. The Fed’s launch of QE to gobble up mortgages brought rates down to historic lows.

With the Fed ending its bond-buying program, it is now entering quantitative tightening. Quantitative tightening, or QT, is the winding down of the Fed’s balance sheet. So, the Fed is no longer purchasing mortgages.

There are a few things driving mortgage rates higher at the moment:

- Higher interest rates

- The end of quantitive easing

- Few other investors are willing to step in and buy mortgage-backed securities.

If rates are going higher and nobody is buying mortgage-backed securities, mortgage rates are going to shoot up.

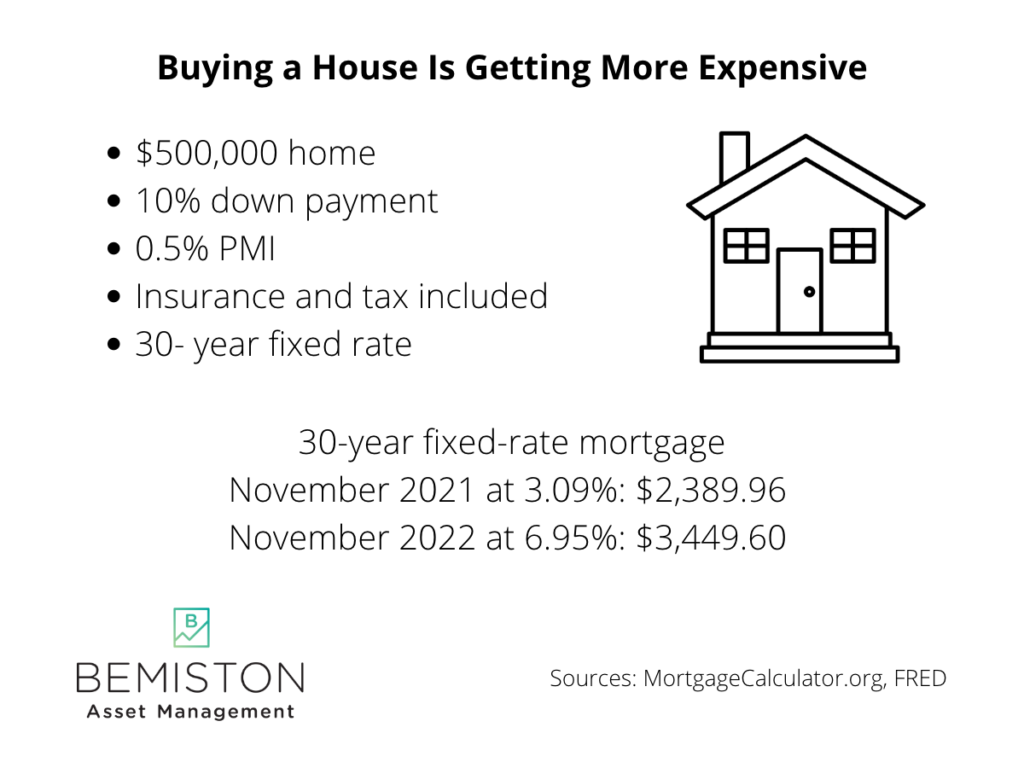

Housing affordability plummets for first-time homebuyers.

The Fed is trying to bring down inflation by going nuclear with its aggressive interest rate hikes. The Fed has increased rates by a record 0.75%–four times in a row this year.

Increasing interest rates might cool inflation by cooling economic sentiment, reigning in the hot jobs market and the demand for housing. The higher borrowing costs have already significantly cooled demand, but prices remain relatively high.

Surging mortgage rates and high home prices mean housing affordability is crumbling. Furthermore, it’s doing so at the fastest pace anyone has ever seen. It’s not falling for just anybody, either. Housing affordability is declining the most for first-time homebuyers, who are predominantly millennials.

Things are not likely to get more accessible for those unable to hop on the property ladder during the last few years. The Fed will likely keep rates elevated for some time, pressuring mortgage rates. Also, elevated interest rates make it more difficult for builders to commit to creating more supply.

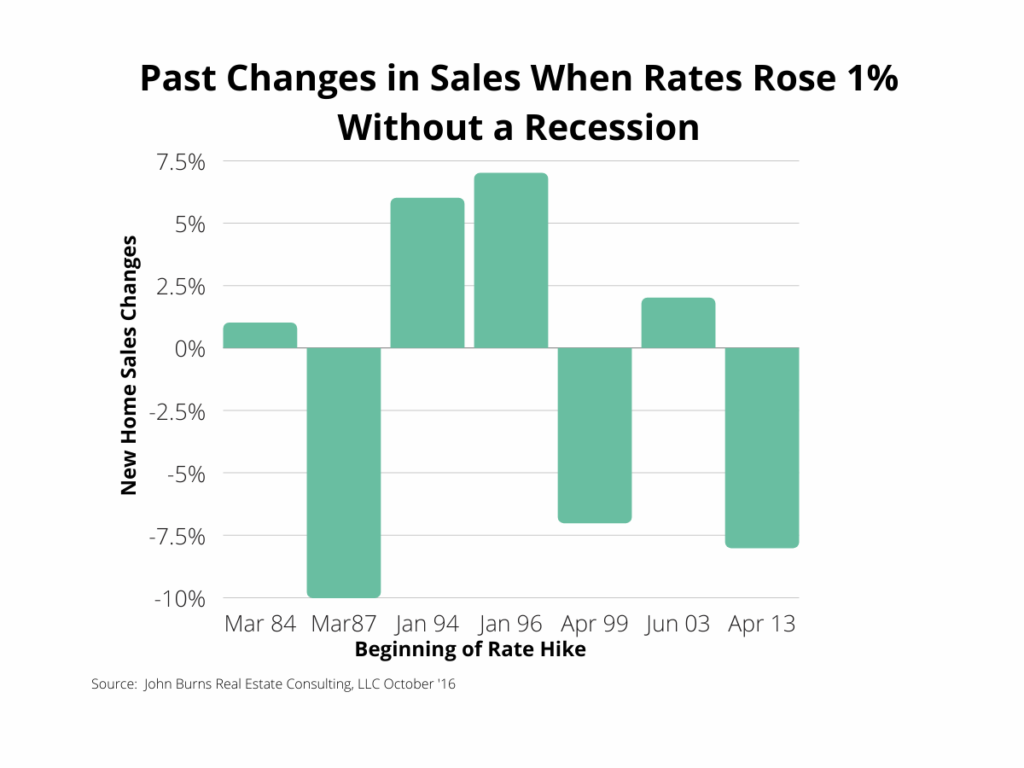

When will home prices go down?

Rising interest rates are slowing the housing market. However, the speed and size of interest rate increases have given homebuyers pause. While transactions may be slowing, prices have yet to come down significantly. It can take a while for policy changes to have a significant impact on home prices and sales.

The Fed recently said, “Though housing price increases have slowed recently as the Fed has raised interest rates, valuations remain stretched when compared with such metrics as rents,” according to Bloomberg.

Short-term interest rates, such as the one set by the Fed, are a vital component of monetary policy. However, homes are long-term assets and use longer-term financing, making long-term rates a more appropriate measure.

Perhaps most importantly, access to credit is the most significant determinant of home prices. Access to credit and financial conditions are a function of monetary policy set by the Federal Reserve. Short-term interest rates matter when predicting home price movements.

Will home prices drop in 2023?

With interest rates increasing and the economy cooling down, the stage is set for home prices to cool off. Home prices are likely to drop in 2023, but it likely is nothing like the Great Recession.

Housing market predictions are about as reliable as any other prediction, but things differ from the Great Recession.

- Lending standards are much tighter now.

- Over 90% of the market uses fixed-rate mortgages, so there are few distressed sellers.

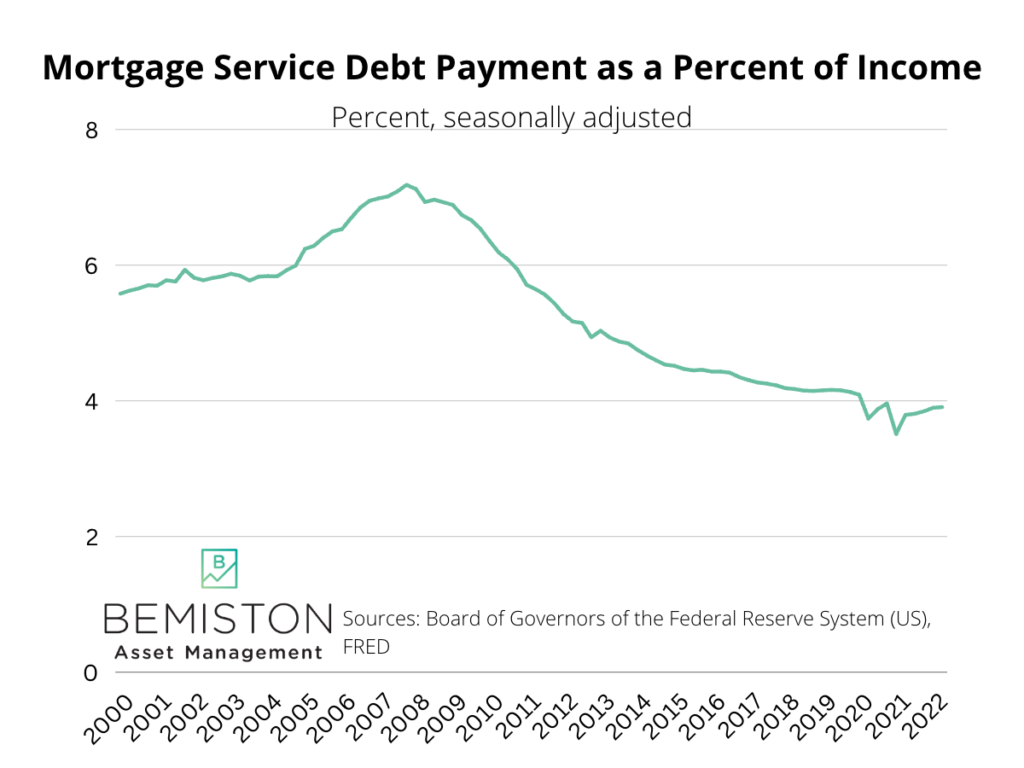

- Mortgage payments are a much smaller portion of household income than before the Great Recession.

The vast majority of homeowners are on fixed-rate mortgages with relatively high equity. Homeowners have effectively locked in their payments and have no incentive to sell in this environment. For these reasons, we will not see a flood of homes hit the market.

Existing US homes available for sale were at their lowest level earlier this year. They have only slightly budged off the bottom. Existing homeowners have little incentive to sell and buy another house, which will keep prices elevated.

For current homeowners to move, they would take on a mortgage that is 3%-4% higher than their existing mortgage. Current homeowners will not want to accept a lower price on their current home to move into a more expensive mortgage.

The lock-in effect puts a floor on home prices. Everybody that could refinance or buy a house over the last two years did. It will be first-time homebuyers left out of the market that feel the brunt of rate increases.

Higher rates will not hurt new homeowners.

There is some concern about the rapid increase in rates impacting new homeowners. New homeowners have not had much time to build equity in their homes.

For new homeowners, an Oxford Economics study suggests if home prices fall by 15%, about two-thirds of their equity generated over the past few years will be eliminated. Older homeowners are much better off, as half of those over 65 bought their homes before 2000.

If home values drop significantly, new homeowners will be underwater on their mortgage, owing more than it is worth. Because almost all new home loans are fixed-rate, new homeowners will not be under stress to make the payments. However, being underwater on the mortgage will make it harder to move or refinance.

Even a tiny drop in home prices would further exacerbate the lock-in effect, putting a floor on home prices. Being underwater on a low-interest mortgage makes it very unlikely that the homeowner will move.

Don’t expect a drop in home prices.

Homeowners are in much better shape than before the Great Recession. They have more income relative to mortgage payments than before. However, if the economy enters a recession with many job losses, that will change, and we could see home prices fall.

The ideal scenario would feature a cooling of house price growth as new housing supply comes to market from builders. With the aggressive Fed rate hikes and economic uncertainty into 2023, builders are less likely to start and finish new constructions.

US homebuyers are unlikely to see a lot of new homes completed in 2023. Especially not enough to fill the gap missing from the Great Recession. We are unlikely to see a lot of homes hit the market unless we see a significant increase in unemployment. There will not be enough homes to meet the growing demand, keeping a floor on prices.