It’s no secret that college is expensive, and college education costs have only accelerated over the past decade. The staggering cost of college and its acceleration will be a significant challenge for millennial parents to meet. Parents want to know first: “How much do I need to save for college?”

How Much Should I Be Saving For College?

Start by setting a realistic goal. Paying for your children’s college education is noble, but it may not be feasible. Doing too much for your children can jeopardize your retirement, meaning you become a burden on your children later in life. Ideally, proper planning for your children’s college education could include savings, financial aid, and loans to help cover the costs.

Paying for the entirety of your children’s college education could strain your current finances and future financial goals. Known as the “⅓ rule,” many advisors recommend paying for part of college expenses with savings, financial aid, and future income.

The rule is more of a starting point for parents recognizing that college 18 years from now will be expensive. The cost of college is advancing at about eight percent a year, suggesting that college will triple over the next 18-year period. While that is no guarantee, it shows us how much college could cost.

Public tuition and fees tend to rise faster than other expenses associated with attending college than at private colleges. Part of the reason for this disparity is that private colleges just cost more than public colleges. Costs can also vary significantly by region and institution. Looking at the cost of college in Missouri and New York for public versus private institutions, we can see the difference in expected expenses per year before any financial aid.

Comparing University Costs

National Average

Public: $27,330

Out of State: $44,150

Private: $55,800

Missouri

Missouri State University: $22,750

Washington University: $79,586

New York

Brooklyn College: $31,886

New York University: $77,632

Applying The One-Third Rule to Set Your Savings Goal

Assuming the rough cut of paying for 1/3 of college expenses is to triple over the next eighteen years, we can see that you need to save the equivalent of the total cost of a college education in the year the child is born. Saving this amount will roughly cover the estimated portion of college paid apart before financial aid and loans.

Using moderate levels of total college inflation upon entering a college of 3.1% public in-state, 3.2% public out of state, and 3.5% for private non-profit, the total average cost of college will be:

- Total four-year public in-state: $114,510

- Total four-year public out-of-state: $185,260

- Total four-year private non-profit: $235,194

Monthly Contribution Amounts

You can figure out a monthly savings goal now that you have the total savings target(s). If you use a college savings account such as a 529 college savings plan, you can invest your savings tax-free.

On average, the stock market historical return is about 8%, so you can use that to estimate a rate of return. Figuring monthly payments over 17 years, at an 8% return, we get the following monthly savings targets:

- Public in-state: $265.19

- Public out-of-state: $429.04

- Private non-profit: $544.69

You Ultimately Need to Start Saving

The vast sums required to cover college expenses are staggering and likely to give anyone pause. Thankfully, you do not have to come up with the cash for college expenses all at once.

Consider contributing portions of financial windfalls such as bonuses, inheritances, and pay raises to the fund. Even if you can’t contribute $265 a month right away, you can still break it into smaller increments to save for a portion of the cost. Once you start saving, gradually increase the amounts. It will become progressively easier to save more and more.

You Need to Consider a 529 Plan

When saving for college, 529 savings plans are much better for saving compared to standard savings accounts. College savings plans allow savers to save, invest, and spend on college tax-free.

Standard savings and investment accounts are subjected to taxes on earnings, eating into your savings. Over eighteen years, taxes can very much eat into your nest egg for college costs. The graph below shows the difference between saving in a tax-free college savings account and a standard taxable account.

For simplicity, let us assume contributions of $3,180 ($265 x 12) a year, an 8% annual rate of return, and a 20% long-term capital gains tax. We can see that over the eighteen years, the tax-free account accumulates about $17,000 more! The tax-free accumulation of returns and qualified tax-free expenses makes 529 savings plans such a powerful college savings tool.

Opening a 529 account for your child(ren) allows you to save tax-free for qualified education-related expenses:

- Tuition

- Textbooks

- Computer and computer equipment

- Room and board

While not tax-deductible at the federal level, you should double-check your state of residence for an income tax deduction related to 529 savings plans. The 529 income deductions do vary by state, a few examples:

Filing Single

- Missouri $8,000

- New York $5,000

- Michigan $5,000

- Illinois $10,000

- Massachusetts $1,000

Married Filing Jointly

- Missouri $16,000

- New York $10,000

- Michigan $10,000

- Illinois $20,000

- Massachusetts $2,000

You Need to Adjust for Your Circumstances

Many parents want to give their children as many advantages as possible, especially as things don’t seem to be getting any cheaper or more accessible. However, as mentioned previously, you cannot afford to jeopardize your finances trying to get your child ahead. The things you need to be on top of before contributing to a 529:

- Emergency fund

- Credit card debt

- Other “high-interest” debt

- Retirement savings

- Other savings priorities

The Sooner the Better

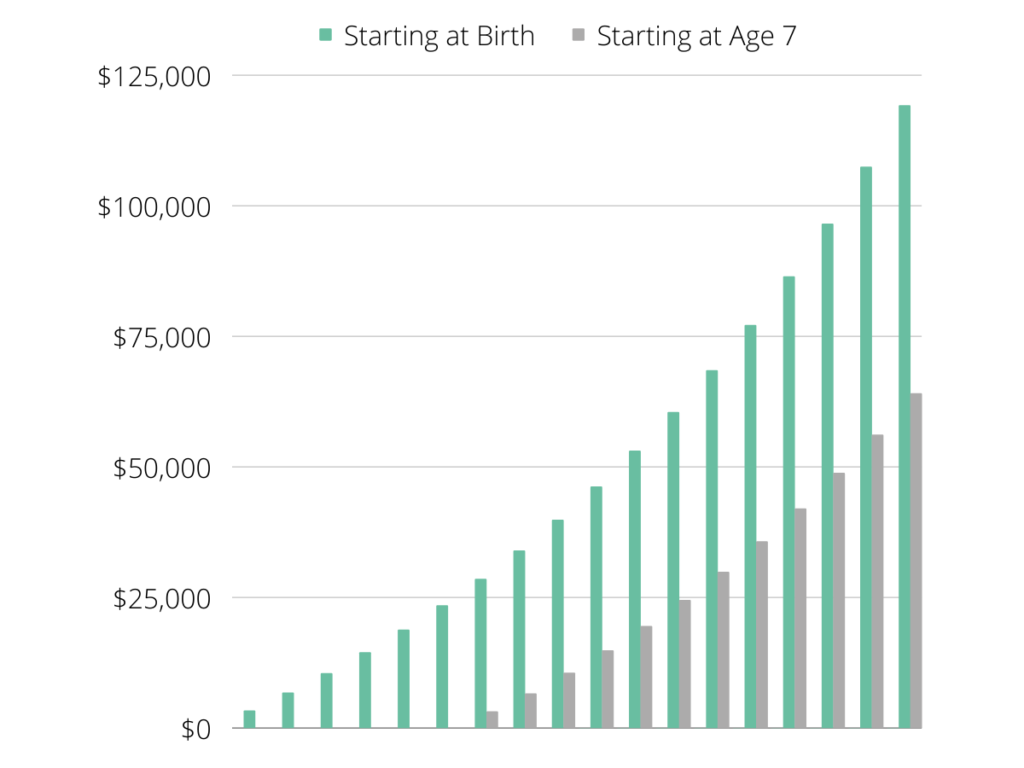

The sooner you start saving, even if it is just a little bit, you will be much closer to reaching your goal. The graph below shows that contributing $265 a month starting when the child is born versus starting after age six, and the difference is staggering. The extra savings and compounding returns are over $55,000 more.

There is no certainty about the cost of college in the semi-distant future. However, setting a reasonable savings goal using current costs and inflation rates is a good start. Starting to save early in a 529 plan is the best way to tackle a seemingly challenging savings goal. Once you have a practical goal set, you can make consistent contributions to a tax-advantaged 529 college savings fund.