Target-date or lifecycle retirement funds have become increasingly popular over the past few years. These funds intend to help investors reach their retirement goals by automatically adjusting the allocation of assets over time. They are very much a “set it and forget it” approach to investing.

What are Target Date Retirement Funds?

Target date retirement funds (or lifecycle funds) automatically change their stock, bond, and cash holdings based on retirement age.

Target date funds have become quite popular in recent years. As firms began shifting away from pensions and toward defined contribution plans (401k etc.), employees became responsible for their retirement.

Regulators and policymakers eventually decided that auto-enrollment would be best for workers. But auto-enrollment created a new problem: where should that money go? So, the use of target date funds in 401(k) plans explodes.

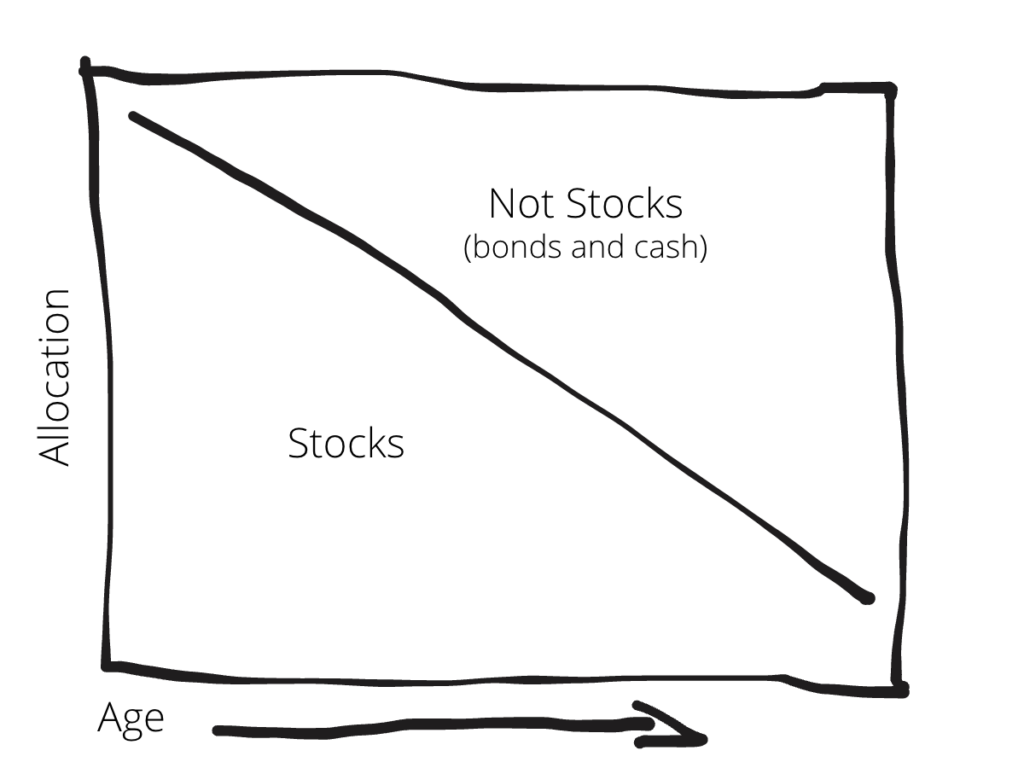

The idea behind these funds is that investors can set it and forget it. They don’t need to worry about constantly rebalancing their portfolio as they near retirement. Instead, the fund’s asset allocation mix gradually shifts from riskier stocks to safer fixed income as the target date approaches.

Since equities provide better long-term returns, the fund’s asset allocation may initially favor stocks over bonds. As the target date approaches, the fund’s asset allocation will shift toward bonds and cash, which are less volatile and stable. Investors who expect to retire in 2050 may choose a target date fund with a 2050 goal date.

Not just for retirement

While they are generally thought of as being used more for retirement, target date funds can be used for various things, including college savings. Knowing you will need cash for large expenditures at a defined period of time makes target date funds a tool available for various scenarios.

Pros of Using Target Date Retirement Funds

- Automatic Asset Allocation – One of the primary benefits of target date funds is that they provide automatic asset allocation. Investors don’t need to worry about constantly rebalancing their portfolio as they get closer to retirement. Instead, the fund’s asset allocation mix is adjusted automatically as the target date approaches.

- Diversification – Typically well-diversified across different asset classes and sectors. The possible benefits of this include lower risk and higher returns.

- Professional Management – The funds use experienced portfolio managers who are responsible for making investment decisions. Professional management can provide peace of mind for investors needing more time or expertise to manage their portfolio.

- Easy to Use – Target date funds are easy to use and are often called “set it and forget it” funds. They are easy to use and require little knowledge of investing. Investors simply choose the fund with a target retirement date that matches their own and let the fund do the rest.

- Low Cost – Compared to actively managed mutual funds, they have a low expense ratio. Lower fees can help investors save money and potentially increase returns.

Cons of Using Target Date Retirement Funds

- Lack of Customization – They intend to be a one-size-fits-all solution for investors. As a result, they may not be suitable for all investors, particularly those with more complex financial situations. Just because you want to retire in 2050 doesn’t necessarily mean a 2050 fund suits your situation. For example, they don’t address balancing student loan repayment, saving for a home downpayment, or building a retirement fund.

- Limited Control – Target date funds use professional portfolio managers, meaning investors have limited control over the fund’s asset allocation mix and investment decisions.

- High Fees – While they are typically low cost, some funds may have higher fees than others. Because life cycle funds hold a family of other funds, there is often another layer of fees. It’s essential to compare the fees of different funds before making an investment decision.

- Risk of Losses – Like all investments, target date funds are subject to market risk. Investors may experience losses if the market performs poorly, particularly in the years leading up to retirement.

- Hard to Compare – Determining target date funds’ overall asset allocation and performance is challenging. For most mutual funds, it is easy to see the holdings and where they fit in your investment plan. Target date funds require another layer of analysis, and that information can be a pain to get. Target date funds use proprietary family funds and proprietary family fund benchmarks that can make meaningful analysis difficult.

Are Target Date Funds Worth It?

Target date funds’ value depends on investors’ financial situation, risk tolerance, and investment goals. They can be a good choice for investors looking for a low-maintenance solution for their retirement savings. However, investors looking for more control over their portfolio may prefer to manage their investments.

Investors should choose a target date fund based on their needs. It’s essential to have a firm grasp of your ability to save and reach your investment goals. If your circumstances change, and they will, you will need a different life cycle fund.

401k Target Date Funds vs. Index Funds

Another important consideration regarding retirement investing is choosing a target date fund or an index fund. Both types of funds can provide benefits, but they work differently.

Index funds attempt to track the performance of a specific market index, such as the S&P 500. They are typically low-cost and offer broad market exposure. The main advantage of index funds is their low fees. The savings can be a significant advantage over time as they can compound.

In contrast, target date funds automatically adjust their asset allocation mix over time to match an investor’s target retirement date. They typically include a combination of stocks, bonds, and other assets. The allocation mix is adjusted as the target date approaches. Automation can benefit investors who need more time or expertise to manage their portfolios.

An index fund may be a good choice if an investor wants a low-cost, diversified investment with broad market exposure. However, a target date fund may be better if an investor wants a more hands-off approach to retirement investing.

Is a Target Date Fund a Good Idea?

A target date fund’s suitability relies on an investor’s finances, investing goals, and risk tolerance. For investors looking for a low-maintenance solution for their retirement savings, a target date fund can be a good choice. However, investors looking for more control over their portfolio may prefer to manage their own investments.

Factors to consider when deciding whether a target date fund is a good idea:

- Investment Goals – Investors who desire a hands-off approach and a fixed retirement date may like a target date fund. However, investors with more complex financial situations or different investment goals may want to consider other options. Target date funds don’t consider all of your other financial goals.

- Risk Tolerance – For risk-averse investors, target date funds become more conservative as the target date approaches. However, investors comfortable with more risk may want to consider other investment options. Also, risk tolerance of the investor and fund may deviate over time.

- Fees – Target date funds are typically low-cost, but some may have higher prices than others. The reason is that target date funds actually a fund of funds, adding another layer of fees. So, it’s essential to compare the fees of different funds before making an investment decision.

- Other Investment Options – Investors can choose index funds, actively managed funds, or equities and bonds. The investment universe is massive and constantly evolving. It’s important to consider all options and choose the best fit for an investor’s unique needs and preferences.

- Difficult to compare – It is complicated to compare target date funds. Comparing Vanguard vs. Fidelity vs. Dimensional Fund Advisors can be tedious. Since they employ different underlying funds and benchmarks, you must look beyond costs and goal year.

Target date funds are a simple solution for a complex problem. The relatively low fees for asset allocation and rebalancing make it a valuable tool. However, the automatic adjustment to the asset mix can create a false sense of security.

Few things are guaranteed when investing, but changing financial circumstances are. Selecting the wrong fund could ensure you miss your goal, even if it seemingly checks your box. Before deciding on a fund, you must ensure it fits your financial plan.