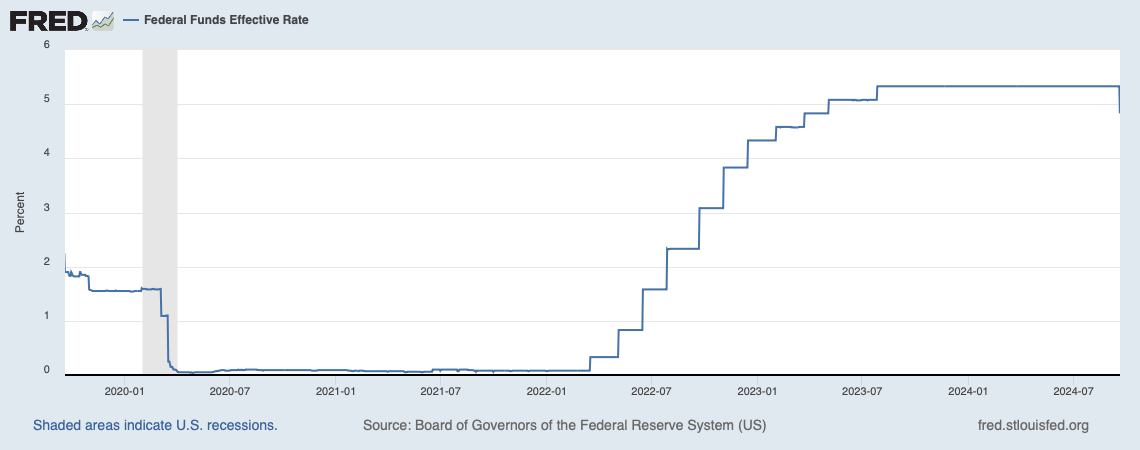

Unless you live under a rock, you probably saw that the Federal Reserve cut interest rates, shifting its focus away from fighting inflation. Whenever the Fed shifts gears on the level or direction of rates, it can be an excellent time to review your overall savings and investment strategy, especially your cash savings.

As the Federal Reserve cuts interest rates, savers and investors should rethink their cash strategies. As interest rates fall, the options that once offered solid returns, like high-yield savings accounts, will no longer provide the same benefit. While HYSAs and savings accounts may fall in favor, investors still have some options for their cash savings.

Whether saving for a future expense, building an emergency fund, or growing your wealth, now is the time to explore alternatives to keep your cash working even in a low-rate environment. One option worth considering is the often overlooked yet reliable Certificate of Deposit (CD).

1. Certificates of Deposit

It’s boring but effective. A CD allows you to lock in a rate for a predetermined period. A CD will offer a higher rate than your checking and savings account, especially as rates will likely fall over the next year. The catch is that you have to lock your money up. You can technically cash in early, but there is a penalty (unless it’s a no-penalty CD).

- They range from a handful of months to five years

- Rates vary among the maturity ranges, peaking around 3

The best use of CDs in this market (or any) will likely match your CD with a goal or create a CD ladder. If you have a known cash outflow in 6+ months, it might make sense to stick the appropriate amount of cash into a CD that will mature when needed. If you need money for a known expense such as a vacation, downpayment, house project, or whatever else, a CD can be a great tool.

2. Using Multiple CDs to Manage Interest Rates

You can use a few CDs of varying lengths to meet your expected outflows rather than keeping what you need in cash.

When can someone use this strategy? You know your cash needs over the next few years, e.g., sending your kiddo to school. You can offset some tuition by purchasing CDs to coincide with those needs.

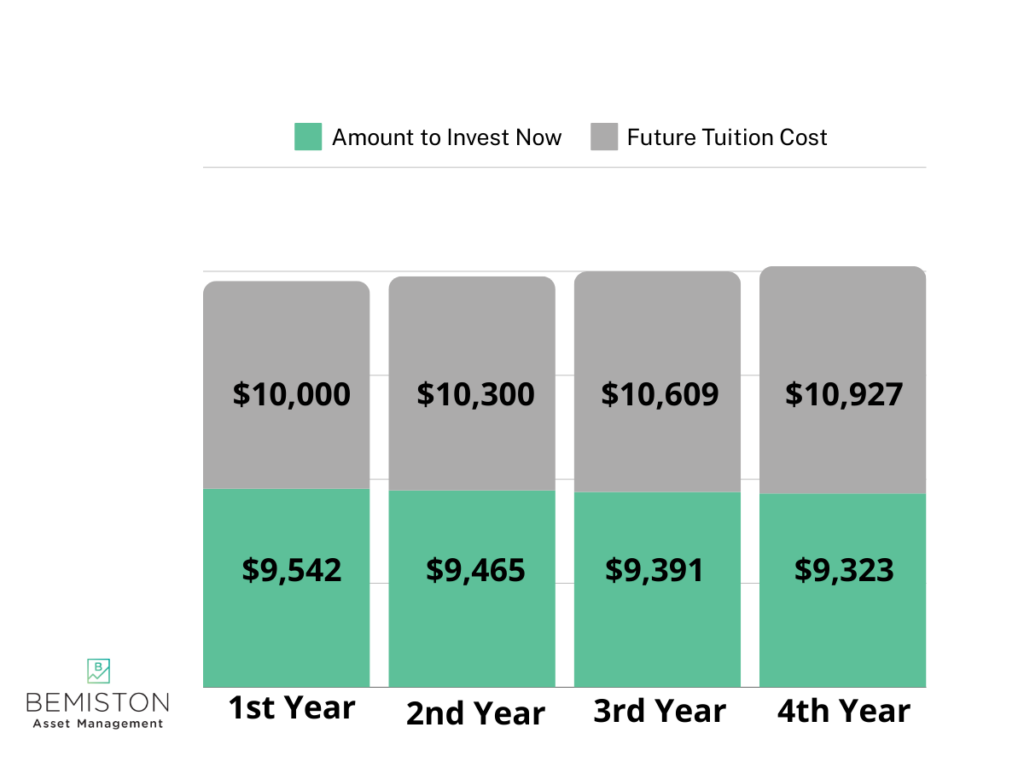

If you know the tuition expenses for the next 1, 2, 3, and 4 years, you can put the appropriate amount of cash into a CD of the corresponding length. You use the interest payment(s) and principal to cover your total needs in the future, freeing up some of your cash now.

Let’s do an example: Keeping the math simple, let’s assume tuition will be $10,000 for the four years, and that it increases at 3% per year. We have the ability to use our cash to invest in CDs now for our future tuition needs as they arise.

Using interest rate information from here, we can find the corresponding CDs we need. Let’s ignore taxes here for the sake of simplicity.

- 1-Year CD (4.8%) for tuition needed in Year 1.

- 2-Year CD (4.32%) for tuition needed in Year 2.

- 3-Year CD (4.15%) for tuition needed in Year 3.

- 4-Year CD (4.05%) for tuition needed in Year 4.

Using a CD savings strategy allows us to put up less money to cover known future tuition expense.

3. Bonds and Bond Funds For Falling Interest Rates

CDs provide a safe, predictable return with minimal risk for the average saver. However, they require locking up funds for a set period, making them ideal for very conservative known savings goals.

Bonds may offer potentially higher returns and more liquidity for when goals are less certain in timing. One significant advantage bonds have in a decreasing rate environment is that they can gain in value, offering investors capital gains in addition to interest income.

- Bonds can be an outstanding option when your goals are a bit further out, offering potentially higher returns, tax advantages, and liquidity over CDs

- Bond funds are an excellent choice, especially when the yield curve is upward-sloping (actively managed bond funds can more easily beat the index in these markets)

- US Treasuries: Very safe and secure, US Treasuries are among the safest assets in the world. While interest and capital gains are taxable, interest is not taxable at the state level.

- Short-Term Bond Funds: These are less sensitive to interest rate changes and provide better yields than many savings products. As rates fall, bond prices rise, making short-term bonds an appealing option.

- Municipal Bonds: Tax-exempt municipal bonds can provide attractive yields, especially if you’re in a higher tax bracket. Because of advantage, they can be an efficient way to manage your cash. To determine if municipal bonds are good for you, you must look at the return equal to the tax rate.

Finding your tax-equivalent yield

TEY = Municipal Bond Yield / (1 – Tax Rate)

Municipal Bond Yield: The interest rate or yield on the municipal bond (which is generally tax-exempt).

Tax Rate: Your marginal tax rate, which is the combined federal, state, and local tax rate that applies to your next dollar of income.

This formula helps you compare the yield of a tax-exempt municipal bond to a taxable bond. It tells you how much a taxable bond would need to yield to provide the same after-tax return as the tax-free municipal bond.

Example:

- Municipal Bond Yield: 3.5%

- Tax Rate: 40%

Formula:

TEY = Municipal Bond Yield / (1 – Tax Rate)

Calculation:

TEY = 3.5% / (1 – 0.40)

TEY = 3.5% / 0.60

TEY = 5.83%

If your tax rate is 40%, a municipal bond with a 3.5% yield would have a Tax-Equivalent Yield (TEY) of 5.83% compared to a taxable bond.

While bonds carry more risk than CDs and savings accounts, they offer distinct advantages in a falling interest rate environment. Investors can “lock in” higher interest rates with bonds and potentially benefit from price appreciation.

4. Stocks and Bonds: Using a Portfolio to Earn When Interest Rates Fall

If the time horizon for your cash is a bit longer, you can take on more risk. Using a taxable account and some tax-efficient ETFs can help you grow your money when the yield on HYSAs falls. A heavily weighted bond portfolio with a small stock allocation can earn a decent return as rates fall. Stocks and bonds tend to do well in a falling-rate environment.

- Using a portfolio of bonds and stocks gives you the potential to out earn the other strategies listed here

- Bonds and stocks can fall in value in the short run, even if rates come down.

- While the risk is higher, a 60% bond/40 % stock portfolio protects value and delivers returns over a multi-year period.

When to use this strategy:

- When saving for something significant over the long run but still trying to figure out what it is.

- You are saving for something expensive, but inflation is rising faster than yields can keep up. For example: housing, cars, or higher education.

- If you think CDs are boring and want to feel alive.

- You aren’t worried about short-term fluctuations in value.

5. Just Buy Stocks

The Fed typically cuts rates in two circumstances: (1) the economy, specifically the labor market, is deteriorating, or (2) disinflation takes root, and keeping interest rates high risks damaging the economy. While the unemployment rate has crept up lately, it has been more due to more workers entering the labor force and not finding jobs immediately. So, the Fed is cutting rates as inflation comes down. Yes, prices are higher than in 2019, but they are increasing more slowly than in the past few years.

What does that mean for stocks?

Even though we have some economic uncertainty at the moment (like always), things are good. Recession fears are all but gone. Inflation is down. The job market is good. Things are fine. The Fed is cutting rates. What does this all mean for stocks? Nick Maggiulli had some pretty good insight over at his much more popular blog:

- Historically, US equity returns have been primarily positive following Fed rate cuts.

- In the last 21 rate-cutting cycles, the S&P 500 averaged a 9% return in the 12 months following the initial cut when the index was within 5% of its all-time high.

- When the index wasn’t within 5% of its all-time high, the 12-month return averaged 16%.

- Out of those 21 cycles, the 12-month return was negative in only four instances.

- Over a longer period, the S&P 500 had a cumulative average return of 51% three years after the initial cut if it was within 5% of its all-time high and 37% if it wasn’t.

- Markets tend to trend—all-time highs lead to more all-time highs.

Despite the economic uncertainty caused by rate cuts and the presidential election, holding stocks is a solid option when you won’t get 5% for “free” anymore.

What about an Emergency Fund?

Of course, which strategy is best depends on your needs. You need an emergency fund, but you can still keep cash in your checking account. Checking accounts are great for covering immediate bills. However, keeping too much in your checking account can slow down your net worth’s growth. Getting creative with your cash savings can boost your savings and investment goals while maintaining a cushion for emergencies.

TL;DR

As the Federal Reserve shifts its focus away from fighting inflation and begins cutting rates, it’s a perfect time to reassess your cash-saving strategies. While high-yield savings accounts have been popular in a higher-rate environment, falling rates call for a more proactive approach to maximizing returns on your cash.

Certificates of Deposit (CDs) offer a safe and effective way to lock in higher rates for set periods, especially when matched with specific financial goals or used in a laddering strategy. Meanwhile, bonds and bond funds provide more flexibility and the opportunity for price appreciation as interest rates fall, making them an attractive option for investors looking to balance income and potential capital gains. A well-structured portfolio of bonds, with a sprinkle of stocks for the long term, can further enhance returns for those willing to take on a bit more risk.

Ultimately, the right strategy depends on your financial goals and risk tolerance. By getting creative with your savings and using a combination of CDs, bonds, and perhaps a diversified portfolio, you can ensure your money continues growing even as interest rates decline.