We often think of wellness in terms of physical or mental health. Paying lots of attention to them, we often spend a lot of time, effort, and money trying to focus on them. To achieve a better quality of life, we focus on our mental and physical health.

We rarely talk about money. It’s so essential to everything we do. How we treat our money and our attitudes toward money are central to our overall well-being. We need to approach financial wellness with the same vigor as physical and mental wellness.

Financial Wellness Definition

Financial well-being is about feeling in control of your money to be confident about achieving your goals. In essence, financial wellness is knowing where your money is coming from, where it is going, and feeling good about it. It’s not about having a certain amount of money or achieving a financial goal, but more about how you think about your finances. Financial wellness affects everyone, and everyone can practice it, regardless of how much they have or make.

The Importance of Financial Wellness

Your overall health and finances are intertwined. Just like your physical and mental health, financial well-being is critical. Studies have shown that financial stress can lower one’s IQ by 13 points (the average IQ is 100).

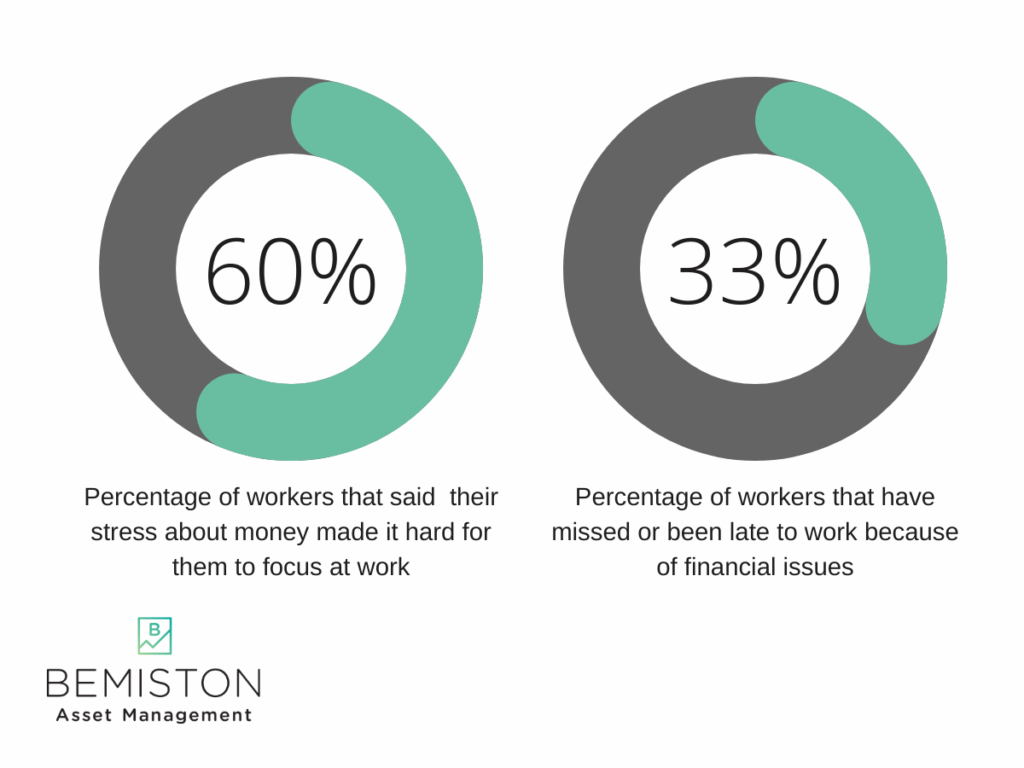

Financial wellness is vital for your work. The Foundation for Financial Wellness surveyed that 60% of workers that struggled with finances found it hard to focus at work. Another study found that 33% of workers were late or missed work over financial issues. Not grasping your finances can significantly impact your physical and emotional well-being. Financial wellness is about moving from money stress to money success.

How to Achieve Financial Wellness

Financial wellness is not a goal in itself. Financial wellness is an intentional way of living your life. It’s not just about budgeting or saving more in your 401(k). It is about getting clear on what you have and want and being confident about it. It is about your feelings and actions about money.

“Physical wellness” is not a goal in itself but an intentional way of living. When we practice physical wellness, we exercise, rest, and eat well. Similarly, financial wellness consists of getting clear on where your money is coming from, where it is going, and feeling confident about it all.

Everyone has unique financial circumstances. Every financial journey is different. We all have individual goals. However, just as with physical wellness, everybody can go to the gym and have personalized “workouts” with financial wellness.

The road to financial wellness has three complementary components:

- Form Your Base

- Create Your Path

- Focus Your Mindset

Form Your Base

Your base is your starting point of all things related to your finances. It is everything you are currently doing (or not doing) to change your circumstances. Your base is all of your good habits like checking your account balances, contributing to retirement, spending less than you make, or your progress in these areas. Having a base is about knowing your current circumstances to start building toward the life you want to have.

Forming your base:

- Figure out where your money is going. Having a rough mental estimate is not good enough. Tracking your expenses will reveal more about how and where you spend than you may think. Many people are surprised by their expenses when they take the time to analyze them. The good news is that there isn’t a “best” way you should spend your money. Everybody has unique needs and wants, so that expenses will differ significantly.

- Be sure to get that 401k match. You have heard before that it’s free money, and it is. There is not a better deal out there than a 401k match. It’s free money to invest in a tax-advantaged account.

- Pay off credit card debt. Credit card debt can be a killer. Rates are often high teens and can breach the 20% mark. You need to pay it off as soon as possible, which means paying more than the minimum balance.

- Build a cash cushion of one month’s expenses. This step is the beginning of your safety net or emergency fund. Life is full of unexpected and unwelcome surprises, and this step will help you meet them while working towards your other goals.

- Invest or pay off debt. Anything you can save over the minimum payment, you can invest in growth assets. High interest rates, over 10%, are heavy and should be paid off ASAP, paying off the highest interest rate first. However, interest rate debt around 5-6% is pretty manageable, and you should pay the minimum balance every month.

- Build a robust emergency fund. The amount you should have in emergency savings varies with each individual or family. Three to six months is the standard-issue advice. If you are relatively healthy and work in a stable industry where jobs are easy to get, you can afford to carry less in your emergency fund. The more at-risk you are, the more you need to hold in your emergency fund. Read More: Where to Put Money for Short-Term Savings

- Develop a plan to meet your long-term goals. Sure, you need to save for retirement, but you have a lot of life to live between now and then. You can work out a savings plan to get there, whatever it may be. Other goals can be purchasing a house or saving for a wedding.

Forge Your Path

Having a solid base for personal finances is pretty straightforward for most people, even if we don’t always practice it. Saving more than you spend is pretty standard advice, and that advice has an order of operations. The intricate work comes from balancing priorities and changes as they come. How do you reach all of your long-term goals that are competing for your limited resources?

Forming a path with your current resources will get you where you want to be in life. A financial path is a timeline that matches your existing assets and future resources to all of your goals.

- Figure out your values. This one is tricky and may take some time to do. We all have different views on what we should do with our lives and money. One person may struggle with getting too much takeout, while others struggle with online shopping. The truth is that getting takeout or shopping online aren’t necessarily problems if those are things you enjoy and they do not interfere with your goals.

- Get on a budget (sort of). Nobody likes budgets, including financial advisors. Budgets are difficult to keep track of, especially over long periods. Budgeting apps only tell you how much you spent after the fact, making budgeting more difficult. However, setting strict saving, spending, and living parameters can make you successful. For example, saving 20%, spending 30%, and living on 50% is an excellent place to start a budget. Having a concrete knowledge of where your money is going in aggregate will set you up for long-term success.

- Prioritize your goals. Your goals are all competing for your limited resources and planning out where your money will go and when will help you better manage your money. Planning and managing short-term, like buying a house, and long-term goals, like retirement, will make your path towards financial freedom a lot easier. Read More: How to Save for a House Down Payment

Goals have tradeoffs

Establishing a solid base to build a plan on is crucial. Having your core needs and a safety net set requires you to take care of first. However, saving for a house and retirement are competing goals, as expenses come from your savings. Buying a home sooner rather than later will delay your retirement. That is why being clear on your values can help you figure out how much of that tradeoff you are willing to make and when.

You don’t need to have your base set entirely before you pursue the goals in your plan. The components of financial wellness overlap, and you can perform some of the steps out of sequence. There is nothing wrong with having different goals and saving priorities from what someone else says you “should” have. What works for one person may not work for another. There is a lot of overly general financial advice out there that is quite dated. This advice has formed a lot of preconceived notions about what “you should” and “should not” do with your money. These notions are formative and run deep, so overcoming these feelings about money can take some work.

That brings us to your mindset.

Focus Your Mindset

Your mindset matters. Whatever your financial situation is, you most likely have areas in your finances where you feel less confident or where you feel like you should be doing more. That is normal. Finance can be a complex topic. Further compounding the complexities, our cognitive biases make it difficult to manage our finances optimally. Developing a healthy mindset with your money will help you better manage your finances.

We have all been bombarded from birth with “shoulds” and “should nots” regarding money. You shouldn’t have debt. Eating out is terrible. Using credit cards is wrong. Renting is wasteful. These are just a few of the things presented as financial “truths” that can sometimes do more harm than good and are far too generalized to have a proper impact on your financial wellness.

- Unlearn bad advice. Debt is not bad, especially if it is low-interest rate debt. Having student loans is not bad, but obsessing about paying them off early might be. Being “debt-free” is an admirable goal, but paying more than the minimum on low-interest debt could hinder your net worth as you are not investing in growth assets.

- Enjoy the simple things. Having that latte or eating avocado toast isn’t what is keeping you from becoming wealthy. Millennials do not eat out more than any previous generation; they just have higher debt burdens from school and faced a stagnant job market after the global financial crisis. Have that latte and avocado toast, but make sure to invest aggressively, as you face a different economy from previous generations. The same advice given to your parents will not work for you. Read More: Financial Advice for Millennials Will Be Different

- Spend your money your way. Use your money in a way that makes you feel comfortable and confident. It’s your money. Not your parents’ or some financial guru’s; it’s yours. It’s a lot easier than it sounds, as we are bombarded incessantly from childhood about how we ‘should’ spend our money. That ‘advice’ is often very dated and overly generalized for your needs and wants. Put your money towards things that make you hapy.

- Talk about money with your peers. Start talking about your financial goals with your friends and peers. It has been taboo for too long, and it does not have to be a big deal. Younger generations are shifting the conversations about money into the open. Not talking about money only benefits employers. Talking about it with your peers can open up opportunities. Talking about money with your friends can lead to new opportunities and access to trusted financial professionals. It’s only a big deal if you make it one, so talk about what you are comfortable sharing.

Financial Wellness

Financial wellness is a big deal. We all know we should be practicing it, but maybe you didn’t know what it was or how to do it. Financial wellness impacts your physical and mental well-being as well. If you stress about your money, it will show up in other aspects of your life, harming you emotionally and physically. Money is our overall number one source of stress, so practicing financial wellness is a great way to grapple with what stresses you out the most. Improving your financial circumstances will lead to a better quality of life.

Getting Started

Practicing personal financial wellness is not easy and will take some effort. Nobody wakes up excited to get their finances in order. The good news is that you don’t have to do it alone. There are some great apps out there that can help you get your financial base squared away. Getting clear on your goals can help you figure out what type of other professional services you may need, such as an accountant or financial advisor. One thing that my firm offers for free is MyBlocks. MyBlocks is a financial planning tool that puts the power of financial planning at your fingertips; enter your assets and income, set your goals, set your plan, and start your journey.

Summary

Whatever your financial wellness journey looks like, it’s essential to keep at it reevaluating where you are with your goals and making any necessary adjustments. Your base is your starting point; it’s about taking control of your current situation and resources. Your plan is all about getting where you want to be, using your existing resources to get the life you want to live. Your mindset will help you develop a healthier understanding of your feelings and attitudes about money, making it easier for you to use your base to form a plan.