Short-Term Investments

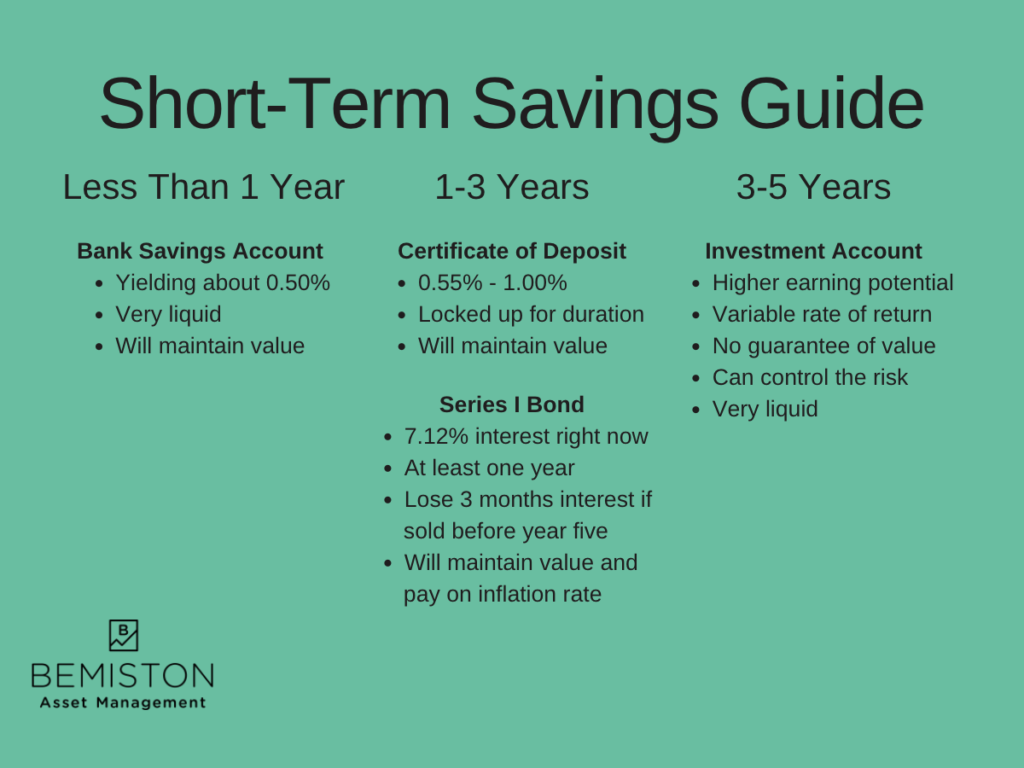

Matching your money to your short-term needs can help you squeak out some gains, even in a low-interest rate environment. A short-term investment can be converted by investors to cash now or soon, with relative ease and safety of principal. However, keeping a pile of money in cash can leave some earnings potential on the sideline.

A short-term investment is anything that maintains its value reasonably well. Generally speaking, lower risk and lower reward investments hold value over higher risk and higher reward growth investments.

Short-term investments are for short-term goals. Think less than five years. Investors are willing to give up a higher expected return for a degree of certainty that they have what they need when they need their money.

Investment Options for Less Than a Year

For the most immediate cash needs or an emergency fund, you need something that maintains certainty of principal above all else. An emergency fund is typically three-to-six months of expenses. Extra cash needs are for non-routine; think of maintenance, repair, or other significant annual payments that are on the horizon.

How To Do It

Bank checking accounts, savings accounts, and money market accounts are not offering much return right now. High-yield savings accounts are earning around 0.50% APY right now. Not very much. These rates are also significantly less than headline inflation.

While your money will technically lose purchasing power in these accounts, it will lose less than standard checking. The point of these accounts is to earn a little return on your immediate needs, not build wealth.

| What? | Bank Account |

| How long? | Less than a year |

| How much? | 0.50% APY |

Where to Keep Your Money for One-to-Three Years

If you are saving for a big purchase over a one-to-three-year period and want to avoid losing money, you have a few options.

Certificate of Deposit

If you are willing to lock your money up for over a year and guarantee its safety, a certificate of deposit is a solid option. Online bank savings accounts offer 0.55% for a year up to 1.00% for five years.

The problem with these accounts is that they still offer very little return. After considering the inflation rate, CDs fall pretty short of protecting your money. Another problem is that you are locking up your funds.

However, CDs can still be a good option for excess cash for which you do not have immediate use. Inflation will undoubtedly erode the value of your money, so investing in a CD will help offset some of that loss in real value.

Series I Bonds

With inflation levels well above short-term interest rates, the best place to put cash right now is Series I Savings Bonds offered by the U.S. Treasury. Series I Bonds earn interest on a combination of fixed interest rates and inflation-adjusted rates. Right now, Series I Bonds are offering a rate of 7.12%!

- The interest rate is one part fixed and one part inflation. The inflation-based interest rate is adjusted twice a year, once in November and once in May.

- I Bonds can be purchased in amounts as low as $25 all the way to $10,000 per individual, per calendar year.

- Series I Bonds pay out for 30 years

- The bonds may be sold after one year. However, selling the bonds before year five will result in a loss of three months’ interest.

Series I Bonds are an excellent place to put money for short-term savings. The certainty of value combined with an inflation-adjusted interested payment provides investors with an ideal place to park cash.

| What? | CD |

| How long? | 1-5 years |

| How much? | 0.50% – 1.00% |

| What? Series I Bond | |

| How long? At least a year | |

| How much? 7.12% (resets) |

Where to Keep Your Money for Three-to-Five-Years

Saving for the three-to-five-year horizon is a little trickier. Money market and certificate deposit rates are 1%, at best. For this longer period, lagging inflation will certainly hurt investors, especially when it’s high.

Series I Bonds can help investors in this time horizon, but there is also a chance that inflation will fall off early next year. Series I Bonds may be the best place to put cash right now, but perhaps not next year.

The Stock Market for Short-Term Savings

Online savings accounts and certificates of deposit are safer investments, but they also ensure that you will not keep pace with inflation. Not keeping pace with inflation will make it harder to reach those short-to-intermediate goals.

Investing in the stock market adds a lot more risk to your assets, allowing you to earn more returns. To help offset some of that stock market risk, you can hold an index mutual fund and United States Treasury Bonds.

Stocks. Investors hold a small piece of a corporation by investing in a stock. Stocks experience ups and downs similar to what an owner would experience.

A stock mutual fund is a collection of many different stocks. The mutual fund allows investors to own many other companies for a smaller cash investment. The mutual fund enables investors to take on stock market returns while diversifying against any individual company’s misfortune.

U.S. Treasury Bonds. Unites States Treasury Bonds are the safest investments anyone can hold. Because they are so safe, investors use them to balance out the riskier parts of their portfolios.

Stocks and bonds together. To get higher returns than a bank savings account, you need to take on some investment risk. The safest way to take on investment risk is with a diversified stock mutual fund.

However, stock alone would be too risky, so you need some bonds. By holding bonds, you give up some potential returns to avoid the risk of potentially significant losses.

How to Do It

While the savings account in the bank is more secure, it does not keep pace with inflation. Taking on some investment risk is the only way to stay ahead in the three-to-five-year horizon possibly.

For example, the Low Variance Portfolio consists of 60% Treasury bonds and 40% of an S&P 500 indexed mutual fund (or ETF).

| Annualized Return | Worst Rolling 3-Year | Worst Year | |

| Low Variance Portfolio | 7.59% | 0.68% (2002) | -10.21% (2008) |

| S&P 500 Index | 10.69% | -12.22% (2002) | -36.01% (2008) |

| Bloomberg U.S. Treasury Index Intermediate | 4.82% | 1.84% (2005) | -1.73% (1994) |

From 1991 to now, this portfolio has only been negative three times. The portfolio has not been negative if we look at trailing, rolling three-year periods. Said differently, the portfolio has not been negative when held for three years within the periods observed.

Over the observed period, the Low Variance Portfolio returned 7.59% per year, significantly outperforming savings accounts. I must state that past performance does not indicate future performance, but taking on some investment risk to save for one to three years can boost savers.

| What? | Investment Account |

| How long? | 3-5 years |

| How much? | Varies |

Investment Options for Over Five Years

Once investors start to get beyond the five-year mark, less certainty is required to meet goals. Five years is a long time to play it “safe.” With the longer time horizon, investors have more time to allow riskier investments to provide the higher return that comes with taking more risk.

Conclusion

The five-year horizon is for those intermediate goals, like buying a house, saving for a wedding, or whatever other large purchase or experience you may wish to do. Much like the volatility of the stock market, your goals are likely to change over this time horizon too. Much like your investment values, your goals will change too.

Focus on what you can control in the short and intermediate-term by matching your savings with the best investments for that time horizon. For cash outlays in the near term, you cannot afford to take losses or lock your money up for a significant period. With longer horizons, your needs and investments are more variable, so you can and need to take on more risk.

Figuring out where to put a pile of money for short-term savings can get complex fast. Working with a financial advisor will help you sift through the complexities to meet your goals.