There are a lot of financial advisors out there. The Bureau of Labor Statistics estimates that the United States has approximately 263,000 personal financial advisors. There are 3,330 St. Louis financial advisors, according to U.S. News. St. Louis has a lot of financial advisors and financial planners for a city of its size.

For a St. Louis financial planner, it isn’t easy to stand out among large firms with unlimited marketing budgets. St. Louis is home to Edward Jones, which employs many financial advisors in St. Louis. Wells Fargo also has a significant presence in the area through its AG Edwards and Wachovia acquisitions.

When it comes to financial planning, bigger does not mean better.

Independent financial advisors are more agile than legacy brokers who have become advisors. Smaller, independent financial advisors use more technology and holistic practices to deliver customized financial plans and investment management to their clientele. Bigger is not always better when it comes to financial planning.

Independent financial advisors use a holistic financial planning approach.

The biggest financial planning and advice firms are most concerned about acquiring new client assets to manage. Their advisors spend most of their time prospecting and marketing and less on client work. The bigger the firm, the more likely your advisor will delegate client work to an associate to focus on sales. It is always about acquiring and managing more assets, with little focus on anything else.

Independent financial advisors offer broader services beyond asset management. Financial planners can focus their time and efforts on solving complex and unique client problems. Financial planning is about more than investments and quarterly performance updates. Independent financial planners can spend time understanding their client’s issues.

Good comprehensive financial plans include:

- Tax planning

- Managing savings

- Investment management

- What to do with that old 401(k)

- Insurance planning

- Estate planning

- Budgeting

- Saving for a house down payment

- College planning

- Debt management

- Allowances for avocado toast consumption

While some larger firms can handle these services in-house, they may still lack some expertise in unique situations. Independent financial advisors have a network of tax and estate planning professionals who they can refer complex cases.

A network of specialized professionals that coordinate provides more clarity and confidence to clients than a single firm can. A network creates a system of checks and balances. An independent advisor will assemble a team:

- estate planning attorneys

- accountants

- insurance providers

- real estate agents

Independent financial advisors have more investment options.

Independent financial advisors better handle individuals’ and families’ unique needs and circumstances. A sizeable financial advice firm will likely have an internal family of funds, creating a potential conflict of interest. Independent investment advisors can better invest your funds in a manner that reflects your preference:

- Risk and return

- Investment themes (AI, tech, clean energy, etc.)

- Environmental, social, and corporate governance (ESG)

- Impact investing (investing for a social change)

With their investment flexibility, independent financial advisors can pursue all sorts of mandates that larger firms cannot.

Independent advisors are more likely to use technology.

As financial planning becomes the focus in the financial advice industry, advisors will rely heavily on more technology to better serve their clients.

Historically, more prominent firms would have the advantage over smaller firms as they can leverage economies of scale with expensive software licenses. However, the development of cloud computing and software as a service business (SaaS) allows smaller advisors to compete.

Smaller independent financial planners can more quickly evaluate and adopt new technologies than their larger, more bureaucratic competitors. Independent financial advisors that deliver holistic financial planning services rely on technology to provide deep value to clients:

- MoneyGuide Pro is a financial planning software that uses client goals to prioritize saving, investing and spending. The program allows an advisor to interact with clients and produce goal-based solutions.

- MyBlocks is a tool from MoneyGuide that puts a variety of tools at the hands of consumers in a user-friendly format. Consumers can pick and choose various modules (it looks like Netflix’s menu) that they feel are important to them and learn about their financial needs. You can try my link here.

- Yodlee is an account aggregation tool that pulls in all of a client’s investments, credit cards, home loans, and bank account information.

- Holistiplan is a tax planning tool that quickly reviews and summarizes tax returns, giving an advisor tax-planning ideas for clients.

- MaxMyInterest is a tool used for cash management. The “robot” moves idle cash around to whichever FDIC-insured account offers the highest rate of return on cash.

- Canva is a design tool that allows advisors to put all the messy financial reports together, making them presentable.

- Zoom enables advisors to engage with clients wherever and whenever—fun fact: while I am a financial advisor in St. Louis, over half of my clients are outside the area.

Fees for financial advice evolved.

The financial advice industry has not figured out “the answer” to fees, but things have changed significantly over the years. When dinosaurs roamed the earth, stock brokers would charge a percentage of each transaction and earn a commission. The problem is it encourages selling people things they may not need, and people hate feeling like they got sold on something.

Fast forward to the stone age, transaction fees are minimal to non-existent as the brokers race to zero costs. Now that nobody can make as much money selling products anymore, brokers started calling themselves financial advisors. Financial advisors began charging a flat percentage of assets under management for investments. Known as the “fee-only advisors,” the consumer pays no commissions.

That brings us to now, where picking assets and rebalancing isn’t good enough to justify asset fees anymore. Passive index funds such as Vanguard offer consumers cheap portfolios that can outperform your dad’s finance guy after fees.

Financial advisors have to compete on more than investments, which is where financial planning comes into play. Financial planning is phenomenal and offers clients real value “now” instead of 30 years later in retirement. A good financial advisor can say, “this is where I added value to you,” through a financial plan and never talk about investments.

Financial advisors are figuring out financial planning vs. investment management fees.

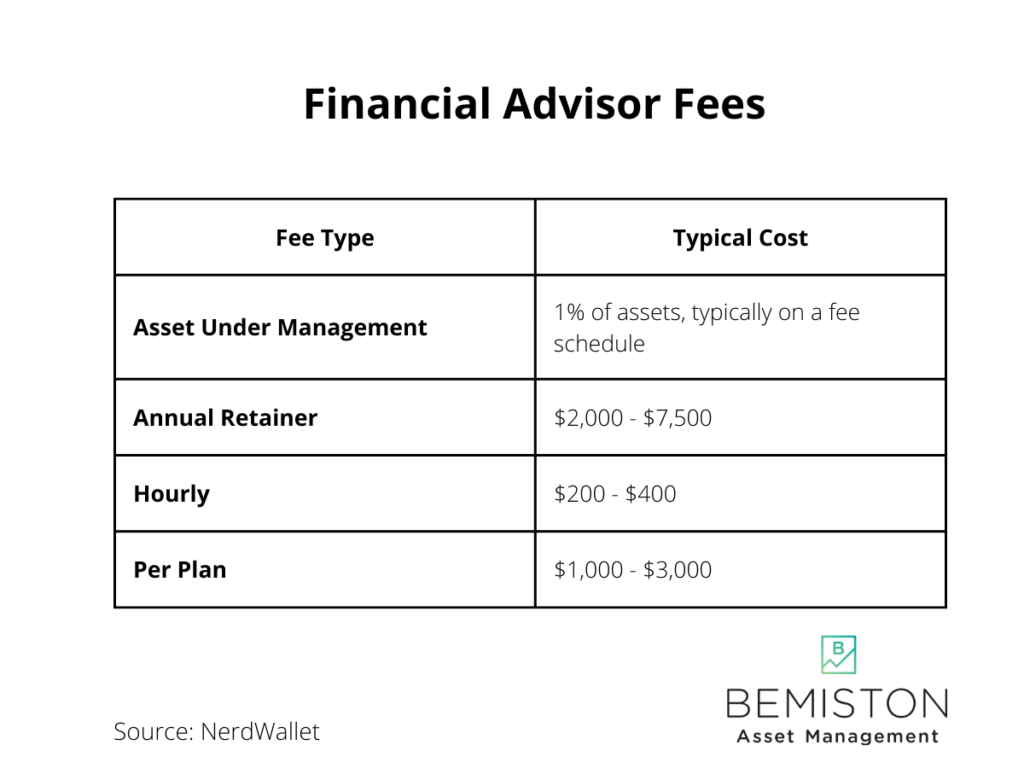

The hard part for financial advisors that manage assets and offer financial plans is figuring out how to charge for them. Financial advisors usually charge a higher percentage of assets that scale down the more you invest. However, the average still comes to around one percent.

Stand-alone financial planning fees often scale with complexity, so it is hard to say one model is better for consumers. However, as more advisors offer financial planning as a value-add or stand-alone service, they are changing how they charge. Some financial planners decided to charge a flat amount and let the consumer decide if it is worth it or not.

The “value add” shift away from asset management to financial planning. The challenge for independent financial advisors is not justifying their value but figuring out how to charge clients fairly.

Some advisors have shifted to charging for financial planning only for one-off or ongoing services. Others have moved to a hybrid of both financial planning and asset under management fees. Others have developed convoluted formulas based on a moving average of net worth.

Whatever the fee model, more assets and more income lead to more complex financial planning needs. The more complex the requirements, the more valuable the planning is to the client. The Notorious B.I.G. said it best, “Mo Money Mo Problems.”

The many fee structures give consumers options. The independent financial advisor fee models put the consumer in control of what they pay. Financial planning fees will work for some, and asset under management fees will be best for others. Some financial advisors even allow clients to pick the fee model that works best for them.

Conclusion

Independent financial advisors and financial planners have changed the industry for the better. Smaller, independent financial advisors have evolved from asset-centric to financial planning-centric service models. The development of new technologies and business models allows financial advisors to offer consumers more in-depth financial planning services than legacy financial advisors.