Roth IRAs are often associated with younger, entry-to-mid-level workers for their tax advantages. However, as millennials step into their high-income years, contributing to a Roth IRA, even indirectly, still makes a lot of sense. I will discuss using a Roth IRA for emergency funds, education savings, a home purchase, Roth IRA conversions, and Backdoor Roth contributions.

Key Takeaways

- Roth IRAs offer investors tax-free withdrawals, giving investors a powerful savings tool.

- It is more tax-efficient to leave money in the IRA for as long as possible, but the funds can be accessed without penalty to meet savings goals.

- Roth IRAs can be used for an emergency fund, home purchase, flexible savings buffer, and advanced tax planning.

What is a Roth IRA

A Roth IRA is an excellent saving and investment tool.

In contrast to traditional IRAs, Roth IRAs use post-tax dollars. Like a traditional IRA, the funds grow in the Roth IRA tax-free. Because investors do not get the tax deduction upfront, Roth IRA withdrawals are tax-free in retirement.

A Roth IRA can be so much more than saving for retirement. Regarding long-term, tax-free, and compounding growth, the Roth IRA is a fantastic account for savers. However, one can use a few different strategies to contribute and access a Roth IRA, even when they may not typically qualify because of income or age.

The use of Backdoor Roth Conversions and Roth Conversions can allow those with too high income to access Roth IRAs. Roth IRAs can make a lot of sense as a savings tool even when above the income limits.

The Basics of a Roth IRA

- Contributions are after-tax, meaning you cannot take a current-year deduction like a traditional IRA.

- The investments grow in the account tax-free, and because the contributions are after-tax, the withdrawals are tax-free–no taxes!

- For 2021, you can contribute up to $6,000 annually or $7,000 if you are over 50.

- In 2021, single filers had an income limit of $125,000, and for married filers, it is $198,000.

- For those making over the modified adjusted gross income levels, there is a phase-out on direct contributions. If you are single and making over $140,000 or married and making over $208,000, you cannot contribute directly. Those that make over the income limits can use a Backdoor Roth IRA to contribute.

Source: Internal Revenue Service

Roth IRA Strategies for Millennials

Roth as an Emergency Fund

As one of the most flexible tax-advantaged accounts, Roth IRAs can supercharge savings for younger, high-earning workers. While you cannot withdraw the earnings in a Roth IRA, you can remove your contributions. That is because the money was already taxed, and the IRS only wants to tax you once, seriously!

Be careful if part of the IRA is from an old 401k or IRA. There is a five-year rule on withdrawing contributions from those transactions.

Use Roth IRA as an emergency fund: The key is to limit any withdrawals to the contributions. It would also be wise only to tap this resource in extreme circumstances.

Figure out the amount you need for emergency savings, and keep that amount allocated to cash or government bonds within the Roth IRA. As your emergency fund grows, you can invest in more aggressive allocations within the Roth IRA.

Education Savings for Kids

Like using a Roth IRA for emergency savings, a Roth IRA can make sense to supplement college savings. Similar to the 529 plan, there is no federal income tax deduction for Roth IRAs. Furthermore, earnings accrue tax-free, and qualified distributions are tax and penalty-free.

The advantage of the Roth IRA over a 529 is that you may use the contributions to pay for anything related to education. A 529 plan is more restrictive in its use, having specific rules on its use. You may use a Roth IRA to cover student loan debt, but a 529 is limited to using $10,000 per beneficiary on student loan debt.

The older you are and the more confident your retirement situation is, the better a Roth IRA looks compared to a 529 plan. Unused 529 funds are penalized when used taken out for non-qualified education expenses.

This strategy can be a tax-efficient way to transfer wealth and not as a means of wealth accumulation. Technically, withdrawing funds from your Roth IRA to cover education expenses would count against your ability to receive financial aid. However, if you can afford to use this strategy, you will most likely not qualify for financial aid anyway.

Using a Roth IRA for a Home Purchase

Roth IRAs also make sense for you to use when saving for a first home purchase. The IRS loosely defines “first-time homebuyer,” but if you qualify, you have a few different options to leverage your Roth IRA for a home.

You’ve got the basic idea at this point; you can take out any contributions you have made so long as you meet the five-year rule. However, the IRS allows a special provision to purchase a home using a Roth IRA. Yes, you can take out the contributions, but you may also take out the earnings, up to $10,000. And, because IRAs are by the individual, you and your spouse may take out $10,000 each for a home purchase.

This strategy makes the most sense when setting aside money in your Roth IRA for a home purchase. It would be best to meet your other savings and investing goals before dipping into a Roth account.

Millennials face a more difficult housing market than their parents. Home prices are rising faster than a money market or savings account can keep up. Using a more aggressive Roth IRA strategy to buy a home could make sense for high-income couples. Even if you cannot withdraw the earnings, at least your $10,000 has the opportunity for a higher return.

Source: Internal Revenue Service

Roth IRA Conversion

A Roth IRA conversion is transforming a traditional IRA into a Roth IRA. This strategy is a tactic that financial advisors and clients love to make, as it can add a lot of after-tax value with no investment risk. A Roth IRA conversion makes the most sense when the time horizon is long, your anticipated tax rate in retirement is higher, and you can cover the tax bill.

You will also need to be very careful when converting to a Roth IRA. You will owe taxes at your marginal income tax rate for the conversion amount. Large conversion amounts can push you into a higher tax bracket because the IRS considers it taxable income for the year, eating away some of the value.

Roth conversion strategies are an excellent strategy for higher-income young workers. If you have 401k funds from a previous employer, working with a financial advisor can help you develop a Roth conversion strategy. Converting these accounts over a few years can be life-changing for investors.

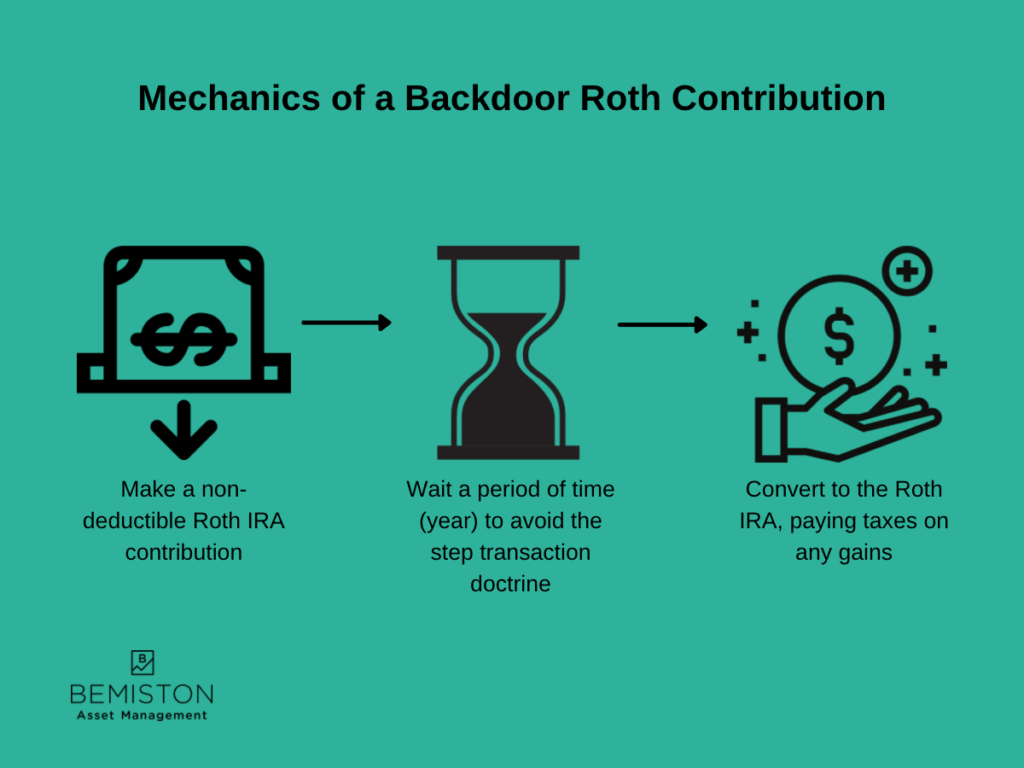

Backdoor Roth IRA Contribution

If you make over the Roth IRA income limits, you can sidestep the rule by making a non-deductible contribution to a traditional IRA. After making the contribution and waiting for some time, you can convert the traditional IRA into a Roth IRA. All you have to do is pay the taxes on any gains. This Roth IRA strategy makes the most sense when you are already maxing out other retirement accounts, such as your

Let’s say that you make a non-deductible contribution to a traditional IRA of $6,000. After waiting an appropriate amount of time, you decide to convert the traditional IRA into a Roth IRA. After some investment gains, your traditional IRA is worth $6,300. Because you funded the conventional IRA with post-tax dollars, you will only owe taxes on the $300 at your prevailing marginal income tax rate.

After that, you will have successfully created a Backdoor Roth IRA Contribution, where your money will grow tax-free. Note that it may not be a good idea to employ this strategy if you need the money soon, as the five-year rule will apply to the conversion.

Roth IRAs Are Extremely Flexible

Roth IRAs make a lot of sense for saving options outside your retirement. High-earning millennials can use quite a few Roth IRA strategies to balance current and long-term goals, supercharging wealth accumulation in a low-interest-rate environment.

- Correctly done, a Roth IRA can serve as an emergency fund while accumulating wealth.

- Roth IRAs allow investors to save for a home outside a typical bank savings account.

- When saving for education, Roth IRAs can be an excellent supplement to other resources.

- Roth Conversions offer investors control over when they pay income taxes and add a lot of after-tax spending power in retirement.

- Backdoor Roth Conversions allow investors that would not qualify for Roth contributions an avenue to access a powerful savings tool.

Conclusion

Roth IRAs make sense for younger investors, not just because of the typical “lower tax rate now” argument. Roth IRAs give investors options to choose how to save and invest for the more critical things in their lives, in addition to retirement planning.

Using an IRA for any of these strategies can have significant tax implications and penalties if not done correctly. Consulting your tax professional or financial advisor beforehand implementing is highly recommended.