It has been a difficult quarter for investors. Major indexes entered bear territory (means down 20%). US treasuries, generally the safest of assets for when investors are scared, have had their worst year since the 70s (when interest rates go up, bonds go down). Commodities, which I generally say “they suck until they don’t,” have not been sucking this year (entities sometimes do well when investors are scared and inflation is high). Stocks, bonds, and commodities have all been quite volatile as investors try to figure out inflation, the Fed, and the global economic slowdown.

Stocks

Stocks have been on a wild ride the past few years. Major indexes roughly doubled as the Fed cut rates and launched an eye-popping quantitative-easing campaign to buoy asset prices. Congress acted with stimulus checks and generous unemployment insurance. Flush with cash, bored-at-home retail traders took advantage of new zero-cost transaction trading apps and platforms to chase (push?) stocks higher.

Valuations did not matter in this environment and perhaps have not been important for quite some time. The only thing that mattered was a narrative and a hope of striking it rich. Money was cheap and easy, so the rosiest of expectations seemed plausible. It was most prevalent among tech stocks, where companies traded at astonishing multiples of sales projected years into the future. Profitable business models did matter, only growth of market share.

Enter the Fed

The most basic forms of stock or equity valuation models have some sort of earnings or dividend projection tied to a growth metric. That future expected earnings number is divided by some discount rate or required rate of return. Some other ways to calculate that rate will yield different answers. However, most of the methods I can think of off the top of my head include interest rates. All else equal, if interest rates go up (like the Fed is doing), valuations must come down. Investors preferred a fantastic narrative and growing market share to profitable business models in the accommodating macro environment.

Valuations Matter Again

Investors are ditching the fanciful narratives for cash-generating businesses as interest rates rise and growth projections fall. Notoriously unprofitable firms, such as ridesharing and meal delivery services, have seen their valuations tumble. Now, investors seek firms that make profits rather than rapid market growth. A famous short-seller, Jim Chanos (profiting from a stock price decline), succinctly stated that if a meal delivery firm cannot make money when everybody is in lockdown and flush with stimulus money, then there is a problem with the business model.

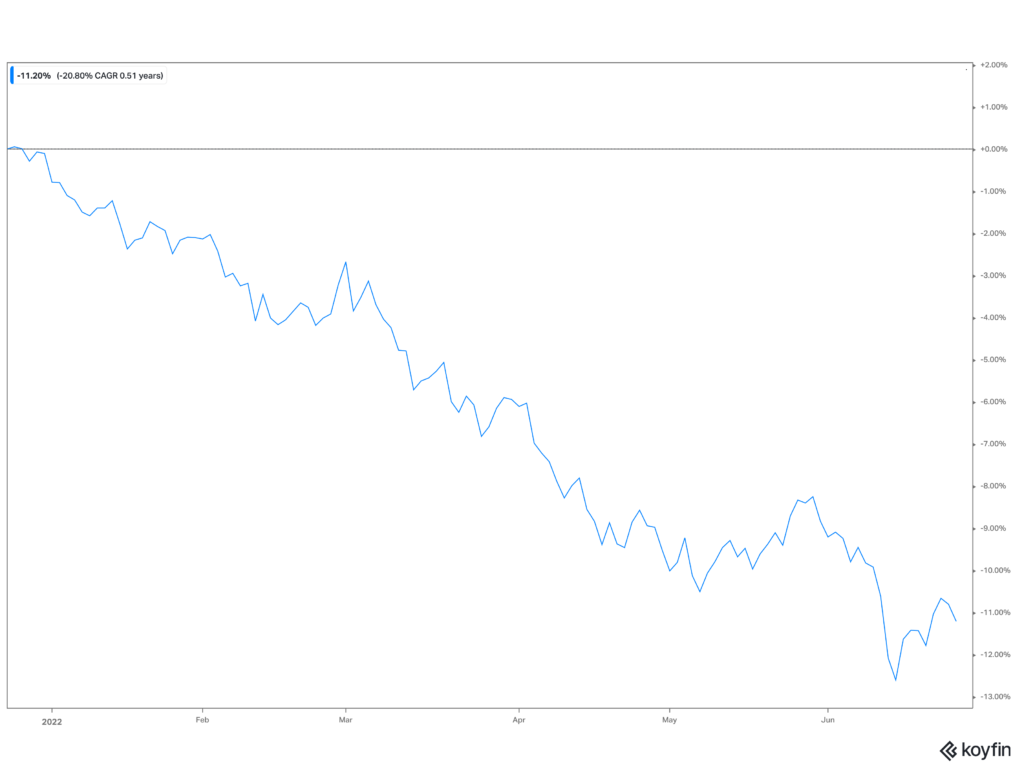

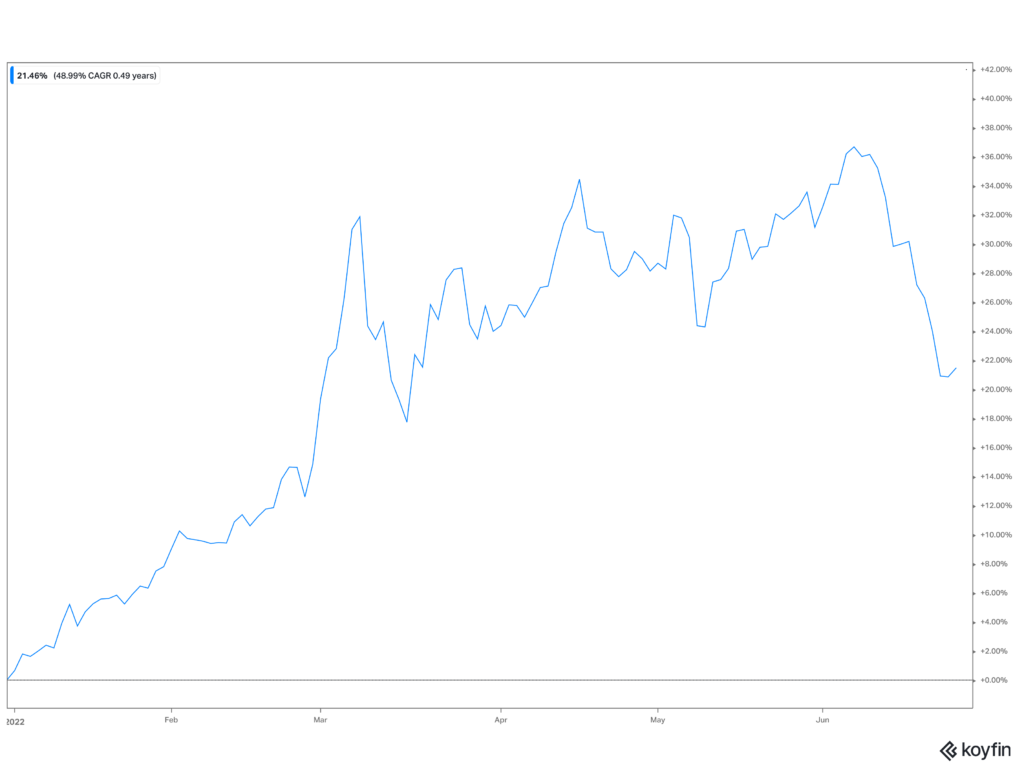

Amid economic uncertainty, rate increases, and uncomfortably persistent inflation, investors are returning to cash-flow generating businesses and shying away from market growth-oriented firms. A study from The Economist divided tech firms on the tech-heavy NASDAQ along profitability using a free cash flow to market capitalization ratio. The higher the ratio, the more cash a firm generates for its relative value.

The researchers found that from the end of 2019 to the peak of November 2021, the low-profitability firms returned 24% to the more boring firms’ 15%. Since the peak, the low-profitability firms have fallen by around 22% to the higher profitability firms’ 8% drop. Over both periods, the higher profitability firms have outperformed by 6%. To further the point, an ETF that focuses on large-cap cash flow generation is up on the year compared to its sister index, which is down on the year.

Bonds

Bonds are boring to most people, but that is the point. They provide a steady income stream for the investors that effectively loaned their money to a corporation( or government). Bondholders prefer the certainty of income over the riskier prospects of stock performance.

When investors are nervous about the stock market, they tend to flee to US Treasury bonds, which are generally considered the safest investment on the planet. While bonds provide a steady income stream to investors, their market value can vary wildly when interest rates rise or fall.

There is an inverse relationship between bond values and interest rates. When interest rates go up, bond values fall. With the Fed increasing rates at the fastest clip in a generation, US Treasuries are having a terrible year to match.

Commodities

Commodities are homogenous goods that are interchangeable with units within that type. You can trade ears of corn and be no better or worse off. Examples of commodities are grains, oil, copper, natural gas, pork, and natural gas.

Commodities are also weird. They are tangible assets, not financial ones. They receive their price in the real world based on the demand for their use. They cannot produce cash flow in the future. So, investors avoid holding them directly and use derivative instruments to gain exposure to price fluctuations.

Because commodities receive prices from the real economy (volumetric and not financial), they can perform quite well during broad-based inflation or rapid economic growth. Commodities have performed exceptionally well this year, with the highest inflation in a generation. However, as fears of a global recession loom, commodities tanked in June.

What Investors Can Do

Over the past few years, it was easy to get wrapped up in the stock market mania. It was difficult to avoid seeing the headlines surrounding meme stocks and crypto and not feel left out (money FOMO is the worst FOMO). Easy monetary policy and fiscal stimulus led to speculative risk-taking and frothy asset prices.

Investors ignored profitability and sent growth stocks soaring, betting on fast revenue and market share growth. Indexes became rather top-heavy with tech names. The biggest names in tech became even more prominent, with the top ten names in the S&P 500 Index accounting for over a quarter of its total value. The epic downfall of some of the top tech stocks (FB and NFLX) dragged indexes along with them.

The reversal in easy money policies forces investors to pay less attention to overly optimistic narratives about “industry disruption” or market growth and focus on business models again. Businesses that produce free cash flow (making money free of most accounting shenanigans) and return capital to investors (dividends or share buybacks) are back in style.

This reversal of fortune is a great time to look at your portfolio. While I philosophically believe in low-cost passive investment funds, there are advantages to diversifying beyond the S&P 500 Index when the Fed tightens monetary policy.

There are other low-cost and passive investment products out there that do not strictly index to the S&P 500. Those funds can focus on size differences, relative value, profitability, global opportunities, and other investment themes. That investment variety can be very beneficial when the most significant names in the index lose the majority of their value relatively quickly. Globally diversified portfolios that ignore strict indexing, focusing on lower market capitalizations, relative value, and profitability have faired relatively well compared to the S&P 500 and NASDAQ 100 indexes.