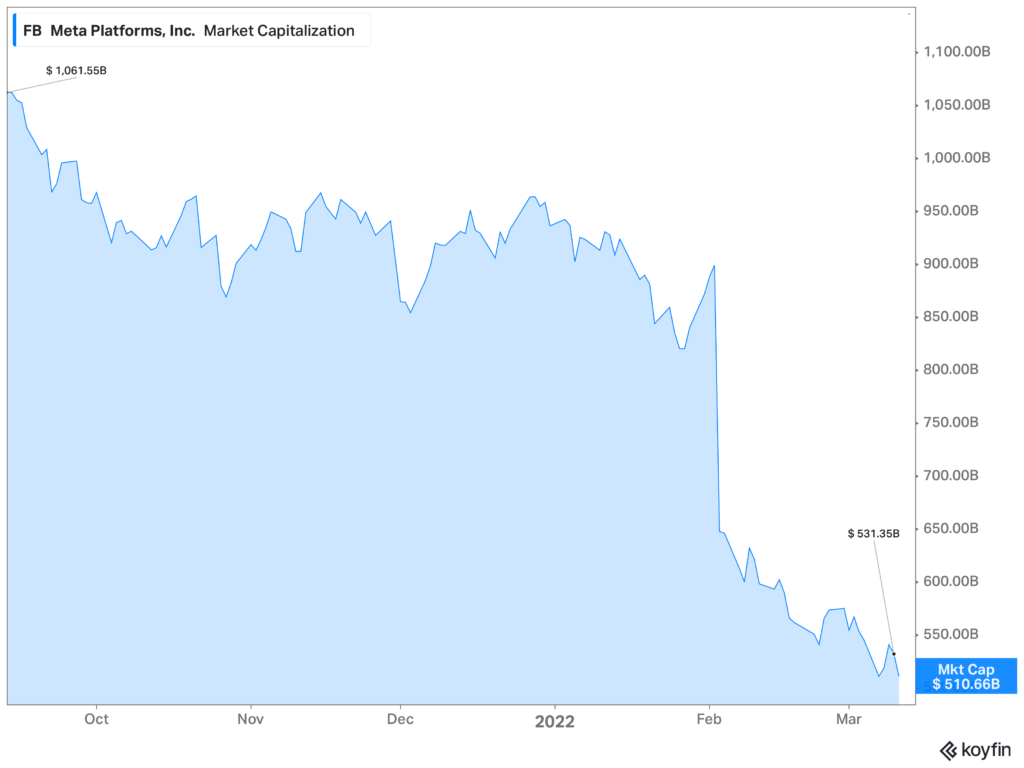

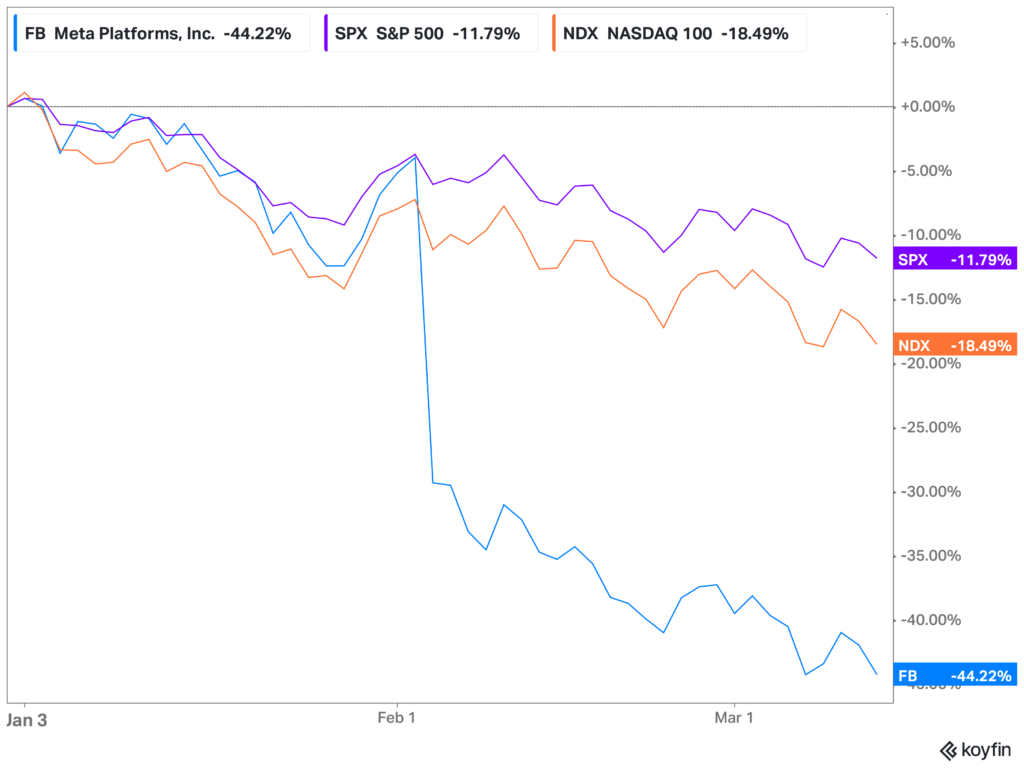

Facebook (I still refuse to call it Meta) has had a rough few months. Its stock has fallen over 40% since November. That is a phenomenal drop, especially for a company in the top ten of the S&P 500 Index. The size of Facebook and its plummet have helped drag the S&P 500 Index down over 11% in the past few months. Why has Facebook lost over $500 billion in market capitalization, and why does it matter for you? Let’s get into it.

Facebook’s Ad Revenue Slips

Apple’s iOS privacy changes have significantly impacted Facebook’s ad revenue. Previously, Apple users had to opt-out of data collection efforts that companies like Facebook would use to sell ads or data to businesses. Now, Apple users must opt-in for such companies to collect such information. The majority of Facebook’s revenue comes from ad sales, so these privacy changes are a pretty significant headwind that will continue to drag. Facebook’s CFO anticipates that the total impact could be $10 billion for 2022.

Facebook Users Decline for First Time

Facebook’s global daily active users fell for the first time in its history. Users fell from the previous quarter for the first time to 1.929 billion from 1.930 billion. Facebook faces increasing competition from apps such as TikTok and is no longer seen as “cool” among younger users. It is attempting to shift to the more popular short video format that has been successful for TikTok and YouTube but is struggling to gain traction and monetize ad revenue in this area.

Facebook Shifts to the Metaverse

Mark Zuckerberg is staking the future of his flagship firm on developing virtual reality and the metaverse. He seeks to create a world where workers can create, interact, socialize, and play on the internet. Zuckerberg is trying to move on from social media and mobile phones as that line of business is shrinking and becoming unreliable for growth as the industry matures. The VR unit expects to burn another $10 billion in 2022 with no prospect of profitability anytime soon.

Virtual Reality adoption has been slow, to say the very least. Without a must-need application for mainstream users, VR profitability does seem quite far off. Zuckerberg is betting that Facebook’s future lies less in online ads and social media and more in whatever the metaverse becomes.

Facebook’s Failed Attempt in Crypto

Meta’s stablecoin project, Diem, is shutting down. A stablecoin is a class of cryptocurrencies backed by a reserve asset that attempts to offer the security and anonymity of cryptocurrency without the volatility of prices. The Diem project was a little different because it sought to be backed by a basket of government currencies.

However, regulators saw some potential problems with this immediately. There is potential that Diem could create volatility among weaker currencies. Also, there were antitrust concerns that Facebook could force businesses using its platform to use the Diem stablecoins. Basically, the Federal Reserve said, “No, we already have these things called “dollars” that are pretty stable, Mark.” This blow was a pretty big deal. Many thought this project would be a cornerstone in Facebook’s push into the metaverse.

Facebook’s Fall Has Rocked Your 401(k)

Facebook (ugh, Meta) is a massive part of the S&P 500. Sure, there are 500 companies, but only a handful make up a good chunk. Impressively, the top ten firms in the S&P 500 make up over 25% of the index’s entire value.

Facebook fell from a top-five firm to outside the top ten in just a few months, shedding over $550 billion in shareholder value on its way down from its all-time high. It’s a fall from grace never seen before on the S&P 500.

Many 401(k) plans feature index funds. An index fund is a mutual fund or exchange-traded fund (ETF) that tracks a broader market index, such as the S&P 500. Index funds are passively managed to meet the index, closely following all the ups and downs. With Facebook being such a significant component of the S&P 500 and many other indexes, it is in many index funds offered in 401(k) plans.

The concerns over inflation and war in Ukraine have certainly riled markets as of late. However, markets began running out of steam in the fall. Tech stocks have been selling off the past few months in anticipation of Federal Reserve rate hikes. Growth stocks, such as tech, tend to sell off as investors reassess their appetite for risk in an increasing interest rate environment.

The decline of tech stocks, especially Facebook, is more related to changes in Fed policy and an uncertain business outlook. Facebook has become such a large part of the S&P 500 Index. Its historic decline dragged down some of the most extensive indexes and passively managed index funds that 401(k) plans hold.

What Can You Do?

It can be challenging, if not impossible, to avoid a market-wide selloff altogether. That challenge compounds for passive index investors when the selloff comprises the most valuable companies.

Passive index funds are an excellent way for investors to access capital markets in an affordable and diversified manner. However, when a handful of companies can dictate the vicissitudes of a broad index, it can be a problem for investors.

Investors can and should still use passive index funds but might also want to consider using funds that are benchmark agnostic. Funds that ignore an index or follow a different investment theme can be a great way to diversify. Limiting exposure of the largest market capitalization firms can provide investors with the protection of their total portfolio.