The housing market is hot. It has been surging since the beginning of the pandemic. The Federal Reserve cut interest rates to historic lows and began purchasing bonds and mortgage securities in an extraordinary effort to boost the economy.

As a result, mortgage rates fell to historic lows and stayed there until very recently. Now, the Fed is quickly winding down its expansive monetary policy, raising interest rates and ending bond purchases. Now, mortgage rates have shot to over 6.0%, a 12- year high.

There are a lot of questions about rates and the housing market: Is this a sign of a turn in the housing market? Is housing in a bubble? Why are home prices surging? While it is far too early to tell what impact the Fed will have, quite a few things are different from the Global Financial Crisis.

Will the Housing Market Collapse?

Not likely. Consumers are in much better shape now than in the early 2000s. After living on too much credit, consumers had to deleverage after the financial meltdown. A decade of deleveraging, Covid-related fiscal stimulus, and shifting consumption patterns have left consumers in a solid spot.

Is This a Housing Bubble?

In contrast to the early 2000s, we are experiencing housing scarcity. The deleveraging after the housing bubble burst caused a lot of pain in the form of stagnation: wages, capital investment, spending, and building. The belt-tightening led to weak supply chains and fewer new homes.

Combine all that underbuilding as a large swath of millennials come into their prime home-buying and family-building years, and you have a recipe for a housing shortage. That is in stark contrast to the run-up in the early 2000s housing boom and subsequent bust. We now have more people chasing fewer houses.

Will Rate Increases Cause Housing Prices to Decline?

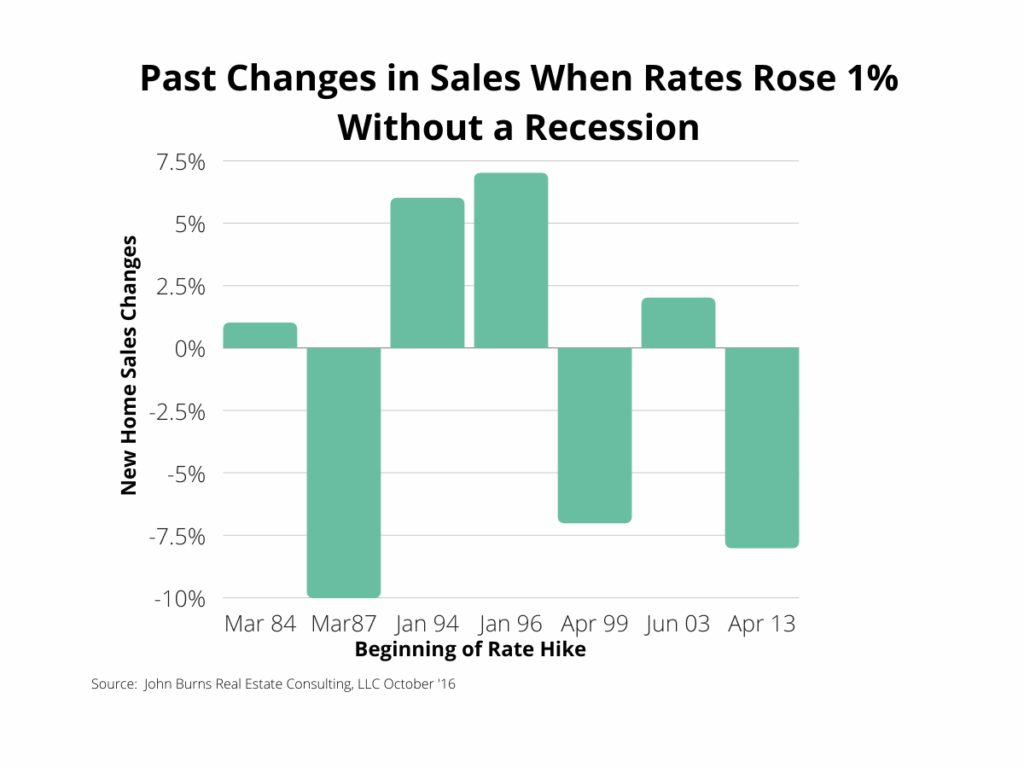

That answer is also a little tricky. Mortgage rates are a poor indicator of a turn in the housing market. The relationship between mortgage rates and housing starts is all over the place and even harder to predict.

Low-interest rate mortgages spur demand for housing. Quantitative Easing involves buying bonds and mortgages to stimulate demand. The Fed is unwinding both prongs of that policy as it attempts to normalize prices. A lot of the violent swing in mortgage rates recently has been from the whiplash change in policy.

Mortgage applications for purchases and refinancing have fallen for the sixth straight week. The average fixed rate on a 30-year mortgage has risen rapidly and is at 5.2%, the highest since April 2010, growing at the fastest pace since 2003. Higher mortgage rates are causing buyers to at least take a pause.

Moving to the Suburbs and Across the Country

The surge in housing prices and scarcity around urban areas has led to millennials seeking houses in cheaper cities and suburban areas. With work from home and hybrid work setups, the long commute is no longer such a burden.

The post-pandemic trend of Californians moving to lower-cost areas of Boise, Idaho and Austin, Texas, is likely to continue. Unfortunately, the migration of Californians buying relatively cheaper homes is putting prices out of reach for local buyers. The migration will likely continue even as mortgages climb and affordable housing remains a problem in constrained markets. It is all relative.

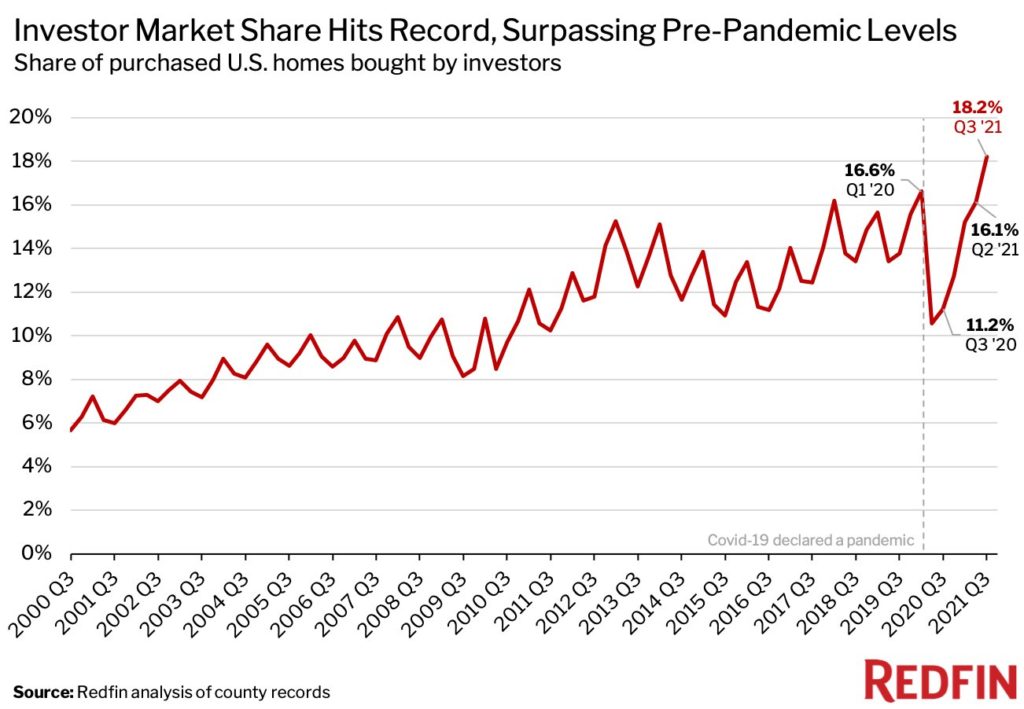

Investors Buying Homes

Mortgage payments have surged over the past year, but institutional investors are less affected by mortgage rates as they tend to use cash to buy homes. The investor class will be much less sensitive to changes in Fed policy. The investor class story is a little oversold, but they gained a larger share of homes from pre-pandemic levels.

Supply Chain Issues

Everyone is tired of supply chain issues, but they are still around and likely to persist. Builders have been having trouble completing homes for over a year. Supply chain issues with lumber, windows, garage doors, and labor shortages will continue to delay home completions.

With builders unable to finish houses, they are running increasing financial risks by carrying this inventory. As rates rapidly rise, tempering demand for new mortgages, builders could run into issues and avoid finishing homes when new inventory is desperately needed to decrease house prices.

Builders expect many of these constraints to ebb in the second half of 2022 (we’ve heard that one before), but we are still unlikely to see a considerable increase in inventory. There are significant demand-related tailwinds supporting house prices at the moment that are likely to continue.

Increasing Rates Will Not Fix Supply Issues

However, a big part of the problem has been the housing supply. After the Global Financial Crisis, the lackluster building has left Americans with fewer homes to buy in the U.S. as millennials are looking to purchase homes. Unfortunately, while interest rates could temper demand, they may also harm new home construction from builders.

Increasing interest rates will also have little impact on the lingering supply chain issues plaguing all the components that home builders need. When it is not lumber causing problems, it is labor, then it is garage doors, and now it is lumber again. All of these issues are supply constraints. Restrictive monetary policy will not fix it.

Many of these supply constraints are occurring because of chronic underinvestment in supply chain capacity following the financial crisis. Fixing some of the supply chain issues would require capital investment. Capital investment is less likely to happen when the Fed rapidly increases interest rates.

Conclusion

Consumers are in better shape financially than they have been in a generation and can continue making mortgage payments. Demographic changes will continue to be a tailwind pressuring home prices upward. Supply chain woes will continue to weigh on housing inventory while demand remains high. Investors will continue to buy homes as they are less sensitive to changes in mortgage rates.

There are few signs indicating a housing bubble or that a housing collapse is imminent. The housing market will likely remain pretty tight over the immediate horizon, even as mortgage rates rapidly rise. Saving for a first house will be even more challenging as housing prices increase faster than the average savings account interest rate. Savers will have to get creative to save for that first home down payment.