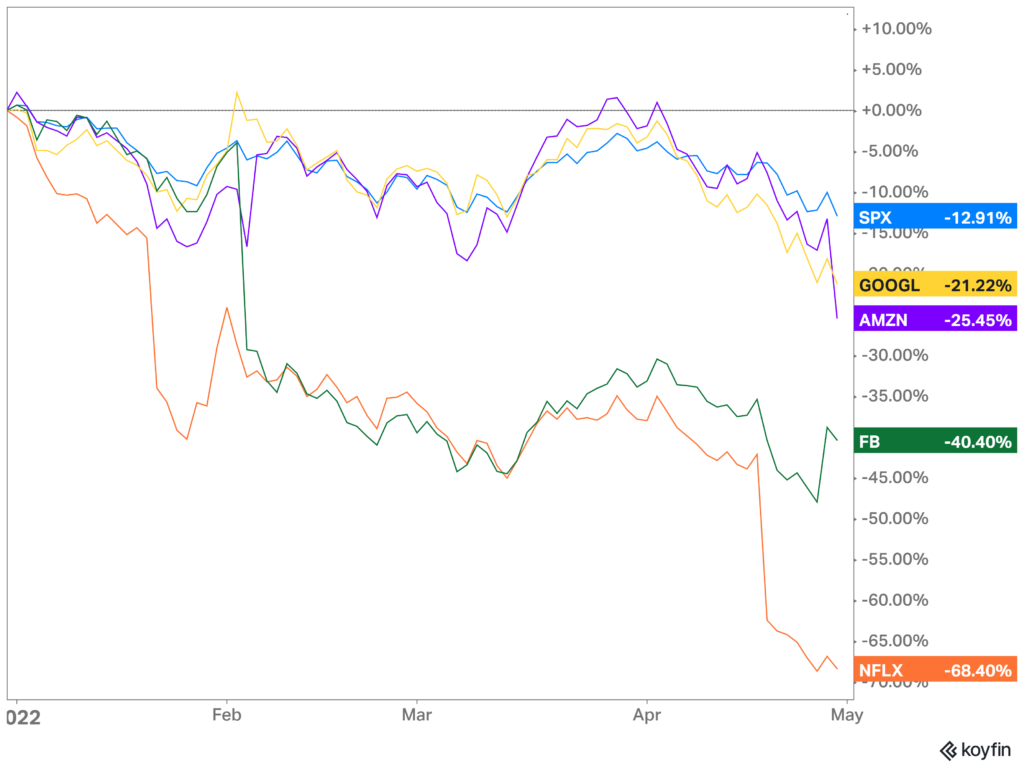

Markets are down significantly to start the year. The most reliable producers of earnings growth have begun to falter. Indexes are experiencing a broad-based sell-off led by big tech companies.

Amazon, one of the largest companies in the S&P 500, dropped 14% on Friday to the lowest level since June 2020. Amazon lost $206.2 billion of value, only succeeded by Facebook’s (I still won’t call it Meta) $251.3 billion in losses this February.

The Tech Wreck Continues

Interest rate increases are notoriously brutal for speculative tech stocks. When interest rates are low, investors are willing to bet more on the speculative earnings growth of tech companies. Investors readjust their expectations as capital gets more expensive, so technology companies lose value. As a result of Federal Reserve rate hikes, the tech-heavy Nasdaq 100 has lost 13.0% in April.

Traders cannot find a positive narrative in the markets right now: rates are going up, concerns over Covid linger, the war in Ukraine, and inflation. The easy money is gone, and the most prominent companies that pulled the indexes along for so long are losing that magic from the pandemic.

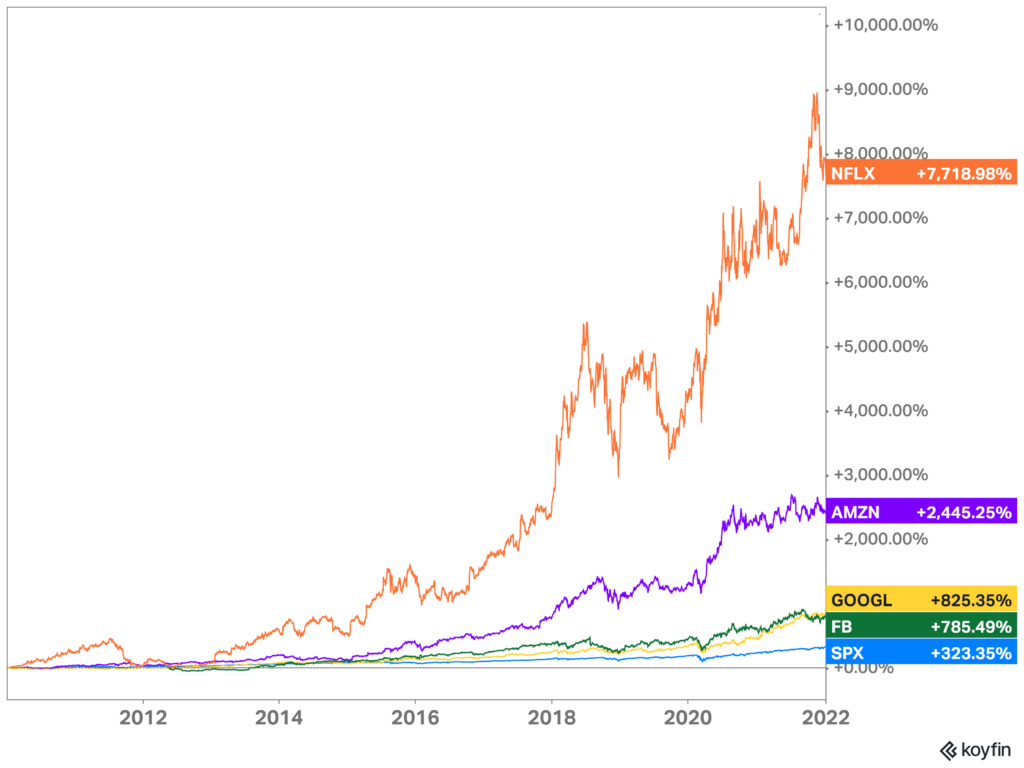

Decade Before the Pandemic Was All About Tech

Netflix was probably the best example of a post-Global Financial Crisis tech company. Netflix might be the most visible consumer brand that took advantage of the cloud early to juice profits and growth. It went from DVD mailings to pioneering streaming services and then to the content producer. As a result, Netflix was one of the best-performing stocks of the previous decade.

Nothing lasts forever. Competition from streaming services accelerated. The Federal Reserve began tapering its financial support for markets. Netflix’s stock is now facing fundamental and technical challenges as it loses users and rates increase.

Netflix was one of the most significant components of the S&P 500, and it has gone from a $306 billion company to under $85 billion in just a few months. This is after it hit all-time highs less than a year ago. As a result, its stock has fallen an astounding 68.4% for 2022. Unreal.

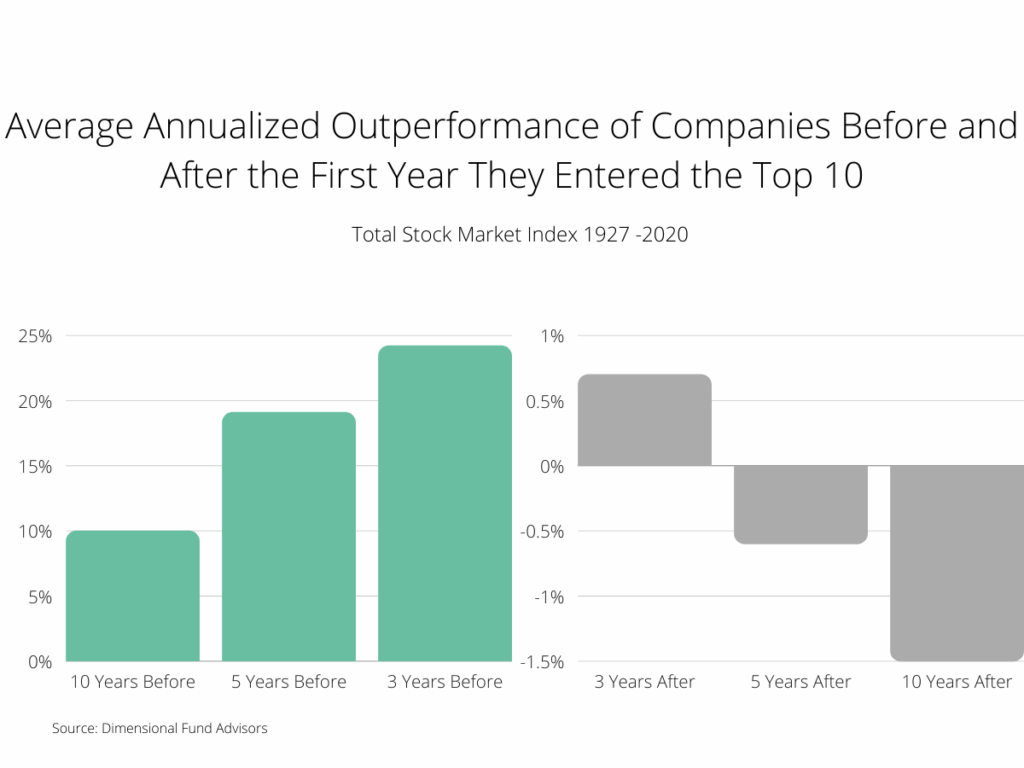

It Is Common for the Biggest Winners to Underperform

Even before their jaw-dropping rally during the pandemic, tech stocks absolutely carried the entire market. It is not a unique phenomenon. Only a handful of names often carry the stock market.

Currently, the ten most significant firms in the S&P 500 make up about 28% of the nearly $35 trillion S&P 500 index. When these mega-firms move, they carry the other 490 companies in the S&P 500 with them. That’s just the math.

The returns that produced these mega-cap stocks are eye-popping. Netflix and other tech firms absolutely crushed the market and carried the major indexes. Historically speaking, after making it into the “Top Ten,” returns lag the overall market. Winners cannot win forever and often go from first to worst(ish).

- From 1927 to 2020, the annualized returns that put stock into the Top 10 averaged just under 25% higher than the market average. However, that advantage had withered to less than 1% within three years.

- Five years after joining the Top 10, these stocks began lagging the overall market.

- After ten years, these former Top 10 firms significantly lagged the overall market.

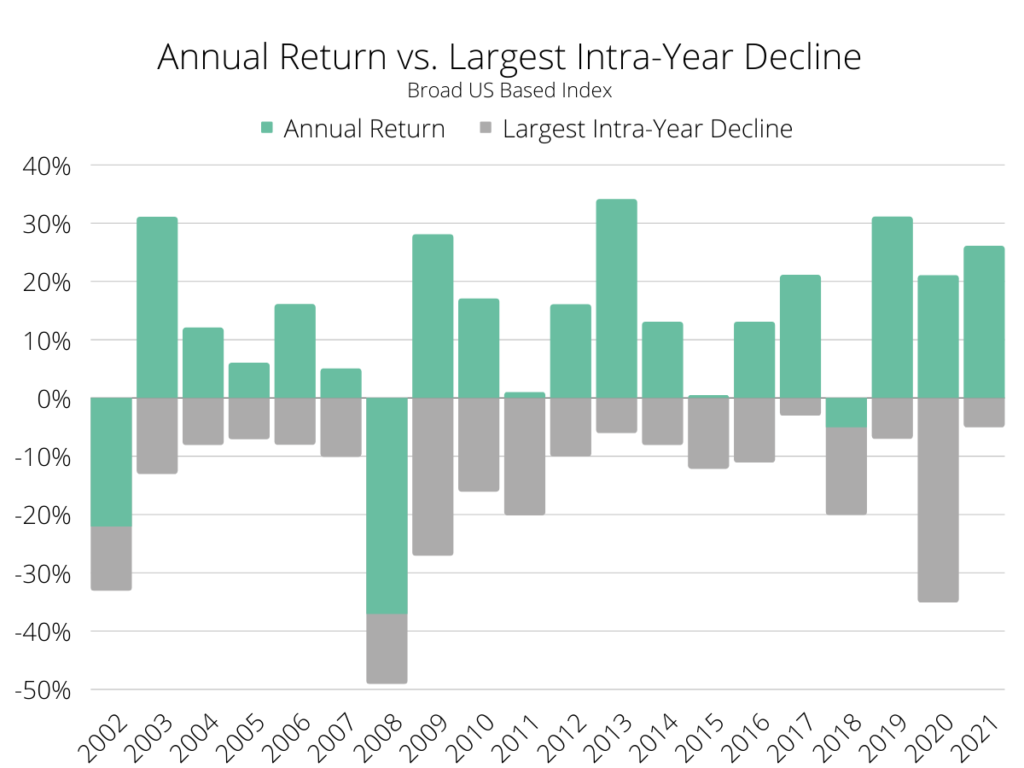

Staying Disciplined After Big Declines

Investors attempting to pick the market’s top (or bottom) must get the timing right twice. First, to get out (or in). Second, to get back in (or out). If the market’s expected return is always the same (it is), then trying to time the market significantly increases the risk for the same level of expected return.

Markets are pretty volatile. It is pretty standard for the stock market to have significant intra-year declines. Even the unprecedented run of the past three years saw significant intra-year drawdowns before posting solid gains for the calendar year.

Focus On What You Can Control

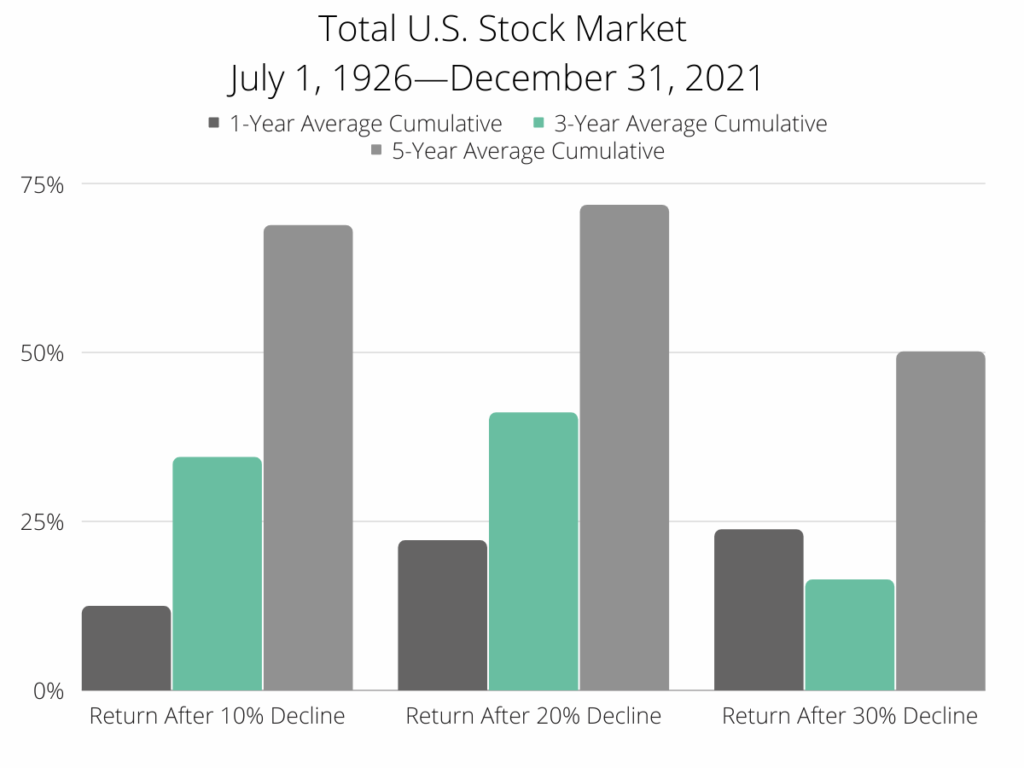

Investors need to stay disciplined to be successful. Historically, markets have bounced back after significant declines.

- Five years after a steep decline, cumulative returns exceeded 50%, no matter the severity of the drawdown.

- In annualized numbers for the five year-horizon, the returns have been close to the historical average of 9.8%

- After one, three, and five years from declining 10% or more, markets have positive returns.

What You Can Do

Focus on your investment goals. It is tough to make mistakes when the market goes up through unprecedented fiscal and monetary stimulus. Having an investment plan in place will help keep you focused on achieving your long-term goals.

- Rebalance your portfolio to the target asset allocation

- Consider selling some losses to create a tax-deferred asset that can offset future gains

- For traditional IRA or 401(k) retirement accounts, it could be an excellent time to explore doing a Roth conversion

- Converting when values are down will for more stock to fit into the current income bracket

- It is imperative to use the guidance of a financial advisor or tax professional when exercising conversion strategies

- Consider buying a broadly diversified index fund or ETF over a fallen stock

- As noted above, firms that were once in the top spot tend to lag significantly over the next several years

- Stock market rallies tend to be broad-based, so holding an index fund or ETF will capture the upswing when it happens

However, when investor sentiment shifts and markets tank, it can be difficult to remain disciplined when it matters the most. Maintaining discipline in turbulent stock markets can make a difference in reaching your investment goals. You are far more likely to have a successful investment experience by investing when you have the money and selling when you need the money.

Chart Sources: Dimensional Fund Advisors