It’s no secret that the Federal Reserve has rapidly increased interest rates in 2022. While those rapid increases have killed investor sentiment in the stock market, they have made short-term investments appealing again. Short-term investments can vary significantly in length, quality, and restrictions, and this guide will help you sort through them.

What are short-term investments?

A short-term investment can be the correct answer when you have a shorter time horizon and want to earn money in your cash.

Saving for retirement or college is a long-term goal for millennials. It’s many years in the future. But there are other things to plan for in the near-to-intermediate future.

- vacations

- home purchase

- home improvement

- building a nest-egg

- or just better cash management

For short-term investments, safety is more important than growth. They are meant to meet a short-term goal or liability. Savers should be willing to give up a little return for some certainty of the outcome. Long-term goals, such as retirement, are so far off for millennials that they can afford to take on more risk.

The best characteristics for short-term investments

Stability of investment: Whether investing for near-term goals or seeking higher returns on cash savings, investors are more concerned about the return of principal versus the return on principal. Short-term investments tradeoff more return for more safety.

Low transaction costs: The lower the transaction costs, the better. You want to access your money without paying commissions or hidden fees (Robinhood). The more frequently you need to access your funds, the more likely you will pay higher fees.

Very liquid: How long does it take you to get your money? The faster you can get your money, the more liquid the investment. Many higher-yielding accounts and investments have constraints on how often you can withdraw and how long it takes the money to hit your spending accounts.

The best places to invest money right now

It’s no secret that the Federal Reserve is rapidly increasing interest rates. As a result, the short-term investment landscape looks drastically different from a year ago. Not that long ago, short-term savings accounts were offering only around 1%. Now, you can find no-penalty withdrawal CDs providing over 3% with few stipulations.

High-yield savings account

Online banking and savings accounts dominate many brick-and-mortar banks regarding rates and liquidity. Many online banks pay over 3.00% with minimal minimums or maintenance fees.

- very safe and FDIC insured

- a stable rate of return

- typically very liquid, but can have constraints on the number of times you can withdraw in a month

- sometimes require minimums to avoid a maintenance fee

Online certificate of deposit

A certificate of deposit (CD) earns interest on a lump sum locked away for a set amount of time. The longer the lock-up, the better that return. There are typically penalties or fees associated with when withdrawing funds early. However, some banks, such as Ally, offer rates over 3.00% with no minimums or early withdrawal penalties.

- very safe and FDIC-insured so that you won’t lose money

- locked-in rate of return

- require a lock-up period where early withdrawals incur a penalty

Money market account

Money market accounts generally operate similarly to savings accounts. They can offer more returns than savings accounts but have more minimums and restrictions. However, there are also typically monthly limits on withdrawals and transfers.

- may offer a bit more than traditional savings accounts

- more liquid than a CD

- FDIC insured

- a limited number of withdrawals per period

- may not provide enough extra return for the headaches

- a safe way to invest money for one year

Money market funds

Not to be confused with money market accounts. Money market funds are offered through a broker as part of a trading account, so they are not FDIC insured. They are still very safe investments, even if they are not guaranteed safety from loss.

- relatively safe and liquid

- not FDIC insured

- often does not pay as much as a money market account

Short-term bond funds

A short-term bond mutual fund holds corporate bonds that mature in 1-4 years. A bond can be considered a loan that earns interest over time, and the principal must be paid back at the end. Short-term corporate bond funds are safe but can experience fluctuations in returns.

- yields of 5.00% to 6.00% are much higher than money markets and CDS

- not as liquid and may incur transaction costs

- not FDIC insured and may lose value

Floating rate funds

Floating rate funds pay based on interest rate levels. As rates increase, investors receive a higher rate of return and vice versa. It sounds great, in theory. However, companies that take on floating-rate debt are less creditworthy. If interest rates increase too quickly and get too high, these firms may struggle to pay investors back.

- rise and fall with current interest rates

- may not get the full benefit of rising rates

- may not be as safe as casual investors think

Treasury Series I bonds

These bonds from the US Treasury pay based on the Consumer Price Index inflation rate. Currently, they are paying a whopping 6.89%. The coupon resets every six months based on inflation. There are some caveats. Investors are locked up for one year. There is also a penalty for withdrawing funds before year five. Series I bonds are a good investment when you are concerned about inflation.

- limited to $10,000 per individual (with exceptions)

- lock-in period and early withdrawal penalties

- very safe as it comes from US Treasury

- coupon resets every six months, but inflation is starting to come down

Portfolio of stock and bond funds

Investing always comes with a risk of loss of value. However, building a conservative portfolio that has a lot of US bonds and conservative stocks can offer capital appreciation while limiting downside risk. It is possible to use a conservative portfolio for periods of three-to-five years.

- offers higher potential gains than a money market or CD

- harder to implement and maintain

- less liquid and transaction costs

- risk of investment loss, especially over shorter time frames

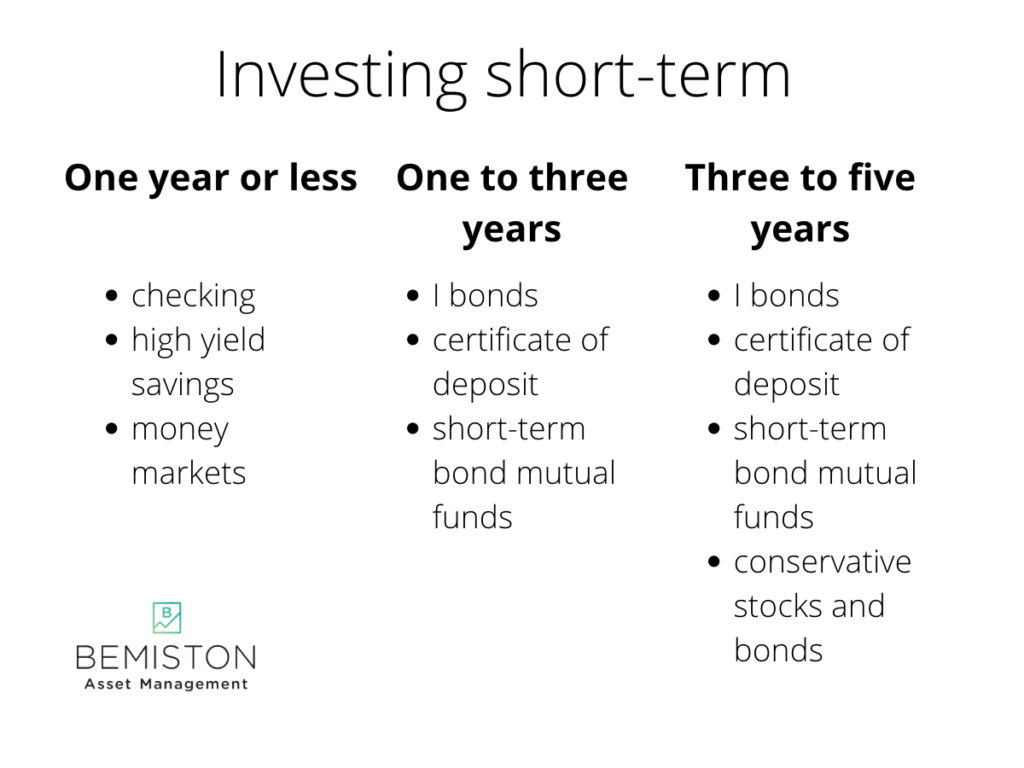

Investing for five years or less

Match your investments to your goals. The longer-term your goal, the longer-term your investment should be. The longer the time horizon, the more risk you can take. A forty-year goal allows for more risk-taking. Money set aside for a home project you are starting next year can’t afford much risk. Short-term investments are an excellent way to put your cash savings to work. A good financial plan matches goals and time horizons to your investments and willingness to take risks.

- Return requirements: Figure out how much you need for your goal first, then set reasonable expectations.

- Safety first: The more critical or near-term the goal, the more security is required.

- Don’t be greedy: The security first principle means you must be careful about reaching for extra returns.

- Do your research: Short-term investments vary a lot on quality and requirements.

- Needs-based: Focus on the time horizon and safety needed to meet your goal when picking an investment

- Don’t forget about debt: Paying off high-interest-rate debt might first be the best option for you.

Short-term investments with your emergency fund

Emergency funds are intended to cover those unplanned expenses or financial distress. Every good financial plan has a carve-out for an emergency fund. These funds need to be kept in liquid and safe investments. Investing in short-term investments can help you earn higher interest rates than keeping your money in cash. Short-term investments are an excellent option for your Health Savings Account.

Using a Roth IRA with short-term investments

It is possible to use short-term investments in your Roth IRA. Remember that you can withdraw contributions to a Roth IRA without incurring taxes or a penalty. The IRS has already taxed you for it. It’s the earnings you cannot touch. Roth IRAs have the potential to count as part of your emergency fund, as you can tap the contributions in an emergency. If your financial plan uses a Roth IRA as part of an emergency fund, you should keep the “emergency portion” in the shorter-term, safer investments to maintain value.